-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessRestrictions Eased In Three More States, Anwar Discusses Electoral Cooperation With Umno

Spot USD/MYR remains stable after the re-open, last trades +15 pips at MYR4.1155. A move through Mar 10 high of MYR4.1382 would expose the 200-DMA at MYR4.1445. Conversely, a dip through the 23.6% retracement of the YtD range/Mar 12 low at MYR4.1046/45 would allow bears to take aim at the 100-DMA at MYR4.0742.

- Malaysia declared just 1,063 new Covid-19 infections on Tuesday, which represented the smallest increase in the daily case tally in over three months.

- Defence Min Ismail Sabri announced that CMCO in Selangor, Kuala Lumpur, Penang, Johor and Kelantan has been extended through the end of the month and through Mar 29 in Sarawak. Kedah, Perak and Negri Sembilan will be moved to RMCO from CMCO (which means a relaxation of restrictions) on Mar 19. However, the ban on interstate travel will remain in place for now.

- Science, Tech & Innovation Min Khairy said that the federal gov't is not opposed to states purchasing Covid-19 vaccines independently, but the availability of shots may be an issue.

- Opposition leader Anwar Ibrahim confirmed that he met with several Umno lawmakers to discuss possible cooperation in the next general election, but clarified that "at this stage, we are just discussing" and there is no deal yet. Anwar noted that no more opposition MPs will back the gov't of PM Muhyiddin after a number of defections in recent weeks.

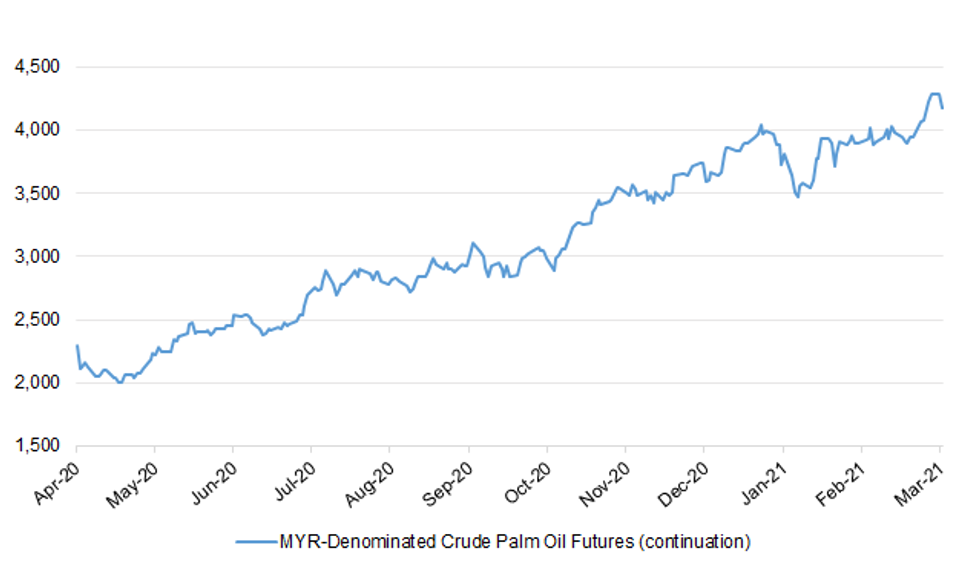

- Palm oil futures faltered in Malaysia, snapping its impressive winning streak, amid speculation re: improving production outlook.

- The Malaysian docket is virtually empty during the remainder of this week.

Fig. 1: MYR-Denominated Crude Palm Oil Futures (continuation)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.