April 30, 2024 07:49 GMT

Q1 GDP Estimates Deteriorate Amid Mixed Data

GERMAN DATA

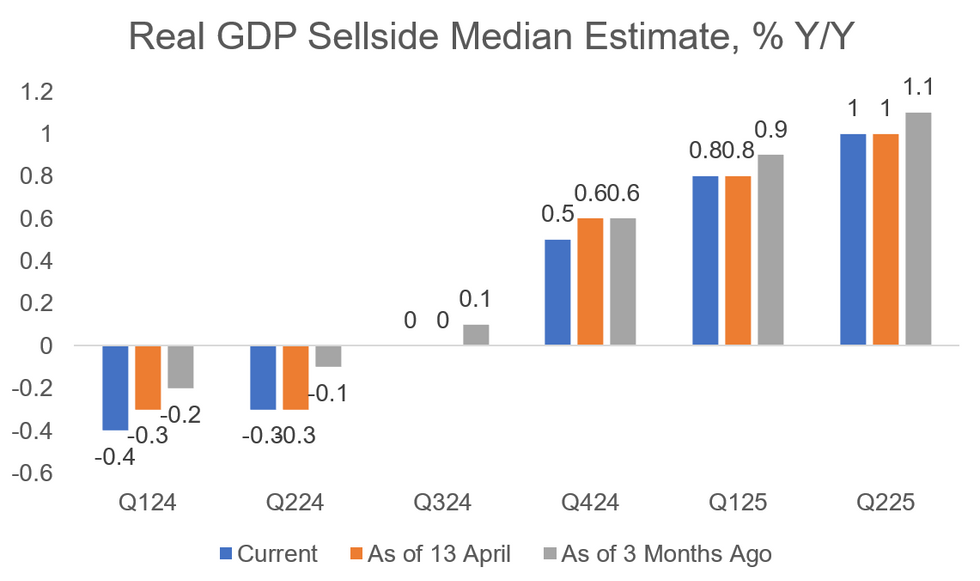

Analysts forecasts for near-term German economic activity have further deteriorated further during the last two weeks (as outlined in our April German Macro Signal publication), with the current Q1 2024 GDP growth median estimate of a set of 7 large sell side institutions standing at -0.4% Y/Y on a seasonally- and working-day adjusted basis (downwardly revised -0.1pp since mid-April, and -0.2pp vs three months ago). In Q4 2023, real GDP stood at -0.2% Y/Y SWDA, for reference.

- The Q1 2024 real GDP preliminary estimate will be published by Destatis at 0900BST/1000CET.

- The downward revision to the Q1 median was driven by updates from Rabobank (-0.1pp to -0.5% Y/Y) and HSBC (-0.2pp to -0.4% Y/Y). Estimates now range from -0.1% Y/Y (UBS) to -0.5% Y/Y (Berenberg, Rabobank). Note that these revisions were published before the Bundesbank upwardly revised their prior Q1 growth estimate to marginally positive.

- Recent data shows a mixed picture but at least partly points towards economic stabilization, with surveys mirroring an improvement in "hard" data: While 'core' factory orders have been weak, industrial production and retail sales have been ticking up, services sector turnover is rebounding, and IFO and PMIs are looking increasingly expansionary.

- Looking further ahead, growth is projected to pick up towards the end of 2024 - estimates were also downwardly revised recently here, though (+0.3% Y/Y Q2, 0% Q3, +0.5% Q4).

MNI, set of sellside analysts

MNI, set of sellside analysts

242 words