-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessTsy Refunding (2/2): Buybacks Still

Apart from the auction size announcement (more in our earlier note), attention in today's Quarterly Refunding was largely on potential debt buybacks, the debt limit, and bill issuance strategy.

- Buybacks: This remains a hot topic but is clearly on the back burner for at least another several months. Treasury has been canvassing opinion from TBAC and primary dealers for the past three Refundings, "in order to assess the costs and benefits ... including liquidity support and cash and maturity management", and said today it expects to share its findings in future refundings. A TBAC presentation (minutes here) concluded with a cautiously positive appraisal, with buybacks assessed in resulting in "indirect benefits potentially outweighing the direct benefits" to US taxpayers, though a program would be "highly complex".

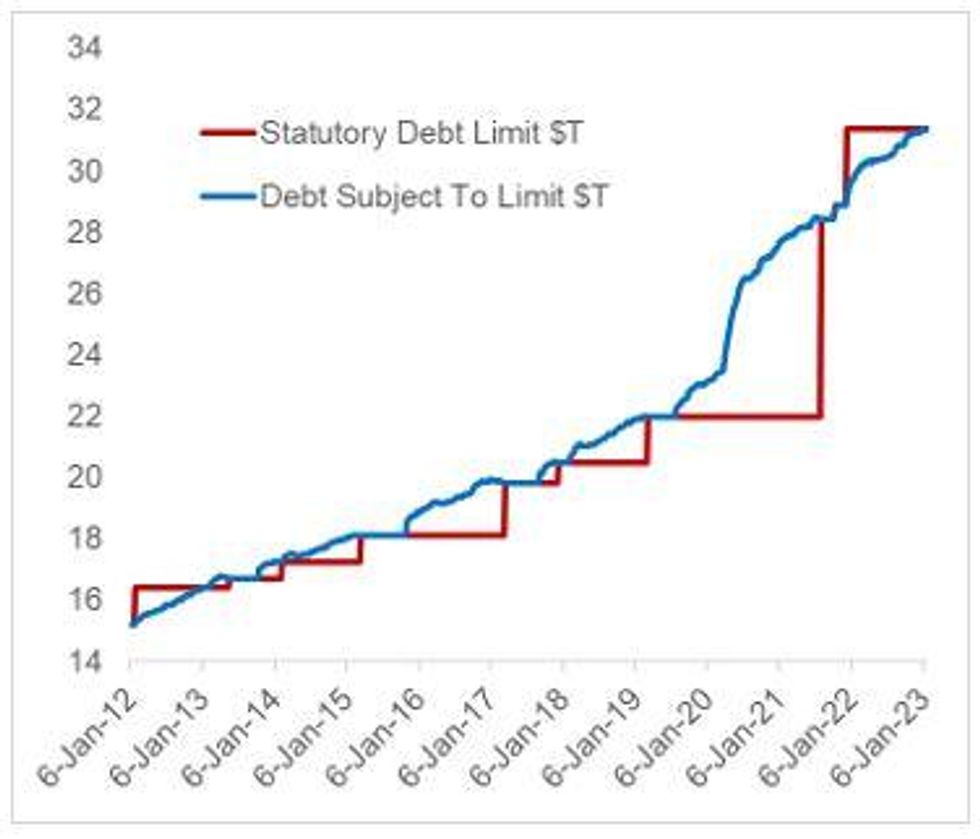

- Debt limit: The Treasury's official statement unsurprisingly echoed Sec Yellen's previous comments that extraordinary measures to temporarily finance the government will "unlikely...be exhausted before early June" (MNI notes that sell-side analysts mostly see late July/August as the "x-date"). But "until the debt limit is suspended or increased, debt limit-related constraints will lead to greater-than-normal variability in benchmark bill issuance and significant usage of CMBs."

- Bills: Part of that "variablility" in bill issuance will extend beyond the resolution of the debt limit crisis, with most analysts expecting bill sales to ramp up thereafter so Treasury can quickly rebuild a dwindling cash pile. In the meantime, TBAC noted that since the bill share of total debt was near the bottom of the recommended 15-20% range, Treasury was "well-positioned to meet near-term borrowing needs with additional bill supply".

Source: US Treasury, MNI

Source: US Treasury, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.