-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessThailand Tightens Covid Control Measures, Remains On U.S. FX Manipulator Watchlist

Spot USD/THB re-opened on a slightly softer footing and last sits -0.037 at THB31.180, looking through support from Apr 1 & 2 lows of THB31.198. Further losses past the 23.6% retracement of the YtD rally at THB31.166 would open up Mar 26 low of THB31.060. Bulls look for a rebound above Apr 16 high of THB31.350, towards Apr 12 cycle high of THB31.575.

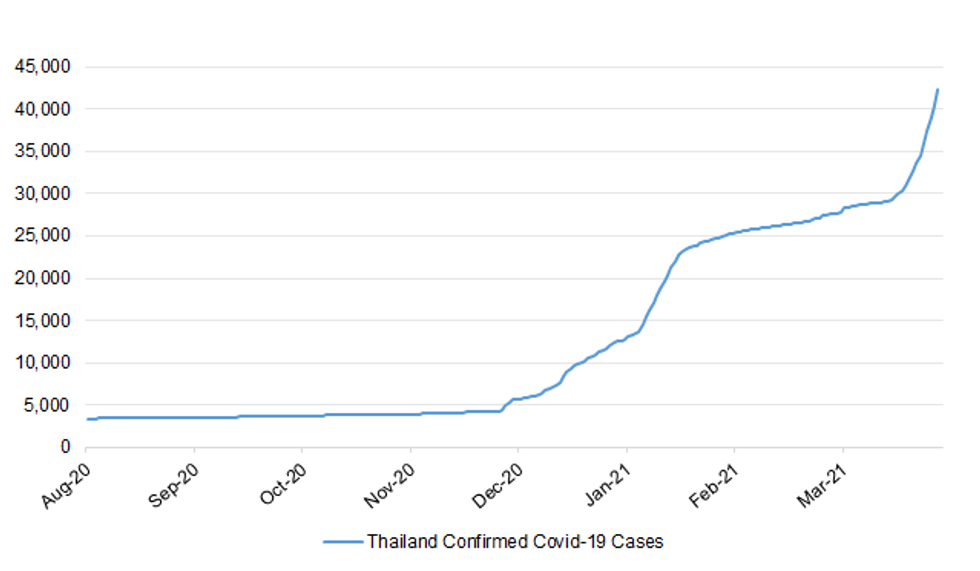

- Friday saw Thailand's officials tighten Covid-19 restrictions in a bid to arrest the spread of the virus, triggering speculation that the plans to reopen borders for tourists can be delayed. At the same time, PM Prayuth ruled out a nationwide lockdown and said that the gov't still has ~THB300bn, which can be used to stimulate economic recovery.

- Thailand set a new daily record in Covid-19 cases on Sunday, recording 1,767 infections, with the local press warning against the risk of hospital bed shortage.

- On Friday, BBG flagged that Thailand appears to be meeting all of the U.S. Tsy's criteria for being designated a currency manipulator. However, the U.S. refrained from naming any trading partner a manipulator in its FX policy report released on Friday, noting that only Switzerland, Taiwan and Vietnam met the criteria and leaving Thailand on the watchlist.

- The BoT downplayed the significance of being on the watchlist and reiterated its commitment to FX flexibility, with "interventions limited only to curbing excessive volatility and rapid movements of the baht on both sides."

- Thailand's Customs Dept will release trade data on Thursday, with the BoT's weekly update on foreign reserves coming up on Friday.

Fig. 1: Thailand Confirmed Covid-19 Cases

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.