-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR Relief Rally as RN Likely Short of Majority

Highlights:

- EUR undergoes relief rally as attention turns to French second round

- ISM Manufacturing the data highlight, following Chicago PMI strength

- ECB's central banking conference kicks off, but BoE to remain silent

US TSYS: Following EGBs Lower With TY In Retracement Mode

- Treasuries have followed EGBs lower in a reversal of the earlier unwinding of political risk premium that had been priced in ahead of Sunday’s French election (first round in line with expectations).

- ISM manufacturing provides today’s focal point before Chair Powell tomorrow.

- Cash yields sit between 0.5bp lower (2s) and 1bps higher (7s and beyond) with the further steepening seen with the Asia open.

- 10Y yields hold just above 4.40% at levels shortly prior to the May CPI report (Jun 12) whilst 2s10s at -34.1bps continues its lift away from recent ytd lows of -50.8bps.

- TYU4 is in retracement mode, currently at 109-18+ off an earlier low of 109-15 with particularly elevated volumes of 475k. The earlier low marks initial support after which lies the key 109-00+ (Jun 10 low).

- Data: S&P Global US mfg PMI Jun final (0945ET), ISM mfg Jun (1000ET), Construction spending May (1000ET)

- Bill issuance: US Tsy $73B 13W, $70B 26W bill auctions (1130ET)

STIR: Fed Rates Rangebound; ISM Mfg Today, Powell Tomorrow

- Fed Funds implied rates are little changed from Friday’s close having lifted ahead of the weekend.

- They remain rangebound. Last week saw them initially push a little above pre-retail sales levels on stronger international CPI readings before easing on domestic data including core PCE inflation at 0.08% M/M in May.

- The Dec’24 rate of 4.88% is below recent highs of 4.895% and pre-CPI levels of 4.94%.

- Cumulative cuts from 5.33% effective: 3bp Jul, 17bp Sep, 26bp Nov, 45bp Dec and 58bp Jan.

- ISM manufacturing headlines today’s docket. There is no Fedspeak scheduled today, with Powell’s Sintra appearance next up.

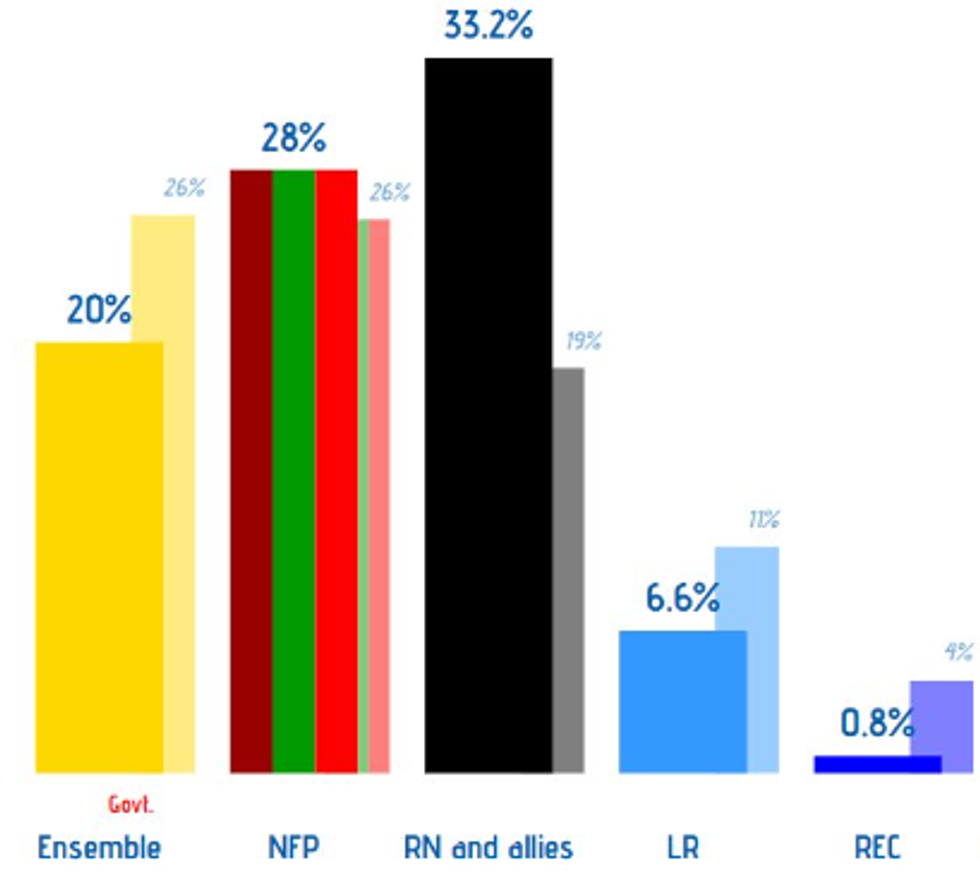

FRANCE: Attention Turns To Run-Off Contests After RN Wins 1st Round Plurality

The first round of the French parliamentary election on 30 June delivered a result largely in line with opinion polling as the right-wing nationalist Rassemblement National (National Rally, RN) secured a plurality of the vote. Attention now turns to the second round on 7 July, where President Emmanuel Macron - after a poor third-placed finish for his centrist Ensemble alliance - is calling for a 'republican front' of the centre and left to join together to stop RN securing a majority.

- Projections from pollster Ifop expect the RN to win between 240 and 270 seats based on these vote shares, short of the 289 required for a majority. The leftist New Popular Front (NFP), in second place on 28%, could win 180-200 seats, while Ensemble could fall to 60-90 according to Ifop projections.

- The election has seen three notable highs:

- The highest turnout since the 1986 legislative election at 66.7%, compared to 47.5% just two years ago.

- A total of 75 of 577 seats were won in a first round, a far greater total than usual. Thirty eight went to the RN, 32 to the NFP, three to the centre-right Les Republicains and its allies, and two to Ensemble.

- A very high number of seats could see three-way contests in the second round, with 285-315 of seats seeing more than two candidates reach the threshold of securing support from 12.5% of eligible voters in that constituency.

- If Ensemble candidates do not stand down in favour of NFP or vice versa it would smooth the path to an RN majority, with the centre/left vote split.

Chart 1. Parliamentary Election Vote Share, % (2022 Result in lighter shaded column)

Source: Interior Ministry, @EuropeElects

Source: Interior Ministry, @EuropeElects

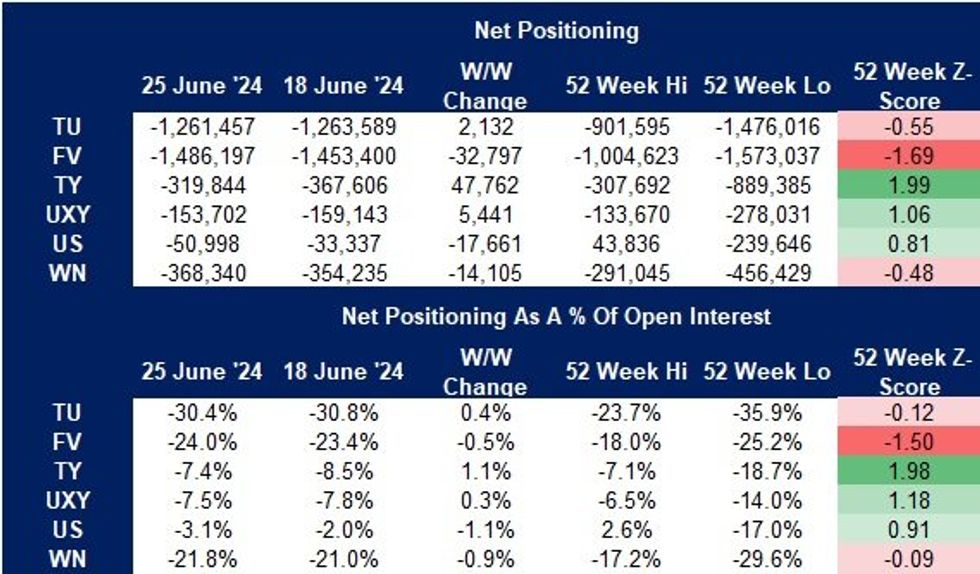

US TSY FUTURES: CFTC Shows Hedge Funds Building Net Short, While Asset Managers Extend Net Long

The latest CFTC CoT report showed an extension of the recent major positioning themes through June 25.

- Hedge fund net shorts in TU futures extended to a fresh record, while the cohort’s net short positioning in WN futures moved to the most extreme level since ’22. They extended net shorts in all contracts outside of UXY futures.

- Meanwhile, asset managers generally took the other side as they built on net longs in most contracts, only trimming existing net longs in FV & WN futures.

- Overall, non-commercial net shorts were trimmed in TU, TY & UXY futures, while net shorts were extended in FV, US & WN futures.

- A reminder that Tsy futures positioning metrics will be skewed by basis trade positions.

Source: MNI - Market News/CFTC/Bloomberg

Source: MNI - Market News/CFTC/Bloomberg

CFTC: Speculators Continue to Favour AUD, NZD Positioning

- The run higher in the NZD net position persists, with speculators adding a net 6.3k contracts in the week ending June 25th, putting the NZD long at 44% of open interest and the largest position of the past twelve months. A similar net short cover in AUD puts the NZD, AUD 12m Z-scores at the highest among all currencies surveyed, at +2.96 and +2.94 respectively.

- The improvement across AUD, NZD positions was consistent for both asset managers and leveraged funds. Elsewhere, the EUR position remains broadly neutral, but close to a yearly low, while markets deepened the net short CAD position, to total 44% of open interest.

- Full update here:

GERMAN DATA: Services Inflation Potentially A Touch Softer; Food Prices Jump

Looking a bit closer at this morning's German state level flash June inflation data, food inflation seems to have jumped up, while services inflation might have softened slightly, and the core goods categories painted a mixed picture.

- MNI estimates services inflation slightly lower than in May, at 3.8%-3.9% Y/Y (3.9% May) based on 49.7% weighting of the national print. This is driven by deceleration centred around a couple of individual categories: We track transport prices at 1.6-1.7% Y/Y (2.6% May) and the recreation and culture category at 1.4-1.5% Y/Y (1.8% May).

- Meanwhile, healthcare and restaurants/hotels inflation appear to have accelerated, to around 2.9% Y/Y (2.7% May) and 6.5% Y/Y (6.3% May), and inflation in the communication, education, and other goods and services categories seems to have kept a relatively steady pace in June.

- Food prices appear to have seen a jump looking at the yearly rate, at 2.4-2.5% Y/Y (1.2% May), which was driven by a firm sequential 1.1-1.2% M/M.

- Core goods seem to paint a more mixed picture this month after disinflating recently. We estimate clothing and footwear broadly around 3.1% Y/Y (2.8% May) and furnishings and household equipment at 0.4% Y/Y (vs 0.8% May).

FOREX: EUR/USD Marked Higher on French First Round

- French politics remains a market focus - results from the first round showed the right-wing RN winning plurality, meaning attention now turns to the second round this weekend. While RN put in a strong showing, polling numbers show no overall majority in the assembly, helping underpin the EUR today, which is firmer against most others in G10.

- EUR/USD has been marked higher to trade back above 1.0750, but resistance at the 1.0777 50-dma has contained the rally so far. Nonetheless, the pair has traded the best levels since Jun13, aided by the rally in core French banking shares.

- AUD/JPY trades a higher high for a tenth consecutive session. Such a streak has only occured a handful of times since the Global Financial Crisis and another higher high tomorrow would be the longest winning streak for the cross since 2011. Price has cleared 107.50 to touch the highest level since 2007 today.

- German national CPI is set to come in alongside consensus, with core CPI tracking at 2.9% for today's release - as per this morning's regional numbers which have provided few surprises. The June Manufacturing ISM is the data highlight, with markets watching for whether the ISM will follow Chicago PMI's strong showing from last Friday.

- The speaker slate is euro-centric this week, with the formal kick-off of the ECB's central banking forum in Sintra. Nagel and Lagarde are both set to speak today but the agenda picks up later in the week, with appearances from Fed members also due. BoE speak remains quiet, however, as MPC members remain inside their pre-election quiet period.

FX OPTIONS: Expiries for Jul01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-85(E580mln), $1.0695-00(E2.4bln)

- USD/JPY: Y159.50($908mln)

COMMODITIES: Bullish WTI Futures Trading Close to Last Week's Highs

A bull cycle in WTI futures remains in play and the contract traded higher last week. The recent breach of $80.11, the May 29 high and a key resistance, strengthened a bullish theme. Note too that $82.24, 76.4% of the Apr 12 - Jun 4 bear leg, has been pierced. A clear break would open $85.24, the Apr 12 high and a bull trigger. Initial firm support to watch is $78.86, the 50-day EMA. A break would be seen as a potential reversal signal. A bear threat in Gold remains present and the yellow metal continues to trade closer to its recent lows. The sell-off on Jun 7 reinforced a short-term bearish theme. Price has pierced the 50-day EMA, at 2318.4. A clear break of this EMA would confirm a resumption of the reversal from May 20 and open $2277.4, the May 3 low. Clearance of this price point would also strengthen a bearish theme. Initial firm resistance is $2387.8, the Jun 7 high.

- WTI Crude up $0.54 or +0.66% at $82.16

- Natural Gas down $0.03 or -0.96% at $2.575

- Gold spot down $2.35 or -0.1% at $2324.28

- Copper up $0.5 or +0.11% at $439.85

- Silver up $0.05 or +0.16% at $29.188

- Platinum down $3.53 or -0.35% at $992.48

EQUITIES: Trend Conditions in E-Mini S&P Unchanged and Bullish

The trend condition in Eurostoxx 50 futures remains bullish. The recovery from the Jun 14 low appears to be an early reversal of the May 16 - Jun 14 correction. Attention is on 5039.84, a Fibonacci retracement. A break of this level would be a positive development. For bears, a reversal lower would signal a resumption of the bearish corrective cycle and open 4846.00, the Apr 19 low and a key support. The trend condition in S&P E-Minis is unchanged and signals remain bullish. Resistance at 5430.75, the May 23 high and bull trigger, has recently been cleared. This break confirmed a resumption of the primary uptrend. Note that moving average studies are in a bull-mode position and this continues to highlight positive sentiment. Sights are on 5594.66, a Fibonacci projection. Support to watch is 5484..21, the 20-day EMA.

- Japan's NIKKEI closed higher by 47.98 pts or +0.12% at 39631.06 and the TOPIX ended 14.65 pts higher or +0.52% at 2824.28.

- Across Europe, Germany's DAX trades higher by 108.55 pts or +0.6% at 18344.52, FTSE 100 higher by 41.01 pts or +0.5% at 8204.78, CAC 40 up 131.21 pts or +1.75% at 7610.61 and Euro Stoxx 50 up 57.39 pts or +1.17% at 4951.41.

- Dow Jones mini up 58 pts or +0.15% at 39527, S&P 500 mini up 8.5 pts or +0.15% at 5530, NASDAQ mini up 30.5 pts or +0.15% at 19958.5.

| Date | GMT/Local | Impact | Country | Event |

| 01/07/2024 | 1200/1400 | *** | HICP (p) | |

| 01/07/2024 | 1345/0945 | *** | S&P Global Manufacturing Index (final) | |

| 01/07/2024 | 1400/1000 | *** | ISM Manufacturing Index | |

| 01/07/2024 | 1400/1000 | * | Construction Spending | |

| 01/07/2024 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 01/07/2024 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 01/07/2024 | 1900/2100 | ECB's Lagarde speech at ECB forum on Central Banking | ||

| 02/07/2024 | 2301/0001 | * | BRC Monthly Shop Price Index | |

| 02/07/2024 | 0130/1130 | RBA Minutes | ||

| 02/07/2024 | 0730/0930 | ECB's De Guindos chairing session on inflation | ||

| 02/07/2024 | 0830/1030 | ECB's Elderson chairs session on biodiversity | ||

| 02/07/2024 | 0900/1100 | *** | HICP (p) | |

| 02/07/2024 | 0900/1100 | ** | Unemployment | |

| 02/07/2024 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 02/07/2024 | 1030/1230 | ECB's Schnabel chairing panel on Geopolitical shock and inflation | ||

| 02/07/2024 | - | *** | Domestic-Made Vehicle Sales | |

| 02/07/2024 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 02/07/2024 | 1330/1530 | ECB's Lagarde in policy panel at ECB forum | ||

| 02/07/2024 | 1330/0930 | Fed Chair Jerome Powell | ||

| 02/07/2024 | 1400/1000 | *** | JOLTS jobs opening level | |

| 02/07/2024 | 1400/1000 | *** | JOLTS quits Rate | |

| 02/07/2024 | 1530/1130 | * | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.