-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessTwo-Way On Regional CPI, RBA Dated OIS Pushes Firmer In Lieu Of Local Prints

Early Sydney trade was two-way, with the early richening inspired by an overnight bid in core global FI markets and NZ CPI data that was a little softer than the RBNZ expected.

- Firmer than expected (vs. newswire surveys) domestic CPI data then applied notable pressure, leaving YM -9.0 & XM -4.0 at the close, a touch above their respective session lows. The major cash ACGBs finished 2-10bp cheaper as the wider curve bear flattened. ACGB widened vs. global peers post-CPI.

- The headline CPI metric was a touch below the RBA’s forecast +8% Y/Y, although the trimmed mean metric topped the Bank’s +6.5% Y/Y forecast. Inflation continues to run at particularly elevated levels for this stage in the RBA hiking cycle.

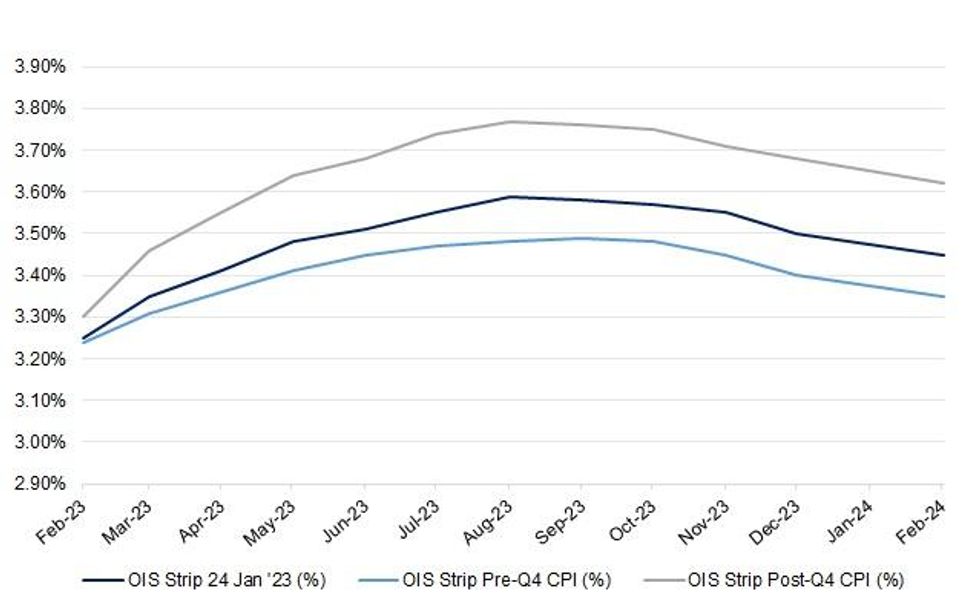

- Bills finished 13-19bp cheaper through the reds, in what was a volatile day for Aussie STIRs. RBA dated OIS now shows ~23bp of tightening for next month’s meeting, almost fully pricing a 25bp hike post-CPI. Meanwhile, terminal cash rate pricing is showing just above 3.75% late in the day after printing below 3.50% in the wake of the NZ CPI release (see chart below for a visual on intraday swings). There hasn’t been any meaningful RBA call changes from the sell-side post CPI.

- Australian markets are closed on Thursday as the country observes the Australia Day holiday.

Fig. 1: Intraday Moves In RBA Dated OIS

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.