-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY248 Bln via OMO Tuesday

MNI Eurozone Inflation Insight – November 2024

Norges Bank Preview - Aug 2020: Bank to Wait Until September Projections

August Meeting of Little Consequence, Bank to Wait Until September Projections

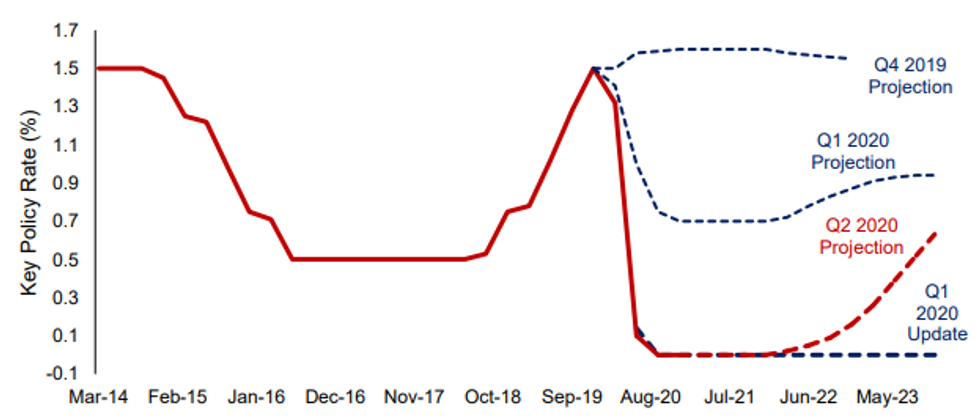

Figure 1: Rate path projections surprisingly edged higher in June

Source: MNI/Norges Bank

MNI Point of View:

- June's policy projections were a surprise, with the Norges Bank going against the tide of other global central banks and specifying a date by which they expect to begin tightening policy. With this month's decision restricted to just the announcement on rates and a small policy statement, the Norges Bank will wait until September before shedding any more light on their policy intentions.

- There remain both upside and downside risks to the Norwegian economic recovery, with bouncing oil prices and a bubbling property market on one hand, and the threat of a second COVID wave and a retrenchment of consumer spending on the other. How the executive board judge these risks will be evident in any revisions to the rate path projections in September.

- Alongside the more hawkish rate path in June, the Bank cemented their stance that they don't see the deployment of negative rates as a viable solution to any future downturn: "the Committee does not envisage making further policy rate cuts". Barring any very considerable downside risks this year, that is to remain the case.

- That's not to say the Bank don't have other tools at their disposal. Despite the bank removing the two-way risk to rates, there are policy measures available to ease financial conditions in any future recession (COVID-induced or otherwise). On August 14th, the bank extended the deadline of their extraordinary F-loans program to the end of 2020 and warned that the offerings of the F-loan program could be adjusted at short notice "if market conditions so warrant". This should protect Norwegian markets from any meaningful liquidity shortage in the coming months.

- This leaves the Norwegian economy well poised to follow the Bank's forecasts, narrow and close the output gap over the coming two years, and justify higher policy rates.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.