April 08, 2024 15:36 GMT

Services Activity Rebounds, With Soft Data Cautiously Positive

GERMAN DATA

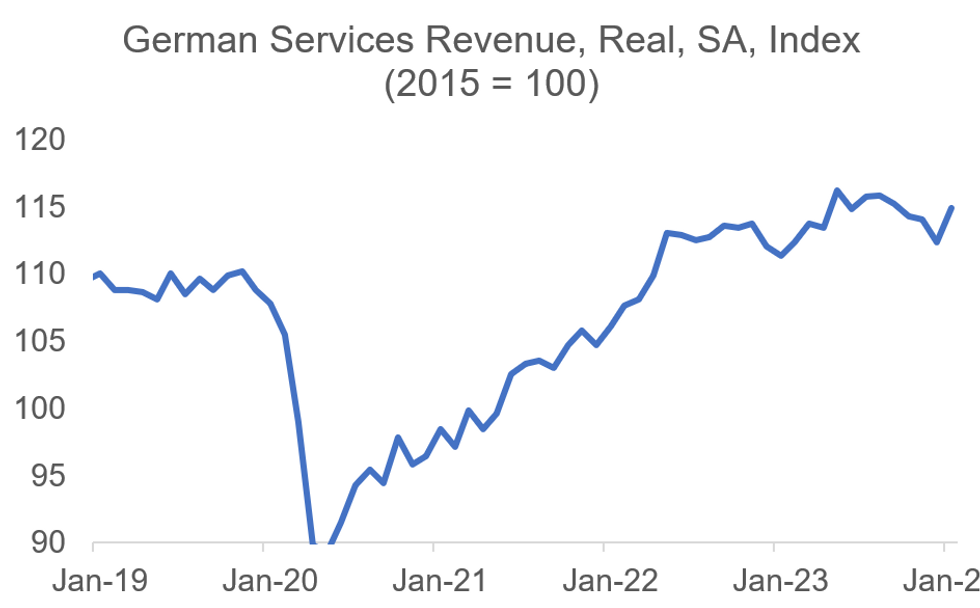

In a tentatively positive sign for German economic activity in early 2024, turnover in German services (excl. finance and insurance) rebounded in January, coming in at +2.3% M/M (vs -1.5% prior, revised from -0.6%) in real (inflation adjusted) SA terms.

- This was the first monthly increase after four consecutive declines for the sector, which accounts for roughly 2/3 of German Gross Value Added (GVA).

- On a yearly basis, turnover increased 3.2% Y/Y (vs +0.3% prior, revised from +0.4%). The 3M/3M measure came in at -1.2% (vs -1.8% prior, revised from -1.5%).

- The monthly uptick was driven by the freelance, scientific and technical services sector (+10.1% M/M vs -6.7% prior) - data which was subject to heightened uncertainty in January according to Destatis, which takes the sheen off the strong overall figure. Additionally, downward revisions suggest that services were even weaker in late 2023 than first thought.

- Other categories were mixed, with hospitality industry turnover falling 1.0% (vs -2.1% prior, though the sector seems to exhibit some seasonality patterns that aren't smoothed out even in the SA series), transport at +0.9% (vs -1.4% prior; the first monthly uptick after 5 consecutive declines), and information and communication at +0.1% (vs +0.9% prior).

- Services have been relatively resilient compared to the manufacturing sector in Germany, but some weakness started to emerge at the beginning of autumn last year.

- Soft data gives some indication that January's uptick could be indicative of an ongoing improvement, however.

- Activity implied by the German Services PMI has moved into expansionary territory in March for the first time since 5 months, coming in at 50.1 (48.3 Feb, 47.7 Jan). The latest release noted "some firms commented on tentative signs of improvement in client interest, while others mentioned working through backlogs of work".

- The IFO services sub-balance also exited contractionary territory in March (at 0.3; vs -4.0 Feb, -4.8 Jan).

Source: Destatis, MNI

Source: Destatis, MNI

322 words