-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessECB Data Watch

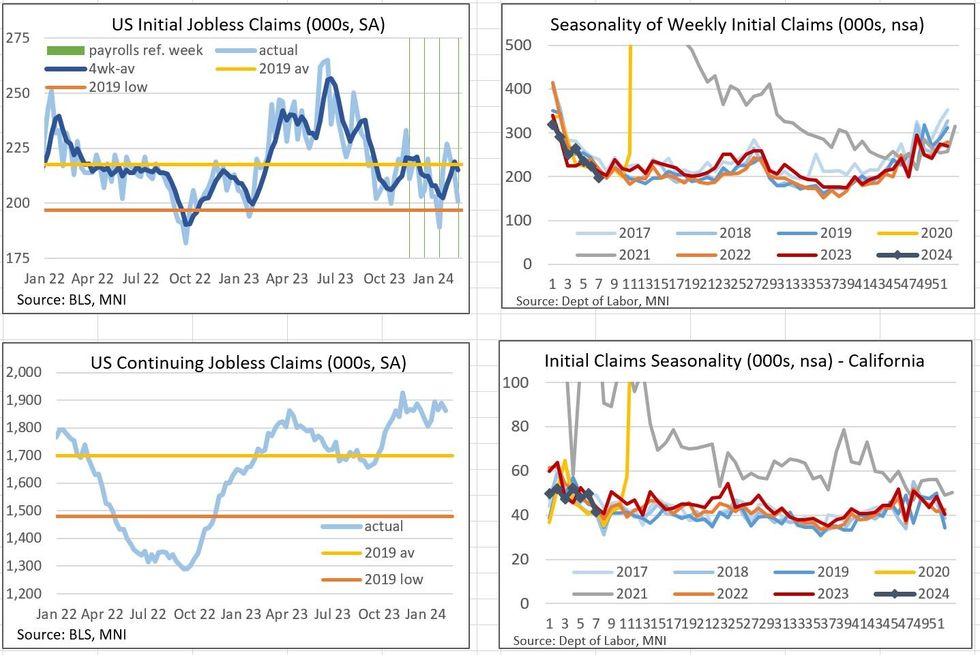

Solid Jobless Claims Return To Stronger End Of Recent Range

Jobless claims data pointed to a still-resilient labor market in mid-February, made more impactful as the reference week for February's nonfarm payrolls report.

- Initial claims unexpectedly fell to 201k in the week to Feb 16 (216k expected vs 213k prior, upwardly revised by 1k), marking. Continuing claims in the week to Feb 10 also came in lower than expected at 1,862k (1,884k expected vs 1,889k prior, downwardly revised by 6k).

- This was the 3rd consecutive decline in initial claims since the 11-week high of 227k hit in late January, and brings the 4-week moving average back down to 215k. This is typically a solid week for claims (the non-seasonally adjusted reading dropped 16k to 198k - the lowest since mid-October 2023), but overall the sub-200k range is well within reach again after remaining in roughly a 200-220k range since the start of September 2023.

- We've seen suggestions that the California figure was estimated due to weather conditions (they fell 8.6k, most since late Nov, all NSA) and therefore could be revised upward, but generally speaking the figures are broadly consistent with the downtick in claims in mid-February - both for the national California reading (CA claims dropped 4.7k in the same week last year).

- Continuing claims hit a four-week low, but generally remained within the 1,800-1,900k range seen for the preceding four months.

- Overall this is another solid-to-strong weekly report that shows no signs of deterioration in labor market strength. The solidly hawkish market reaction suggests that the reference week status added some additional impetus, as the next NFP will be the last before the Fed updates its economic projections in March.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.