-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

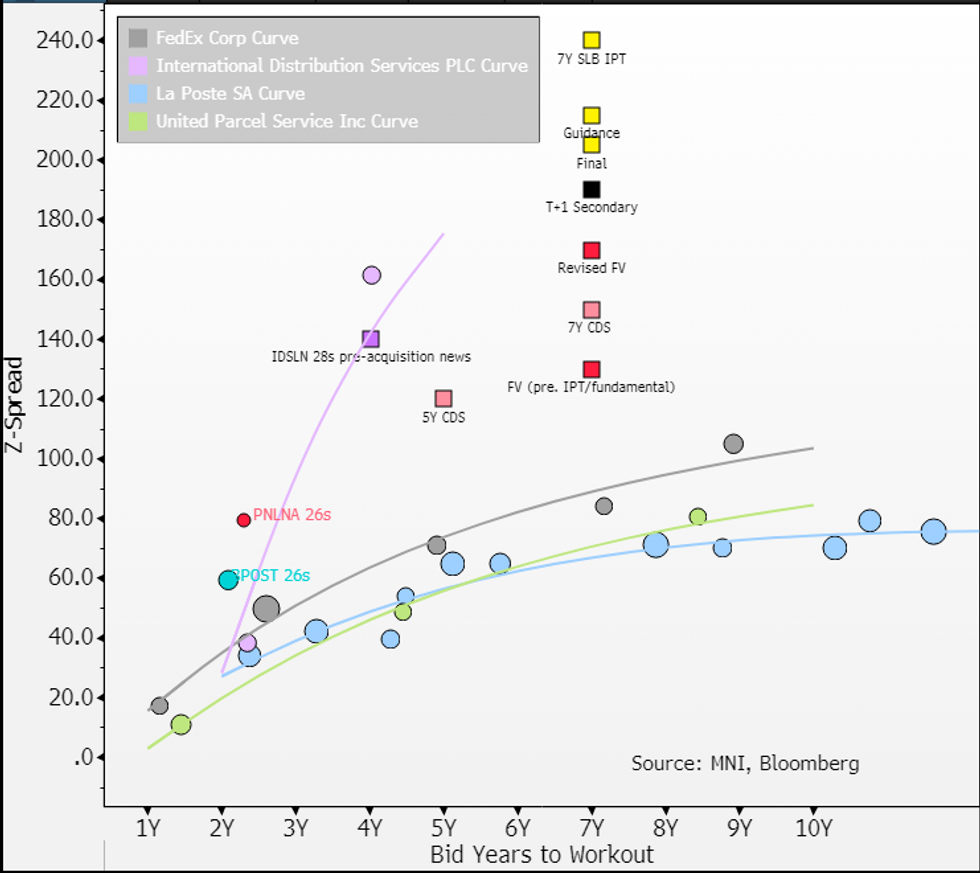

Free AccessPostNL (PNLA; NR/ BBB Neg) T+1 Secondary

New PNLNA31s -15bps, CDS moving with Main (-1). Cheap view was added at guidance. Valid for those that missed out here, but only on carry & roll. Ex funding costs we see C&R giving duration adj. 6bps of protection into 2Q earnings.

- Key question for us yesterday was if we would see a repeat of IDSLN28s (385bp spread & 550bp yield return in 6m) in secondary. It's off to a good start this morning (88bps).

- To clarify our FV was +130 and included the 26s trading history vs. higher rated comp's since issuance. In hindsight we perhaps should've weighted the IDSLN28s poor pricing last year & current wides more.

- We added before IPT, FV at +130 for this duration was never attractive on a number of company specific issues - investors may have shared those views/nerves adding to the poor pricing. Why it did not wait till we saw more of the 'company guided to recovery' in parcel volumes remains a mystery to us noting front maturity is only in Nov. We will record the NIC to revised FV at 35bps.

- For investors that missed out (books swelled to €2.5b/8x cover into final), our dislike for the name/timing here had us indicate cheap view valid on final at or north of 200. Its at Z+190 this morning; the moves will eat into the supportive technicals which that view was based on including basis (CDS) and vs. IDSLN28s (another cheap view) - both ~unch. We leave a cheap view on it here for those that missed out, but emphasis it is based on carry & roll & 2Q earnings that comes in 2-months. We see it giving about 35bps of protection (6bp move in spreads) by then.

- Key updates we are looking at in 2Q (in order): is FY guidance left unch, any updates on removing the 1 day delivery requirement with parliament, any updates on remaining PostNL collective labour agreement negotiations, any signs of loosening labour market (300 vacancies last reported in Mail) and any change to dividend policy of 70-90% of net income (not expected but could be a positive if so).

Revised FV from yesterday, Initial FVand Background on Co.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.