-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPlenty To Talk About On Taper

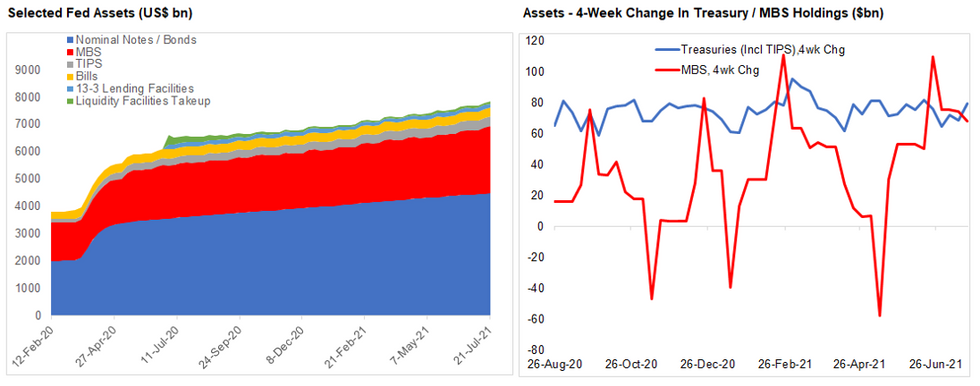

Fed asset holdings hit a fresh record $8.24T in the week ending Jul 21, with a monthly rise of $139B and $39B weekly (mainly nominal Tsys and MBS offsetting a decline in maturing TIPS). 13-3 and other pandemic facilities look to have peaked in size (see table) and should be a drag on Fed balance sheet growth going forward.

- The July 27-28 FOMC meeting is very unlikely to culminate in a taper announcement, but September is a distinct possibility. In any case, the debate over slowing and stopping net asset purchases will continue at the July meeting, and will be multifaceted: the timing, pace, composition, and end-point are all contentious areas.

Source: Federal Reserve, MNI

Source: Federal Reserve, MNI

- On timing: Multiple regional Fed presidents are advocating a reduction in asset purchases soon, but most FOMC members want to see more "substantial further progress" on the labor market front., with Chair Powell saying that is "still a ways off". Markets continue to expect a taper to begin early in 2021.

- On pace: While the prevailing consensus is that the current $120B/monthly in purchases would be tapered by an average $10B a month over the course of a year (or divided up $15B over 8 FOMC meetings), this has been one of the least openly-debated aspects among the current FOMC. But ex-Fed officials told MNI that the uncertainty in emerging from the pandemic means the Fed is likely to be open to adjusting the pace if their fundamental view of the outlook changes.

- On composition: Regional presidents and Gov Waller have suggested tapering MBS earlier or more quickly than Treasuries, in part because house price gains have been very strong. But Powell and NY Fed Pres Williams have been lukewarm about the idea, noting that MBS buys impact broader financial conditions in a manner similar to Tsy purchases. Other members have concurred, and/or see a shift on MBS as confusing the Fed's messaging and not worth the risk.

| Assets | Total | Nominal Tsys | TIPS | Bills | MBS+Agencies | 13-3 Facilities | Liquidity Facilities | Other* |

| Last Week's Net Change (USDbn) | 38.9 | 29.3 | - 7.9 | - | 19.8 | - 1.7 | - 1.0 | |

| 4-Week Net Change (USD bn) | 138.6 | 80.1 | - 2.3 | - | 68.0 | - 5.4 | 0.9 | |

| Total Holdings (USD bn) | 8,240.5 | 4,514.0 | 346.9 | 326.0 | 2,424.5 | 138.3 | 87.9 | 402.8 |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.