April 26, 2024 03:57 GMT

USD/CNH Above 7.2600, CNY Spot Remains Close To Daily Trading Limit

CNH

USD/CNH sits back around 7.2620, slightly above end NY levels from Thursday. Onshore spot continues to track very close to the upper daily trading limit, last around 7.2465. Today's daily trading limit is 7.2477 after the steady fixing earlier.

- For USD/CNH moves back towards the 20-day EMA (currently 7.2525/30) remain supported. Recent highs remain intact in the 7.2730/40 region.

- Speculation continues around a possible yuan devaluation. With rising metal holdings onshore cited as a factor around local concern on further FX weakness (our London team touched on this earlier in the week, as well as yuan weakness on crosses, see this link).

- CNY/JPY has continued to push higher, last 21.93, as yen weakness continues post the unchanged BoJ outcome. This is fresh highs in the pair back to the early 1990s.

- Official rhetoric has continued to push the stability line, and stronger supervision of FX markets. The other focus point has been caution around low domestic bond yields and that the PBoC is not embarking on QE.

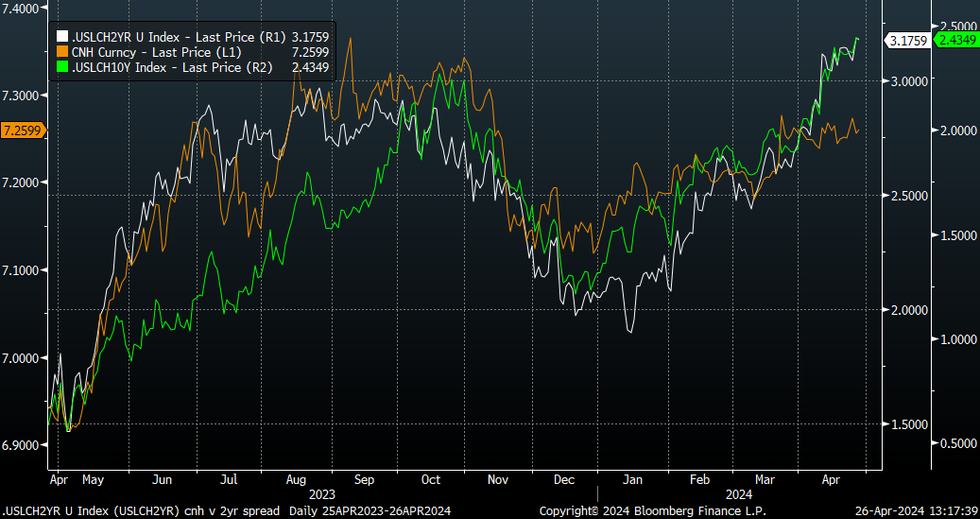

- Local government bonds are modestly up from recent lows, although this has done little to turn US-CH yield differentials bank in CNH's favor. The chart below overlays spot versus the 2yr and 10yr spreads. Such a backdrop should keep USD/CNH dips supported all else equal.

- The local equity backdrop is providing some support, with the ratio of China to global equities on the improve. We are coming from a low base though, so it remains to be seen if this turns into a more material source of support for the yuan.

- Next week we have the China PMIs in focus, out on Tuesday, which are expected to ease from recent elevated levels.

Fig 1: USD/CNH Versus US-CH Yield Differentials

Source: MNI - Market News/Bloomberg

Keep reading...Show less

301 words