May 07, 2024 13:15 GMT

Trade Surplus Boosted By Improved Global Picture

GERMAN DATA

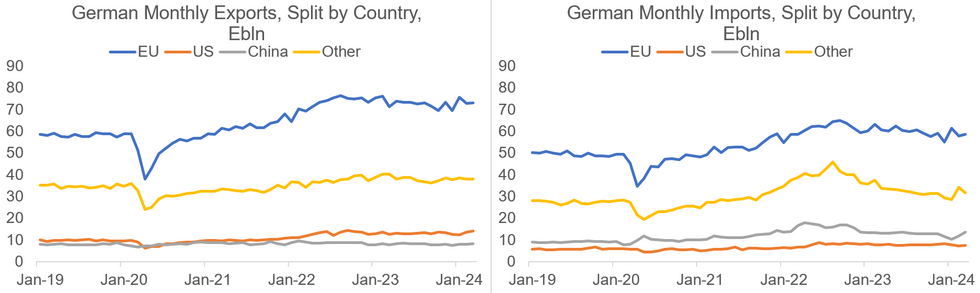

The German trade surplus widened slightly less than forecast in March, to E22.3bln on a seasonally-adjusted basis vs E22.4bln consensus and E21.4bln in February, but exports still rose faster than imports (+0.9% M/M and +0.3%, respectively). While these are nominal, not real, figures and thus don't account for the recent large shifts in price volatility, to put it into perspective, the trade surplus widened to the equivalent of about 5.9% of nominal GDP on a 12-month rolling basis - the highest since April 2020.

- The data adds to the narrative that domestic demand in Germany remains relatively weak, while foreign demand has gained momentum - one of the drivers behind the slight GDP growth in Q1 was exports.

- Exports to the US have increased particularly strongly (+3.6% vs +10.1% prior) alongside robust growth there.

- Imports from China also grew sharply in March (+14.3% vs +16.4% prior), partially reversing a previous longer-term downtrend which has been ongoing since October 2022. From a geopolitical point of view, it seems questionable if this incline of Chinese imports is set to be continued.

- While a recovery of any kind would be welcome following acute economic weakness in 2022-23, manufacturing export-driven growth amid soft domestic demand leaves the German economy exposed to downturns in the global economic cycle.

MNI, Destatis

MNI, Destatis

224 words