-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - UK, France Aim for New Ukraine Peace Deal

MNI China Daily Summary: Monday, March 3

Sweden Macro Signal - May 2024: Recovery In Sight

Sweden Macro Signal - May 2024: Recovery In Sight

MNI Point of View: Recovery In Sight

The Riksbank became the second G10 central bank to ease policy rates at its May meeting, cutting by 25bps to 3.75%. This decision reflected downside surprises to inflation and a weakening of the labour market, through the weak krona, geopolitics and Fed policy were once again highlighted as risks to the outlook. Economic activity remained subdued in Q1, but “green shoots” (in the Riksbank’s words) are beginning to emerge, supported by improving sentiment and positive real wage growth.

- Economic Activity: Flash Q1 GDP printed unexpectedly weak at -0.1% Q/Q, signalling economic activity remains subdued. However, improving consumer and business sentiment, combined with rising real wages should help support activity going forward.

- Inflation: Has tracked below the Riksbank’s March MPR projections in the last 2 months, and the lower-than-expected March reading was the key factor in giving the Riksbank confidence to cut rates in May. Normalising business pricing plans suggest further disinflation is likely, though the weak SEK remains a concern.

- Labour Market: The Swedish labour market has shown signs of loosening, with increases in unemployment and redundancy notices seen alongside moderations in employment and vacancies. However, these trends are expected to reverse alongside the wider economic recovery in the coming years.

- Monetary Policy: The Riksbank Executive Board unanimously voted to cut the policy rate by 25bps to 3.75%, with the domestic macroeconomic data since the March meeting having met the required threshold to begin easing.

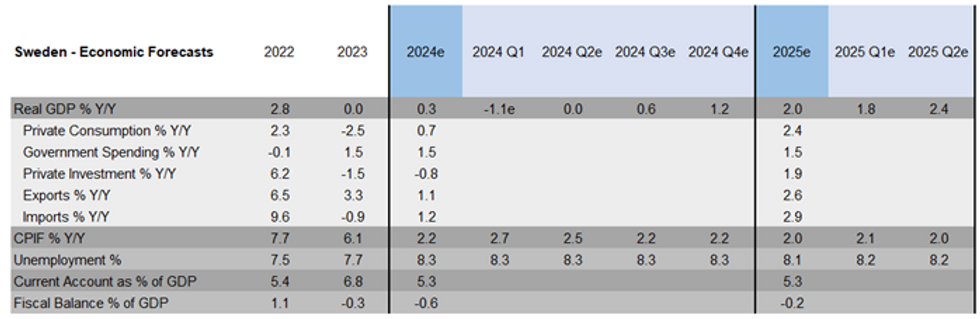

- Medium-Term Outlook: Expectations for short-term Swedish economic activity have slightly improved for 2024, with a more pronounced recovery expected through 2025/2026. Growth is expected to average 2.0% Y/Y in 2025 and 2.2% in 2026 - slightly below the Riksbank’s forecast - as the restrictiveness of Riksbank policy is dialled back. Annual CPIF inflation is expected to fall below the Riksbank’s 2% target by 2025, while the unemployment rate is expected to remain around 8.3% through 2024, before falling through 2025 and 2026.

Full PDF Analysis:

2024_05_Sweden_Macro_Signal.pdf

Note: 2024 Q1 real GDP populated using the GDP indicator. Figures represent Medians. Source: MNI Consensus based on forecasts entered on Bloomberg, as of May 20, 2024.

Note: 2024 Q1 real GDP populated using the GDP indicator. Figures represent Medians. Source: MNI Consensus based on forecasts entered on Bloomberg, as of May 20, 2024.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.