-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Japan Real Wages Back Positive In Y/Y Terms

MNI: PBOC Net Drains CNY716.5 Bln via OMO Wednesday

Real Wages Rise For First Time In Cycle In Q4

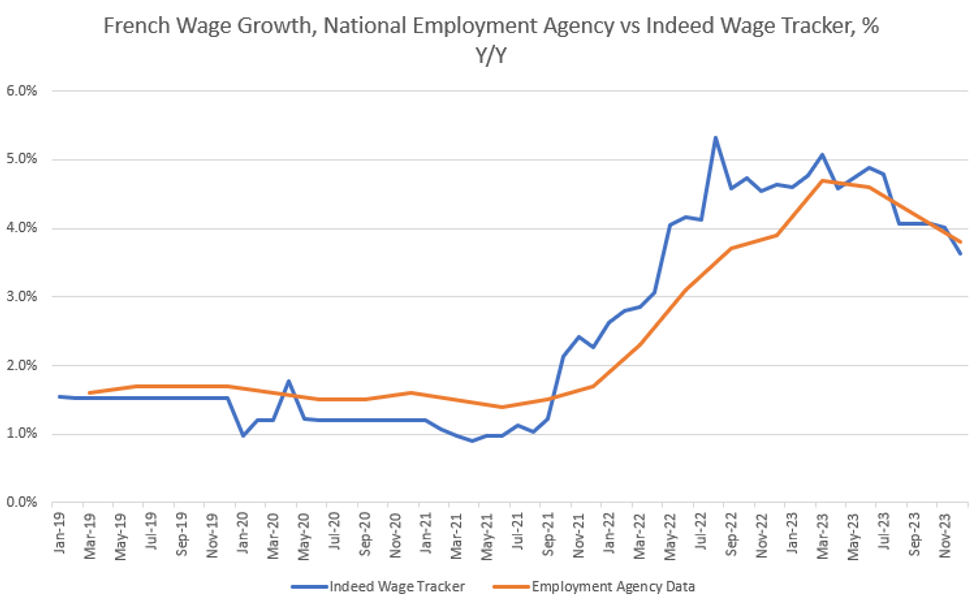

French nominal wages increased in Q4 2023 by +0.3% Q/Q (vs +0.5% prior) and +3.8% Y/Y (vs +4.2% prior). This was the fourth consecutive slowdown in the Y/Y rate, but nonetheless marks the first time in the current cycle that the yearly wage growth rate exceeded the average CPI inflation rate (3.7% Y/Y) of the respective quarter.

- Looking at the individual sectors, wage growth developments were fairly uniform, with industrial wages excl. construction and services wages rising +0.3% Q/Q (vs +0.5% prior, both), and construction wages at +0.2% Q/Q (vs +0.4% prior).

- The official Q4 growth rate largely mirrors the monthly data from the Indeed.com wage tracker, which printed at +3.6% Y/Y (+4.0% prior) in December 2023.

- Wage growth in France has been softer than in some Eurozone peers since the beginning of 2023, which has allowed French unit labour costs to remain relatively in-line with others despite poor productivity.

- That intersection between wage growth and productivity will be a key to unlocking ECB rate cuts, as stressed again by ECB's Lane and Schnabel in recent interviews and panel discussions.

- Additionally the nascent pickup in French real wage growth will be eyed as a constructive macro factor, with ECB President Lagarde noting in January's press conference: "one of the reasons why we see [Euro area] growth coming up and the recovery beginning in the course of 2024; because of rising wages while inflation comes down, which will free up some purchasing power, which hopefully will stimulate consumption."

MNI, Indeed.com, Ministry of Labour

MNI, Indeed.com, Ministry of Labour

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.