April 30, 2024 10:55 GMT

Q3 Financing Needs Above-Expected, But QT Taper Should Offset

US TSYS/SUPPLY

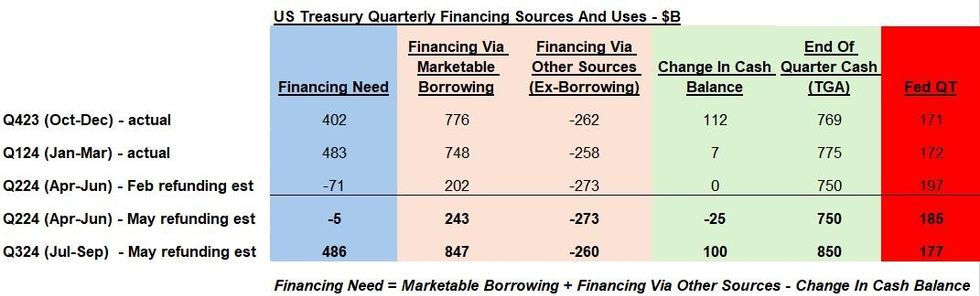

The quarterly refunding process began on April 29 with Treasury’s release of its latest financing requirement estimates. As broadly expected, Treasury increased the anticipated amount of borrowing from private markets for Apr-Jun (calendar Q2, to $243B from the $202B estimated in the February refunding round, and vs the roughly $220B MNI consensus), though its Jul-Sep (calendar Q3) borrowing estimate was on the very high side of expectations at $847B (MNI consensus looked for something in the neighborhood of $700B, with some estimates well below $600B).

- Looking at the details, for Q2, the higher estimate vs expectations looks due in part to slightly disappointing tax revenues at the end of April (“largely due to lower cash receipts”) leading to $66B more financing required, offset partially by a $25B higher cash balance to start the quarter, though the overall difference vs expectations is marginal.

- For Q3, the main reason for the upside surprise was the higher end-of-quarter cash pile of $850B, which all else equal implies an additional $100B in required funding.

- The overall implication is that bill issuance will be higher in Q3 than most had expected in order to build the cash pile up by end-September. Unanimous expectation is that coupon auction sizes will not be changed for the upcoming quarter.

- Of course, Fed QT is another consideration: the Treasury assumes in its estimates that SOMA runoff will continue at $60B a month through September, but the FOMC is widely expected to announce on Wednesday that it will immediately lower the caps on redemptions from $60B to $30B (more in MNI’s May FOMC Preview).

- That would mean $90B less financing per quarter that the Treasury would be required to raise, effectively offsetting (and partially accounting for) the $100B upside surprise to the Q3 estimate.

- MNI's full refunding preview will be out later today.

Source: US Treasury, MNI

Source: US Treasury, MNI

316 words