-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

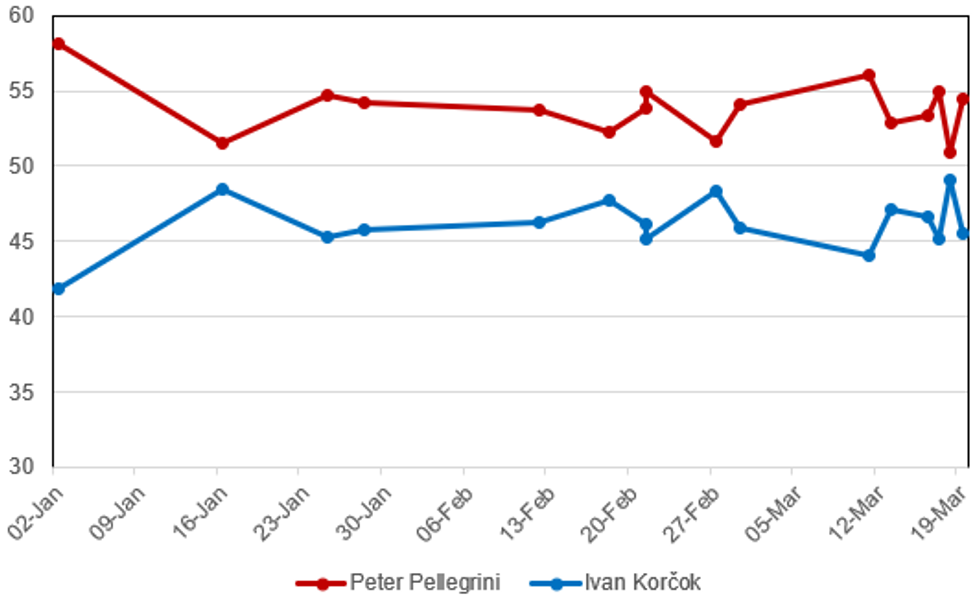

Free AccessPresidential Run-Off Set To Prove Close Contest

Following the first round of the presidential election on 23 March attention now turns towards the run-off on 6 April. Former Foreign Minister Ivan Korcok won a first-round plurality, taking 42.5% of the vote. He is an independent, but has the backing of the main oppostion liberal Progressive Slovakia. Joining Korcok in the run-off will be former PM and current Speaker of the National Council Peter Pellegrini, who took 37.0% of the vote. Pellegrini is leader of the centre-left Hlas-SD and has the endorsement of PM Robert Fico's left-wing populist Smer-SD.

- No polling has been released since the first round took place. The hypothetical polling on a Korcok-Pellegrini run-off carried out prior to the election has consistently shown Pellegrini in the lead.

- Third-placed candidate Stefan Harabin, who won 11.7% of the vote, was backed by two nationalist pro-Russian parties. As such his supporters are more likely to opt for Pellegrini than the pro-EU Korcok in the run-off. However, Korcok's strong performance could act as a boost for his campaign, and he requires a smaller increase in voters to push him over the 50% level.

- Given Slovakia's position as a eurozone and EU member the outcome of the election has notable implications both domestically and regionally. A win for Pellegrini would bolster Fico's position given he would not face a political opponent in the president's office.

- A Korcok victory could maintain incumbent President Zuzana Caputova's stance of criticising Fico's policies for allegedly being anti-EU, anti-Ukrainian, and pro-Russian.

Source: Sanep, NMS, Ipsos, Focus, AKO, Median, MNI

Source: Sanep, NMS, Ipsos, Focus, AKO, Median, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.