-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessRupiah Outplays Emerging Asia Peers

Spot USD/IDR has been in retreat this morning, shedding 80 figs so far to last trade at IDR14,688, as the rupiah became the best performer in emerging Asia both today and on a weekly basis. The rate is narrowing in on its 100-DMA, which intersects at IDR14,651, providing the next bearish target. Note that the pair accelerated losses after crossing its 50-DMA/neckline of a short-term head-and-shoulders pattern (Fig. 1). A rebound above those levels (IDR14,851/14,859) and Aug 4 high of IDR14,939 is needed to give bulls some reprieve.

Fig 1. USD/IDR

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- USD/IDR 1-month NDF last -36 figs at IDR14,693, flirting with its 100-DMA at IDR14,690. A clean breach of that moving average would open up the 200-DMA at IDR14,520. Bulls look for recovery towards the 50-DMA, which kicks in at IDR14,883.

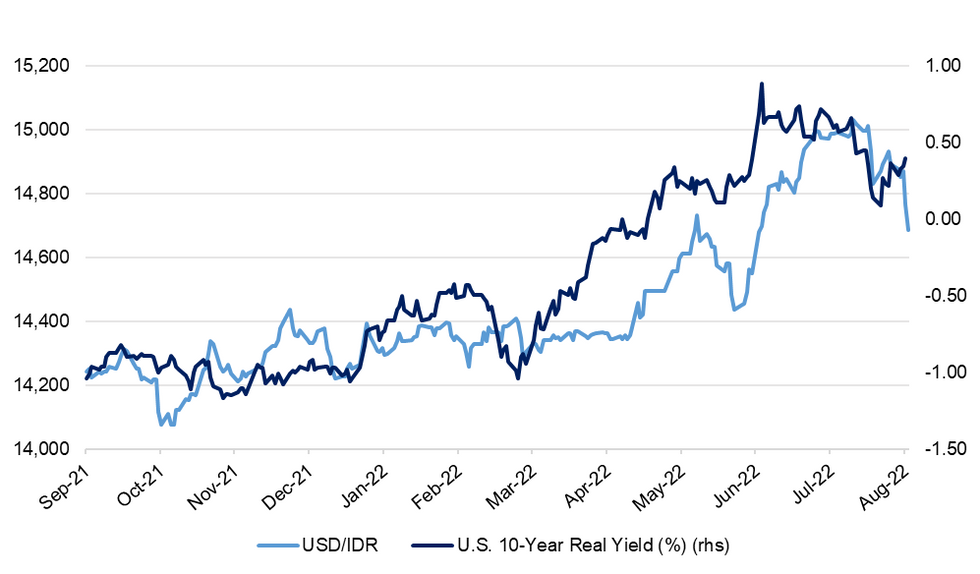

- The spot rate posted a sharp drop despite Thursday's uptick in U.S. 10-year real yield (Fig. 2). The risk backdrop is also unlikely to be underpinning such a notable swing, with U.S. equity benchmarks paring gains late doors Thursday. However, firmer commodity prices may be lending some support to the rupiah (palm oil futures are slightly up on the day and the ringgit is the second best performer in emerging Asia), boding well for Indonesia's already solid trade surplus.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

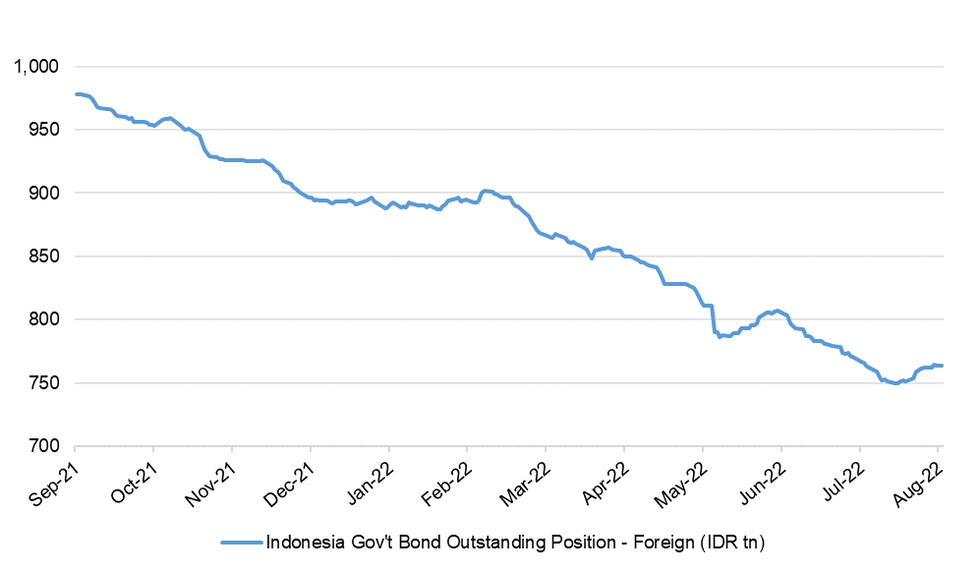

- Bloomberg circulated a note from TD Securities, who argue that the rupiah is set to appreciate on the back of Indonesia's trade surplus and attractive relative yields, which will draw foreign investors to local assets. In the grand scheme of things, the outstanding position of foreign players in Indonesian gov't bonds has already bounced from cyclical lows towards the back end of last month (Fig. 3).

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- From near-term perspective, global funds were net buyers of Indonesian stocks for the sixth consecutive day on Thursday, purchasing a net $45.0mn of equities. They sold a net $56.9mn worth of INDOGBs but it was the first net outflow since Monday. The Jakarta Stock Exchange Composite Index has slipped today, last trading ~0.2% lower on the day.

- Bloomberg reported that surveyed analysts raised their Q3 & Q4 forecasts for Indonesian CPI inflation by a full percentage point to +5.00% Y/Y and +5.15% respectively. The full-year growth estimate remained unchanged at +5.2% Y/Y.

- Next week's data docket is headlined by trade balance (Monday) & BoP current account balance (Friday).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.