-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessRisk Of Further Escalation In Myanmar Violence

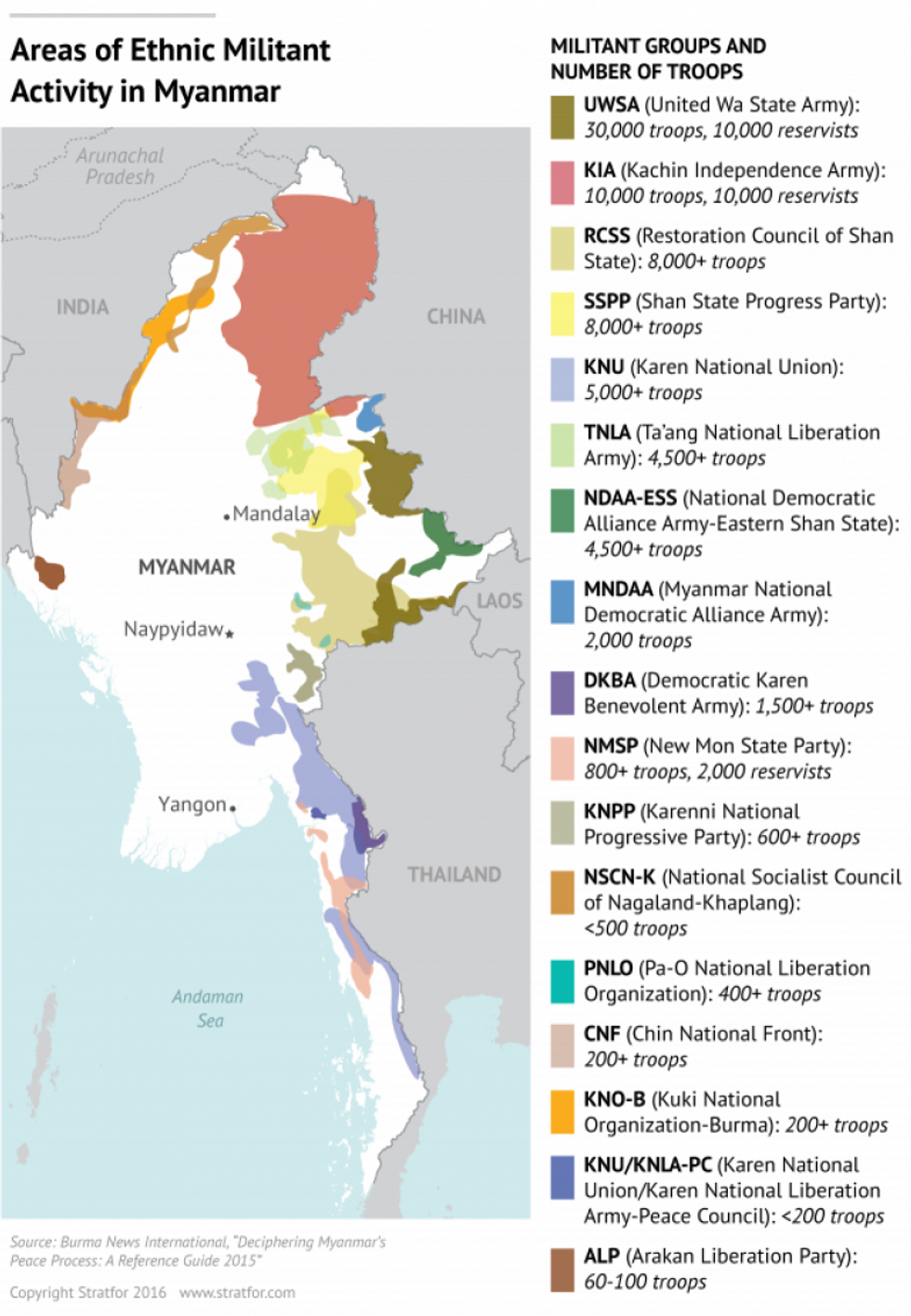

The already unstable political situation in Myanmar risks deteriorating further as one of the largest of the country's numerous separatist groups has stated that due to "advances" made by troops from the governing Tatmadaw junta, that they have "no other options left but to confront these serious threats posted by the illegitimate military junta's army in order to defend our territory".

- The statement came from the Karen National Union, whose military wing - the Karen National Liberation Army - is estimated to have a force of 5,000-12,000, and has since 2012 been party to a ceasefire with the Tatmadaw.

- The military coup of 1 February has seen mass protests on the streets of Myanmar, resulting in a brutal crackdown that has seen over 400 protestors killed by security forces.

- An escalation of violence with heavily-armed and entrenched regional and ethnic militias, combined with the ongoing anti-Tatmadaw protest movements could result in Myanmar descending into major domestic violence that risks spilling over into neighbouring India, Bangladesh, China, Laos, and Thailand.

- There is growing pressure on the ASEAN nations to act with regards to the escalating violence in Myanmar (one of the group's member states). The leaders of Singapore and Indonesia have both called for an emergency summit to discuss the crisis. However, without action from the most powerful political and economic external influence on Myanmar - China - there may be little that the ASEAN group can do to improve the situation.

Source: Stratfor, Burma News International

Source: Stratfor, Burma News International

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.