-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessProductivity Dynamics Make "Last Mile" Of Disinflation Look Long (2/2)

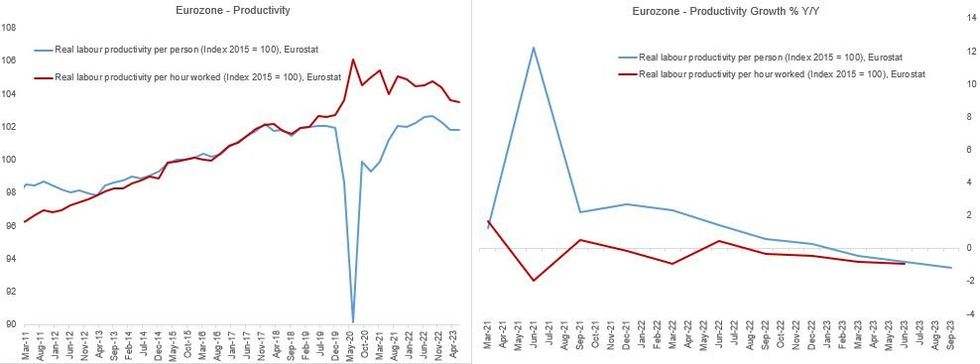

Meanwhile productivity per worker has not helped, having been negative Y/Y for three consecutive quarters through Q3 2023. Per hour productivity picked up sharply vs pre-pandemic levels as hours worked per person dropped, but has been negative Y/Y for 6 of the past 7 quarters; per employee, productivity is flat /below 2017 levels.

- With productivity running at a negative 1% Y/Y pace, theoretically wage growth would have to be around 1% for the ECB to have comfort that inflation was converging to the 2% target. Alternatively, with current wage growth, productivity growth would have to levels not seen outside of very brief periods in eurozone history, usually recoveries from recessions, thus unlikely.

- This is a key reason why the mild contraction in economic activity currently gripping Germany and impacting the broader eurozone isn't enough to push the ECB to consider easing soon: it's barely had a dent on employment so far (possibly due to post-pandemic hoarding of labour), with wage growth only beginning to slow.

- Even if employment were to contract, it could be some time before it impacts incoming wage data, let alone bring down core inflation.

- ECB's Schnabel presented on "Monetary policy in times of stubborn inflation" this week (link here) eyeing the tight labour market as one reason why disinflationary progress was set to slow going forward.

- And in a speech earlier this month called "The last mile", Schnabel noted "It is reasonable to assume that the longer economic activity stagnates, the harder it will be for firms, most notably small and medium-sized firms, to hoard labour. And indeed, we are seeing first signs that the labour market is softening and demand for labour slowing. But the more slowly this process unfolds and the weaker it is, the higher the risks that persistent labour market tightness will challenge the assumptions underlying the projected decline in core inflation."

- This will be a core consideration for the ECB's decision making at coming meetings, with the employment picture increasingly important. We will take a deeper dive into Eurozone employment and productivity dynamics in an upcoming publication.

Source: Eurostat, MNI

Source: Eurostat, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.