April 29, 2024 08:38 GMT

Rand Consolidates Last Week's Gains, USD/ZAR 1-Month Implied Vol Soars Pre-Elections

ZAR

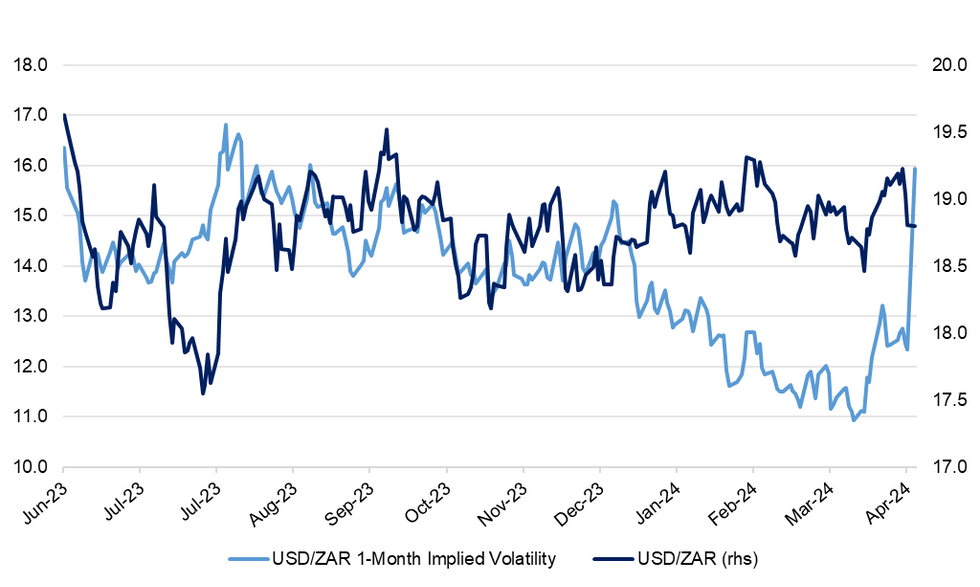

Spot USD/ZAR stabilises after a 2.2% sell-off during the final two days of last week, with the second leg of that decline driven by domestic political risk. The rand is sensitive to signals related to the potential outcome of South Africa's national and provincial elections slated for May 29. This has been reflected in a surge in USD/ZAR 1-month implied volatility to its highest point since August 2023 this morning, as the contract started capturing the election day.

- On the positive side, Eskom confirmed that its 32-day streak of loadshedding suspension will be extended until further notice. The utility has also signalled that power cuts should not exceed Stage 2 during the winter period.

- The precious metals subindex has edged higher, with gold last seen +$1.8/oz. on the session. SAGB yields are marginally lower across the curve, with 10-year breakeven inflation rate sitting at 7.00%.

- Spot USD/ZAR trades at 18.7962, a touch lower on the day. Bears seek further losses towards Apr 9 low of 18.4131. On the flip side, bullish focus falls on Apr 19/Feb 23 highs of 19.3862.99.

Fig. 1: USD/ZAR 1-Month Implied Volatility vs. Spot USD/ZAR

195 words