-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

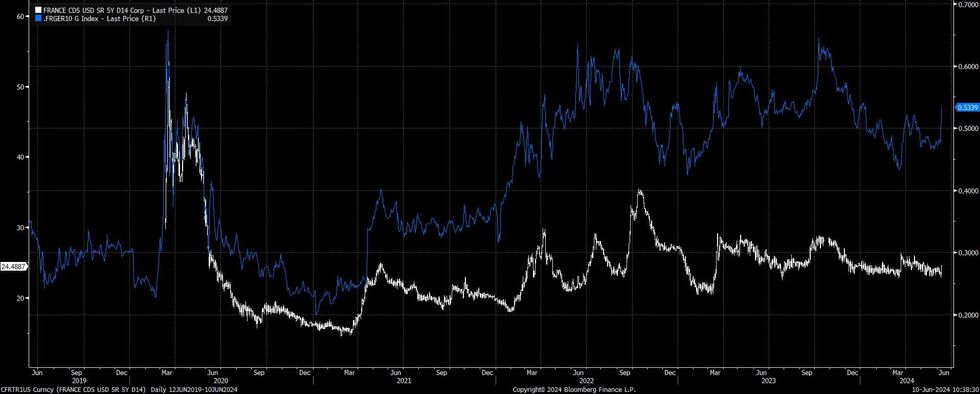

Free Access/OATS: CDS Sticks To Recent Range, 10-Year OAT/Bund Spread Above April Closing Wides

Benchmark French CDS reaction to the EU election results and the subsequent calling of a French snap election generally encapsulates the broader prevailing view.

- Ultimately, markets seem to hold limited long-term worry surrounding the French political situation, albeit with short-term uncertainty heightened.

- 5-Year CDS widens by a little over 1bp to trade at ~25bp, shy of the March ’24 highs

- OATs have been more sensitive, with the 10-Year OAT/Bund spread showing above the early April '24 closing highs.

- Fiscal worry was already evident in France.

- A reminder that policymaker rhetoric and tabled actions seemed to prevent the worst-case sovereign rating scenario as France avoided negative action from Fitch & Moody’s, allowing OAT spreads to move off early April wides.

- Still, the country received a one-notch downgrade from S&P in late May (placing that rating on an equal footing with the Fitch equivalent).

- Different forms of Iberian/IRISH tighteners vs. OATs remain a favoured sell-side call.

- When it comes to the upcoming French election, our political risk team has already noted that “the most likely outcome is for RN to increase its seat total but fall short of an overall majority. RN President Jordan Bardella has said that he would serve as Macron's PM, and the prospect of RN becoming the largest party cannot be ruled out.”

- Markets are therefore contemplating the issue of 'Cohabitation' (PM and President from different parties), which is rare in France and would likely limit policymaking capabilities during a period of already heightened fiscal uncertainty.

Fig. 1: French 5-Year CDS Vs. 10-Year OAT/Bund Spread

source: MNI - Market News/Bloomberg

source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.