-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Little Market Conviction Ahead Of CPI

EXECUTIVE SUMMARY:

- MNI US CPI PREVIEW: CORE INFLATION SEEN EASING, JUST A BIT

- PBOC TO BOOST CREDIT SUPPORT FOR ECONOMIC GROWTH

- UK MAY GDP GROWTH HIGHER, BOOSTED BY HEALTH SPEND

- ITALY'S SALVINI SAYS SHOULD HOLD SNAP ELECTION IF 5-STAR DOESN'T BACK GOV'T THURSDAY

- RBNZ "RESOLUTE" ON INFLATION, DESPITE RISKS

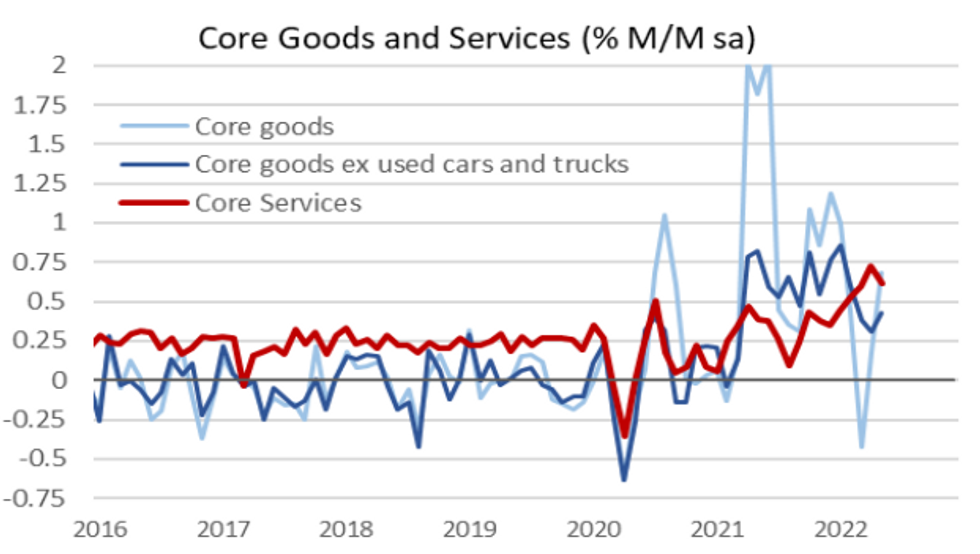

Fig. 1: Overall US Core CPI Seen Moderating Slightly, With Services In Focus

Source: BLS, MNI

Source: BLS, MNI

NEWS:

US CPI (MNI PREVIEW): Consensus has headline CPI inflation rising +1.1% M/M in June after an equally rampant +1.0% M/M as energy accelerated even further on a large rise in gasoline as well electricity price increases. Core inflation is seen dipping to a ‘large’ +0.5% M/M (av. 0.54% M/M) after surprisingly accelerating from 0.57% to 0.63% in May for the strongest since Jun’21.

CHINA (RTRS): China will step up policy support for the real economy, central bank official Ruan Jianhong said on Wednesday, adding that the macro leverage ratio was expected to rise amid efforts to revive the slowing economy. The remarks came against the backdrop of a pledge by Yi Gang, the governor of the People's Bank of China, to keep monetary policy accommodative to support the economic recovery. "We will use various monetary policy tools in a timely and flexible manner, give better play to the dual functions of aggregate and structural tools, boost support for the real economy," Ruan, head of the statistics department, said.

ITALY POLITICS (RTRS): Italy's rightist League party will pull out of the government if the 5-Star Movement carries out its threat to do the same, League leader Matteo Salvini said on Wednesday. The 5-Star Movement is holding a meeting to decide whether to remain in the coalition supporting Prime Minister Mario Draghi, having issued a series of policy demands ahead of a key vote of confidence on Thursday. Speaking at a news conference in Rome, Salvini replied "no", when asked if his party would continue to back Draghi if 5-Star withdrew, adding that early elections were the best solution.

RBNZ (MNI STATE OF PLAY): New Zealand’s central bank is "resolute" on raising interest rates to a level where it is confident that consumer price inflation will settle within its target range of 1% to 3%, while acknowledging that higher rates are likely to impact on economic activity in the medium term. The Reserve Bank of New Zealand today raised its Official Cash Rate by 50 basis points to 2.5%, the sixth hike since the tightening cycle began in October last year when rates were at the record low 0.25%, (See: MNI BRIEF: RBNZ To Lift Rates Until Inflation Inside Target).

CHINA YUAN (MNI): The Chinese yuan could be buoyed against the dollar in the fourth quarter by economic recovery at home just as the U.S. potentially heads into recession, allowing it to strengthen against other emerging-market currencies, market analysts said.

DATA:

MNI BRIEF: UK May GDP Growth Higher, Boosted by Health Spend

UK GDP rose by a better-than-expected 0.5% in May, boosted by a strong upswing in health-related activity as a rise doctors appointments offset falling test and trace spending, data released by the Office for National Statistics Wednesday showed. GDP grew by 0.5% in May 2022, after an upwardly revised decline of 0.2% in April 2022, increasing 0.4% 3m/3m, and by 3.5% y/y.

Services output grew by 0.4% as human health and social work activities grew by 2.1%, mainly because of a large rise in GP appointments, which offset the continued scaling down of Covid-19 programs. Output in consumer-facing services fell by 0.1% in May 2022, driven by a 0.5% fall in retail trade, underlining the weak consumer position. Non-consumer facing services grew by 0.5% in May, following a fall of 0.8% in April.

Production grew by 0.9% in May 2022, driven by growth of 1.4% in manufacturing and 0.3% in electricity, gas, steam and air conditioning supply. Construction grew by 1.5% in May 2022, following 0.3% growth in April. This is construction's seventh consecutive month of growth.

EUROZONE: Flash Estimates Largely Confirmed for June CPI Prints

GERMANY JUN HICP -0.1% M/M, +8.2% Y/Y; MAY +8.7% Y/Y

FRANCE JUN HICP +0.9%r M/M, +6.5% Y/Y; MAY +5.8% Y/Y

SPAIN JUN HICP +1.9%r M/M, +10.0% Y/Y; MAY +8.5% Y/Y

- This morning's round of final June inflation prints largely confirmed the flash estimates, which saw a 0.5pp deceleration for Germany to +8.2% y/y, versus 0.7pp and a hot 1.5pp acceleration to +6.5% y/y for France and +10.0% y/y for Spain. The slowdown in German inflation is largely a product of energy, fuel and transport rebates.

- Small 0.1pp upticks were seen in the French and Spanish month-on-month readings.

- Soaring gas and energy prices continued to generate upward pressure across the Eurozone in June, as well as food prices which increased at a series-high rate in Spain. Core inflation saw some relief in Germany and France, however, continues to tick upwards in Italy and Spain.

- As such this data confirms the need for affirmative action by the ECB in upcoming months, but offers nothing new to the debate.

Source: MNI / Bloomberg

MNI BRIEF: China June Exports Beat Expectations In 17.9% Jump

China's exports jumped by 17.9% in June from a year ago, beating the previous month and a market forecast of 12.9%, customs data on Wednesday showed, on the accelerated resumption of the production in south China cities as well as a weaker yuan exchange rate.

Imports, led by energy purchases, rose 1.0% in June and missed the consensus of 4.0% gain expected, the data showed. Exports in the first half reached $1.73 trillion, or up 14.2%, while imports amounted $1.35 trillion up by 5.7%. The trade surplus in the first six months was $385.44 billion, with June contributing $97.94 billion, (See: MNI BRIEF: China Foreign Trade To Achieve Stable Growth In H2)

The United States still ranked the biggest buyer with imports from China up 15.8% y/y in the first half, while the European Union placed the second, up 19.1%. Imports from the US increased 3.6% in the first half, and those from the EU fell 7.6%.

FIXED INCOME: Waiting for US CPI and first results of Tory leadership contest

- Gilts underperformed at the open as the market digested comments from Governor Bailey last night (he didn't rule out a move of a magnitude other than 25bp) and better-then-expected UK May activity data. However, gilts have moved off their lows, while Bunds are sitting around their lows of the day, and the performance of the gilt and German curves on the day has converged. Moves are limited to less than 4bp, however, with moves across the UST curve even smaller.

- Treasuries are a little higher on the day as the market awaits the key US CPI report, due at 13:30BST / 8:30ET. There are two-way risks further out the curve than the July meeting in particular. For the MNI US CPI Preview click here.

- We will also have the results of the first round of voting in the Conservative party leadership contest (race to become next UK PM), in which we will receive the vote breakdown and see either the bottom candidate or any candidates who do not receive 30 MPs' votes eliminated from the contest.

- TY1 futures are up 0-1 today at 118-22 with 10y UST yields down -0.8bp at 2.963% and 2y yields down -0.7bp at 3.044%.

- Bund futures are down -0.58 today at 152.43 with 10y Bund yields up 3.3bp at 1.162% and Schatz yields up 4.9bp at 0.389%.

- Gilt futures are down -0.40 today at 115.65 with 10y yields up 2.6bp at 2.099% and 2y yields up 3.1bp at 1.805%.

FOREX: Currencies Tread Water Pre-CPI

- Markets are generally treading water ahead of the key US data releases later today, with JPY marginally the poorest performer in G10 ahead of the NY crossover. The USD/JPY outlook remains bullish, but prices hold below the cycle highs printed earlier in the week at 137.75.

- The greenback is moderately weaker as equity markets look more stable after Tuesday's late sell-off. Futures markets across the US are indicating a positive open on Wall Street later today, helping currency markets adopt a modest risk-on tone.

- AUD is extending the recovery posted off the week's low yesterday, putting the pair closer to 0.68. Nonetheless, AUDUSD maintains a bearish tone and 0.6685, the Mar 9 2020 high, remains the key support. On the upside, initial firm resistance is seen at 0.6881, the 20-day EMA.

- US inflation data takes focus going forward, with markets expecting CPI to rise 8.8% on the year and 1.1% on the month. Core price rises are expected to decelerate, dropping to 5.7% from 6.0% in May. MNI's full CPI preview found here: https://marketnews.com/homepage/mni-us-cpi-preview...

- Elsewhere, the Bank of Canada announce rates later today, with markets expecting the Bank to raise rates by 75bps to 2.25%. MNI's full preview here: https://marketnews.com/mni-boc-preview-jul-22-eyei...

EQUITIES: No Clear Themes Ahead Of CPI

- Asian stocks closed mostly higher: Japan's NIKKEI closed up 142.11 pts or +0.54% at 26478.77 and the TOPIX ended 5.55 pts higher or +0.29% at 1888.85. China's SHANGHAI closed up 2.825 pts or +0.09% at 3284.292 and the HANG SENG ended 46.79 pts lower or -0.22% at 20797.95.

- European equities are a little weaker, with no clear themes present (a mix of cyclicals and defensives are both leading and lagging), with the German Dax down 96.39 pts or -0.75% at 12818.98, FTSE 100 down 59.66 pts or -0.83% at 7142.7, CAC 40 down 19.8 pts or -0.33% at 6019.93 and Euro Stoxx 50 down 20.28 pts or -0.58% at 3469.27.

- U.S. futures are a little higher, with the Dow Jones mini up 78 pts or +0.25% at 31042, S&P 500 mini up 10.25 pts or +0.27% at 3834, NASDAQ mini up 40.75 pts or +0.35% at 11819.75.

COMMODITIES: Oil Claws Back From Overnight Lows

- WTI Crude up $1.3 or +1.36% at $97.26

- Natural Gas up $0.13 or +2.14% at $6.296

- Gold spot up $3.89 or +0.23% at $1727.23

- Copper up $2.5 or +0.76% at $331.1

- Silver up $0.08 or +0.4% at $18.9825

- Platinum up $4.66 or +0.55% at $850.18

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/07/2022 | - | *** |  | CN | Trade |

| 13/07/2022 | 1230/0830 | *** |  | US | CPI |

| 13/07/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 13/07/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 13/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/07/2022 | 1500/1100 |  | CA | BOC press conference | |

| 13/07/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/07/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 13/07/2022 | 1800/1400 |  | US | Federal Reserve Beige Book | |

| 14/07/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/07/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 14/07/2022 | 0800/0400 |  | US | Treasury Secretary Janet Yellen | |

| 14/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/07/2022 | 1230/0830 | *** |  | US | PPI |

| 14/07/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 14/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/07/2022 | 1500/1100 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.