May 08, 2024 06:33 GMT

Strongest Manufacturing IP Since April 2008

NORWAY

Norwegian industrial production saw a notable rise in March. There was no consensus for the print, but manufacturing industrial production was +5.4% M/M SA and +5.7% Y/Y WDA.

- This was the highest M/M manufacturing IP reading since April 2008.

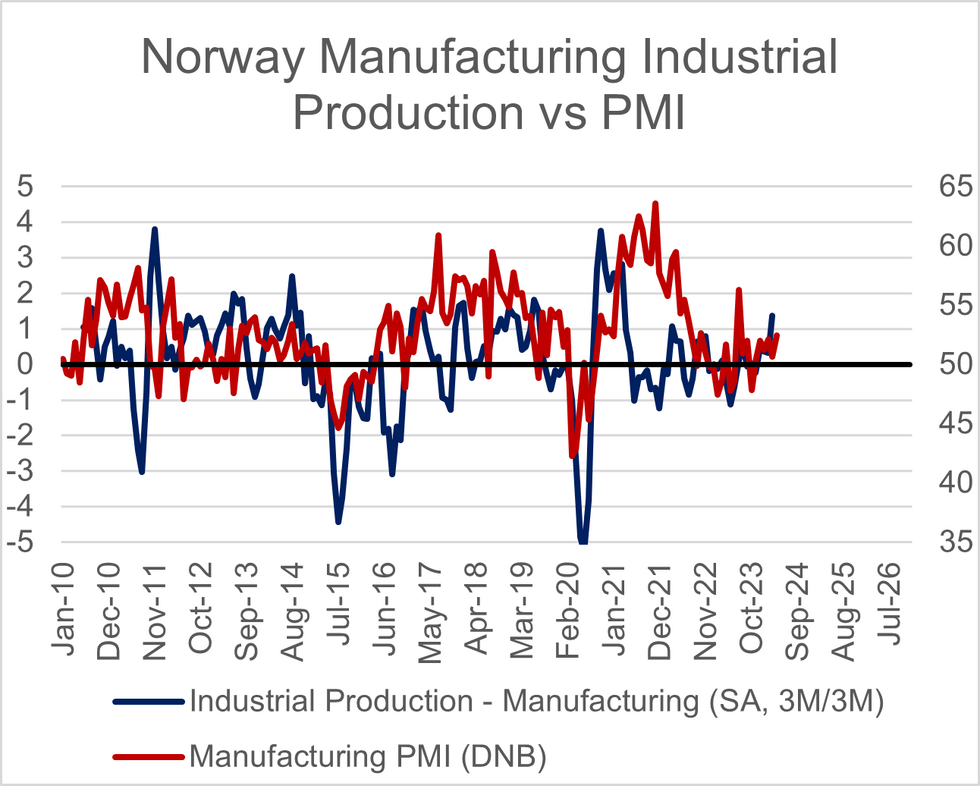

- On a 3m/3m basis, manufacturing IP was +1.4% (vs 0.3% prior). This follows the continued expansionary signals from the manufacturing PMI, which has been above 51 for the last 3 months (most recently 52.4 in April).

- February’s figures saw minor revisions, to -1.0% M/M (vs -1.1% prior) and -2.0% Y/Y (vs -2.2% prior).

- All major manufacturing sub-components rose in March, with consumer goods +8.1% M/M and +5.9% Y/Y, while capital goods rose 4.1% M/M and 11.5% Y/Y.

- Elsewhere, Q1 employment and earnings figures showed average monthly basic earnings rising 6.1% Y/Y (vs 6.3% prior).

- The recent labour union wage agreements will overshadow the Q1 wage data, with the former providing a firmer than expected outcome and factoring into last week’s hawkish tilt from the Norges Bank.

169 words