-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPopulation Decline Report Garners Attention

Offshore yuan is weaker, USD/CNH rising towards the top of yesterday's range, last at 6.4848, up 45 pips.

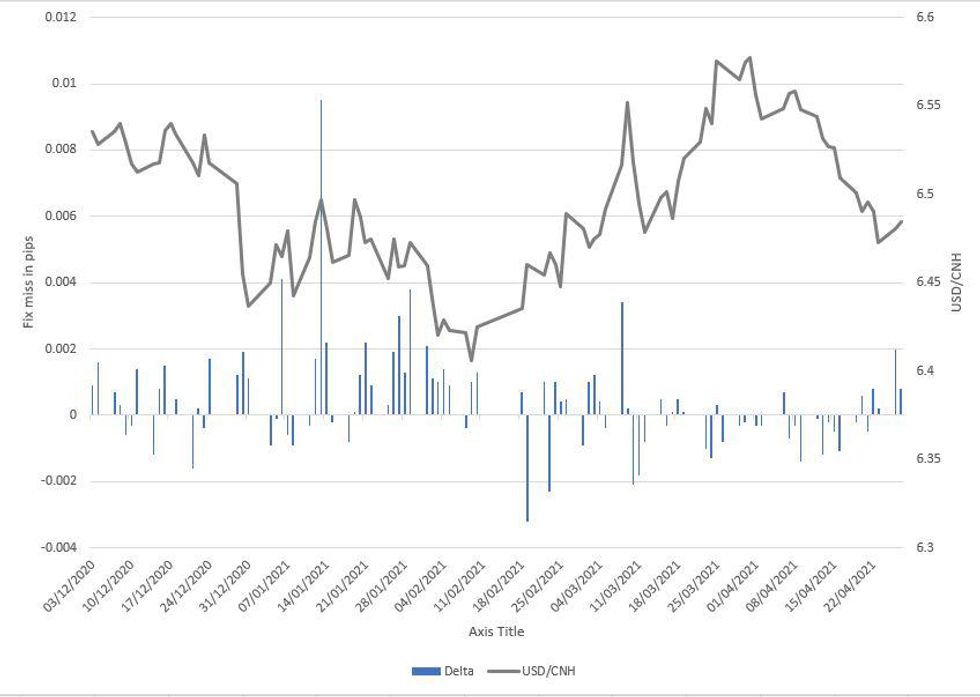

- There was a report in the China Securities Journal that the yuan FX rate is more likely to see two-way moves this year. The PBOC seems to have loosened its asymmetric bias for the yuan, since the return from LNY (48 sessions) the sum of USD/CNY sell side estimates minus PBOC fixes is -58 pips, compared to 465 pips in the 48 sessions pre-LNY. Earlier this week China's SAFE said the forex market would remain stable with a solid foundation.

- Fig.1: USD/CNH & Fix Delta

Source: MNI/Bloomberg

Source: MNI/Bloomberg

- Asian Development Bank (ADB) released a report today that forecasted China's GDP to surge this year despite persistent uncertainties over the coronavirus disease (COVID-19) pandemic.

- A story in the FT said that China is set to report its first population decline since the People's Republic was founded in 1949. This could have significant implications for China's economy, a Capital Economics note posits that a shrinking population could pose headwinds that mean China never overtakes the US as the world's biggest economy, while as the population ages extra strain could be put on the pension system which is already underfunded. A PBOC report in March estimated that China's potential growth could be 5.1% in 2025, from around 5.7% in 2021.

- Elsewhere, leaders from Germany and China will hold virtual talks today. China's foreign minister Wang said both sides should work deepen practical cooperation after agreeing to advance investment last year.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.