-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessNZD/USD Pops Higher Into Month-End, New Zealand Consumer Confidence Falters

NZD/USD bounced off near two-year lows on the final day of June, with greenback sales facilitating the move. While the kiwi came under some pressure in reaction to local consumer sentiment gauge released in local hours, U.S. data took focus later in the day. The U.S. dollar gave up its earlier gains as core PCE & personal spending both printed slightly below forecast levels.

- On top of that, potential profit-taking ahead of month-end rebalancing may have played a role in sapping some strength from the greenback.

- Cross-asset signals may have kept a lid on the kiwi, as equity sentiment was broadly negative and the VIX index edged higher, while BBG Commodity Index slumped to a four-month low.

- Despite Thursday's uptick, spot NZD/USD is hovering close to recent cyclical lows. It last sits at $0.6235, down 9 pips on the day.

- Key near-term bearish target is located at $0.6197, which limited losses on Jun 14, with the $0.6200 area providing a firm layer of support in recent weeks. Below there lies May 25, 2020 low of $0.6084.

- Bulls look to a rally above $0.6327, which capped gains on Jun 24 & 27. A clean break here would bring Jun 16 high of $0.6396 into play.

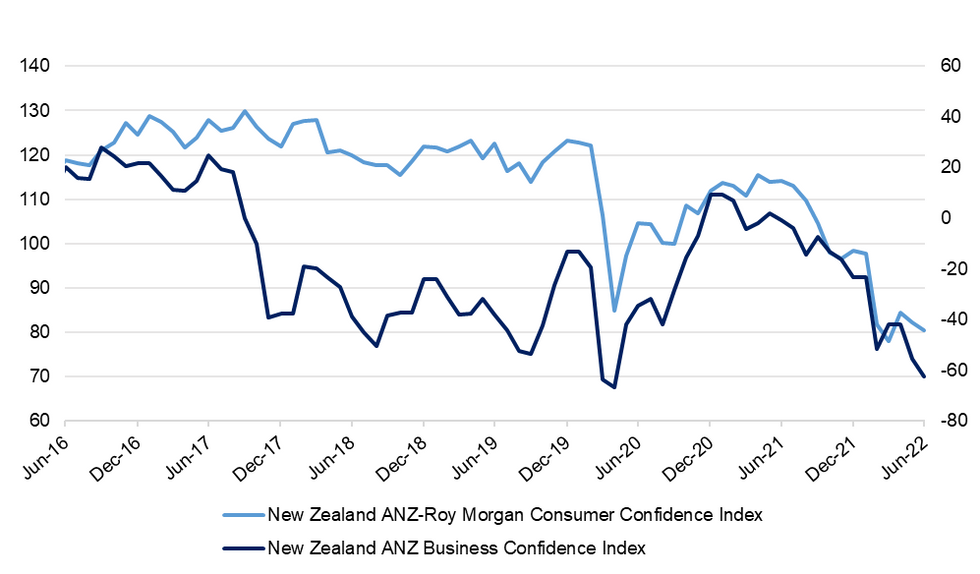

- New Zealand's ANZ-Roy Morgan Consumer Confidence Index fell to 80.5 in June from 82.3 recorded in May. Most sub-indices deteriorated, although the share of people who thought it was a good time to purchase a major household item jumped 9 points. ANZ commented that the index was "a touch above its record low, but still deep within the “something to worry about” zone."

- This comes on the heels of ANZ Business Outlook Survey that hit the wires yesterday, showing further deterioration in business conditions and particularly weak profitability expectations.

- Looking ahead, New Zealand building permits will be out shortly.

Fig. 1: New Zealand ANZ Consumer vs. Business Confidence

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.