-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessRupee Reprieve Could Prove Temporary

Spot USD/INR stabilized last week around record highs close to 77.50, following reports that the Indian authorities were intervening in the FX market. However, fundamentals still point to meaningful headwinds for the rupee.

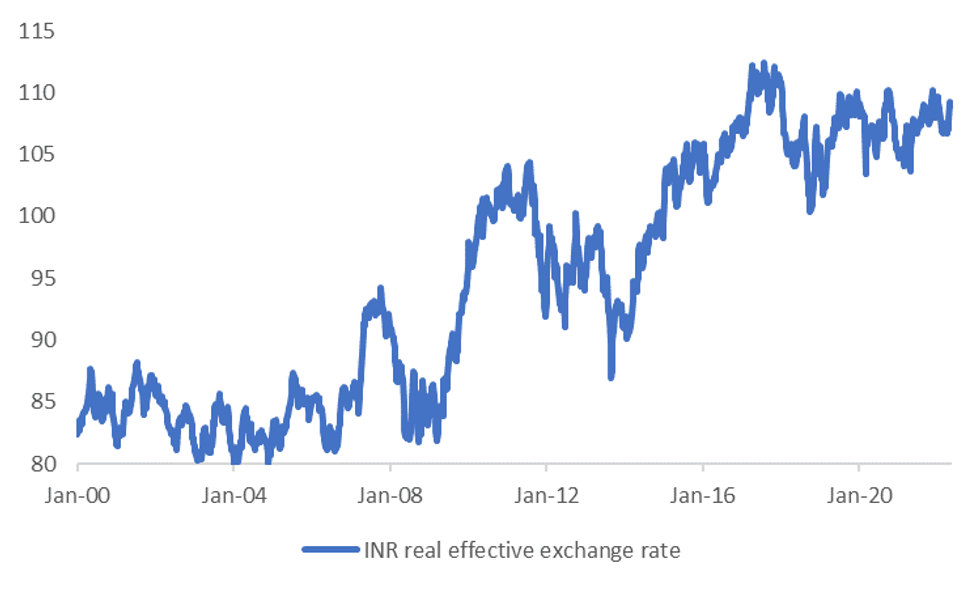

- It's difficult to make the case the INR is cheap from a long term perspective. The first chart below is the INR real effective exchange rate (REER). Current levels sit just below recent cyclical highs and we are only around 3% off record highs.

- A large driver of the elevated REER for INR is the persistently stronger inflation rate in India compared to the rest of the world. Indeed, it has only been in the last 12 months or so that the rest of the world has seen inflation rates on par with those in India. Over the long term the positive CPI differential India has had with the rest of the world has more than offset INR nominal FX depreciation.

Fig 1: INR FX Still Expensive In Real Effective Terms

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- An expensive currency won't help India's wide trade deficit position, which sits close to historical lows. Exports could also be hurt by lower wheat exports following the weekend announcement. To recap, India's government announced it will ban wheat exports for food security reasons, although exports will still be allowed to countries that require it for their own food security and at the request of governments.

- Net equity outflows persist from offshore investors as well, due to valuation concerns and the RBI's more hawkish turn. Last week saw net outflows of $1.8bn, the largest in EM Asia (outside of China). Outflows from bonds are also evident.

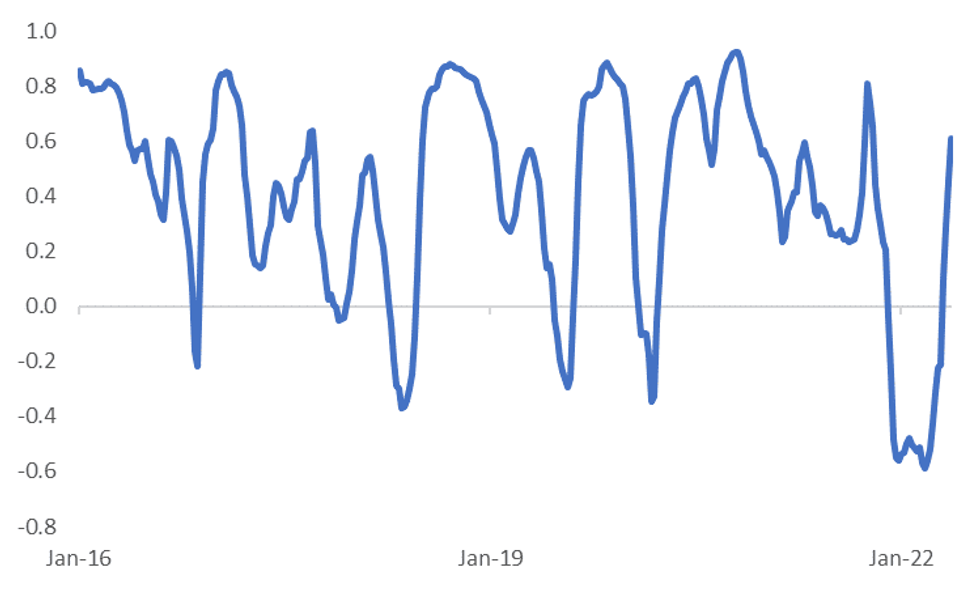

- USD/INR's correlation with USD/CNY is also trending back up, see the chart below. So higher USD/CNY levels should bias USD/INR higher, all else equal.

- The RBI maintains a very large pool of FX reserves of just under $600bn. However, we doubt the central bank will defend 'a line in the sand' with USD/INR, but rather manage the pace of depreciation.

Fig 2: USD/INR And USD/CNY Rolling Correlation (6mth Window)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.