-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI US MARKETS ANALYSIS - Month End Flow on Market's Mind

HIGHLIGHTS:

- Month-end flow dominates, with sell-side models pointing to USD weakness into November close

- Copper extends recent rally, hitting new multi-year high

- MNI Chicago PMI last material datapoint of the month

US TSYS SUMMARY: Early Flattening Reverses

A choppy start to the week for Tsys, with equities and the dollar a little weaker as we get back into a higher gear following the holiday period.

- Curve continued to flatten from Wednesday's steepest levels, but that's reversed in the last hour.

- The 2-Yr yield is up 0.2bps at 0.1544%, 5-Yr is up 0.9bps at 0.3734%, 10-Yr is up 1.5bps at 0.852%, and 30-Yr is up 1.2bps at 1.5816%.* Mar 10-Yr futures (TY) down 3/32 at 138-3 (L: 138-03 / H: 138-08)

- Month-end today and the outlook is for fairly +ve extensions (Tsy index +0.16 per BBG/Barclays) supporting Tsys. It's also first notice day for Dec20s and as implied above, Mar21 is the active futures contract.

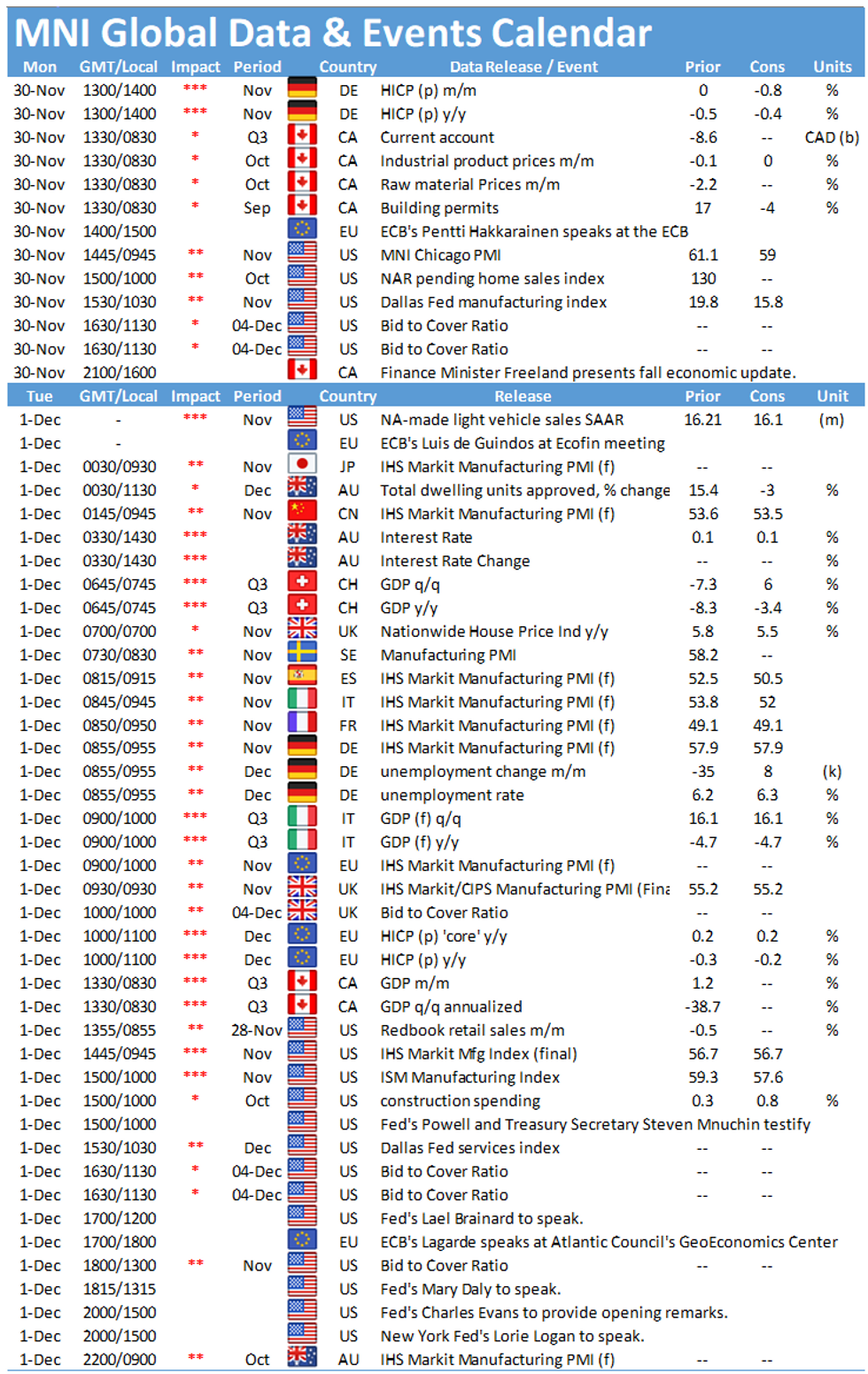

- Data resumes today: MNI Chicago PMI at 0945ET, with pending home sales at 1000ET and Dallas Fed manufacturing at 0930ET.

- Richmond's Barkin is the only scheduled Fed speaker, at 1200ET.

- NY Fed buys ~$1.75B of 20-30Y Tsys, and also releases its next forward schedule at 1500ET.

- Supply consists of 13-/26-wk bills for a combined $105B (1130ET).

FINAL U.S. Bloomberg-Barclays Estimates

| FINAL Bloomberg-Barclays US month-end index extensions; forecast summary compared to the avg increase for prior year and the same time in 2019. TIPS 0.01Y; Govt inflation-linked, 0.01. |

| Estimated | 1 Yr Avg Incr | Chg Last Yr | |

| US Tsys | 0.16 | 0.09 | 0.12 |

| Agencies | 0.06 | 0.06 | 0.15 |

| Credit | 0.08 | 0.12 | 0.10 |

| Govt/Credit | 0.12 | 0.10 | 0.11 |

| MBS | 0.14 | 0.07 | 0.09 |

| Aggregate | 0.13 | 0.09 | 0.11 |

| Long Gov/Cr | 0.13 | 0.09 | 0.12 |

| Interm Credit | 0.05 | 0.10 | 0.09 |

| Interm Gov | 0.12 | 0.08 | 0.10 |

| Interm Gov/Cr | 0.09 | 0.09 | 0.09 |

| High Yield | 0.12 | 0.12 | 0.11 |

EGB/GILT SUMMARY - Uneven Start to the Week

It has been a relatively uneven and cautious start to the week with oil and equities trading weaker, the dollar on the backfoot against G10 FX and EGBs trading mixed.

- The gilt curve is marginally flatter with the 2s30s spread 2bp narrower on the day.

- Bunds have traded weaker with cash yields 1bp higher.

- OATs trade broadly in line with bunds. Last yields: 2-year -0.6902%, 5-year -0.6641%, 10-year -0.3361%, 30-year 0.3495%.

- BTPs trade close to unch on the day.

- Supply this morning came from Germany (Bubills, EUR1.78bn allotted). France will sell a combination of 3-/6-/12-/month BTFs for E5.8-7.0bn.

FOREX: Month End Flow on Market's Mind

EUR/USD continued to grind higher throughout European hours on Monday, with the pair cresting at new multi-month highs and narrowing the gap with 1.20 and the post Covid highs printed back in early September. As a result, the USD's been sold across the board, with the USD index hitting its lowest level mid-2018.

Month-end models continue to point to USD weakness into the November close, which markets remain focussed on headed into US hours.

Scandi FX is strongest, with USD at the bottom of the G10 pile along with AUD.

Focus turns to MNI Chicago PMI, pending home sales and Germany's CPI release. Speakers include BoE's Tenreyro and Fed's Barkin.

OPTIONS: Expiries for Nov30 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1800(E502mln), $1.1900(E808mln), $1.1950-65(E511mln), $1.2000(E402mln)

USD/JPY: Y102.00($790mln-USD puts), Y103.00($882mln-USD puts), Y104.00($572mln), Y105.25($576mln)

AUD/USD: $0.7400(A$777mln-AUD calls)

USD/CNY: Cny6.50($515mln)

TECHS: Key Price Signal Summary

- Gold is soft. The focus is on $1763.5, 50.0% of the Mar - Aug rally and $1747.6 - Low Jun 26. Oil markets appear to be correcting. Support to watch in Brent (G1) is $45.87, Nov 27 low and in WTI (F1) at $43.33, Nov 11 high and $42.82, Nov 24 low. Copper (H1) continues to defy gravity and targets $353.66 next, 1.382 projection of the Oct 2 - 21 rally from Nov 4 low.

- In the FX space, EURUSD is closing in on this year's 1.2011 high from Sep 1. USDJPY key support lies at 103.18, Nov 11 low. Initial support is 103.65, Nov 18 low. Key EURGBP trendline resistance drawn off the Sep 11 high, intersects at 0.8995. The trendline capped gains Friday and is under pressure today. It remains a pivotal resistance. 0.8995/9000 is a key intraday hurdle. The major resistance for bulls in Cable is 1.3421, a multi-year trendline drawn off the Nov 2007 high.

- Key FI resistance levels: Bund fut: 175.73, Nov 20 high and 176.08, 76.4% of the Nov 4 - 11 sell-off. Gilts (H1): are off to the races again and eying 134.70 next, 1.00 proj of the Nov 16 - 23 rally from Nov 25 low. Treasuries (H1): 138-09+, the 20-day EMA.

- E-Mini S&P is still trading below 3668.00, Nov 9 high. Support to watch this week is 3506.50. EUROSTOXX50 focus is on 3553.05, Feb 27 high.

EQUITIES: European Markets Mixed, US Futures Lower

US equity futures are on the backfoot ahead of NY, although the e-mini S&P has bounced off the overnight lows of 3602.75 to minimise losses ahead of the cash open later today.

Reflecting the continued on/off nature of the post-vaccine reflation trade, tech firms are modestly outperforming in the US, with the NASDAQ future indicating a higher open later today, standing out against the S&P, Dow Jones markets.

In Europe, markets are more mixed, with Spanish, Italian equities underperforming (down 0.6%, 0.4% respectively) while UK's FTSE-100 and Germany's DAX trade in the green. Across the continent, healthcare, real estate and industrials are at the top of the pile, while energy, financials and utilities slip.

COMMODITIES: Oil Lower as OPEC+ Decision Delay Hits Prices

WTI and Brent crude futures are both lower to begin the week, with the weekend talks over a potential extension to OPEC+'s output cut plans thrown into jeopardy as UAE and Kazakhstani representatives refused to sign up to the idea. Meetings continue Monday, with focus turning to headline risk out of the various oil ministers.

Copper continues to outperform, with fresh multi-year highs printed at 349.85 for the active contract. The continued outperformance of copper over precious metals (particularly gold) has put the copper/gold ratio at it's highest since June last year, with the rotation into growth assets persisting following the vaccine news over the past few weeks.

Gold weakness extended below the 200-dma after Friday's break, putting the metal at its lowest since early July.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.