-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

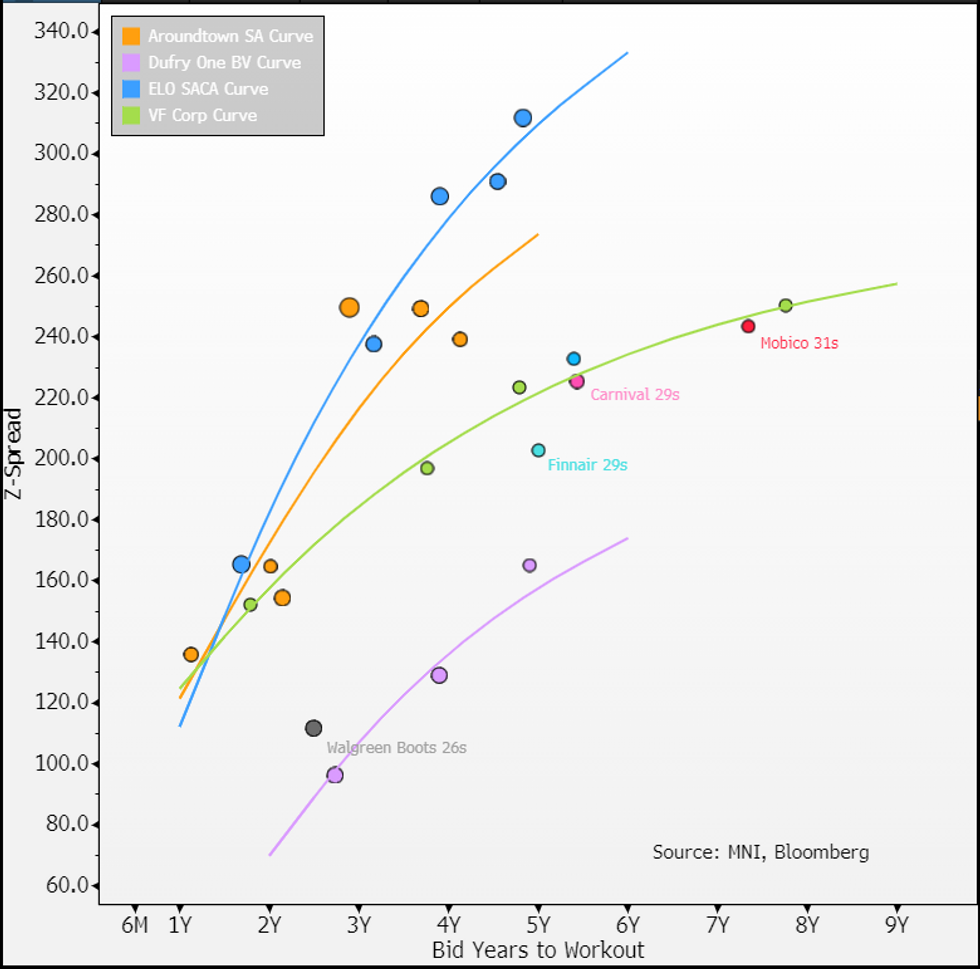

VF Corp (VFC; Baa3 Neg, BBB- Neg) 4Q24 Results

- We've had some questions on RV that includes the normal cheap for ratings, $ curve looks tighter etc. As mentioned in preview, curve is priced to BB- ratings. We would note though that local HY consumer/retail space is sparsely populated & many of the names under coverage have firm operating performance/on the rise (see Coty, Dufry).

- For those looking to rotate into safer names without giving up carry, new Finnair 29s (NR/BB+) with government support only gives up 20bps (we've liked it but flag the single airport/country concentration risk).

- On short-end we recommend eyeing RE sector for opp's (Aroundtown e.g.) that still give pickup and are starting to show stabilising valuations (see Dave's notes). Elo/Auchan (private co) does trade wider on 26s in consumer but it is yet to show a turnaround in performance & is unlikely to when it reports 1H results in late July/August. We liked the new 28s on a 57bp NIC and Xover CDS protection (runs sizeable negative basis) - its come in 20bps since.

- Re. US being cheaper - we are not a fan of using XCCY ASW valuations (€29s look tad dislocated/cheap on that) - as e.g. in $'s carnival (B3/BB-) trades 60bps inside VF while in € the 29s sit on the curve (below).

- Finally, we've had some questions on what FY25 FCF guidance (12m to March) means for operating performance. Again co's guidance at $600m includes asset (not brand) sales - we don't have a exact number on latter but in Q3 it said non-core physical assets would amount to $50-100m over next 2-3 qtrs (i.e. we see as small). Regardless it's a disappointing FCF number (down yoy & less than half of pre-covid FCF levels) & when combined with weak 1Q25 colour makes any turnaround hard to see.

Our take; https://marketnews.com/vf-corp-vfc-baa3-neg-bbb-ne...

Equity analyst takes; NSN SDXOBYDWLU68 <GO>

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.