-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessVF Corp (VFC; Baa3 Neg, BBB- Neg) {VFC US Equity}

VF (parent of Vans, North Face & Timberland) is looking at another rough earnings (for 3months ending March) when it reports next month. Despite curve trading wide, hard for us to have a firm view without a turnaround in sight noting liquidity is still point of concern.

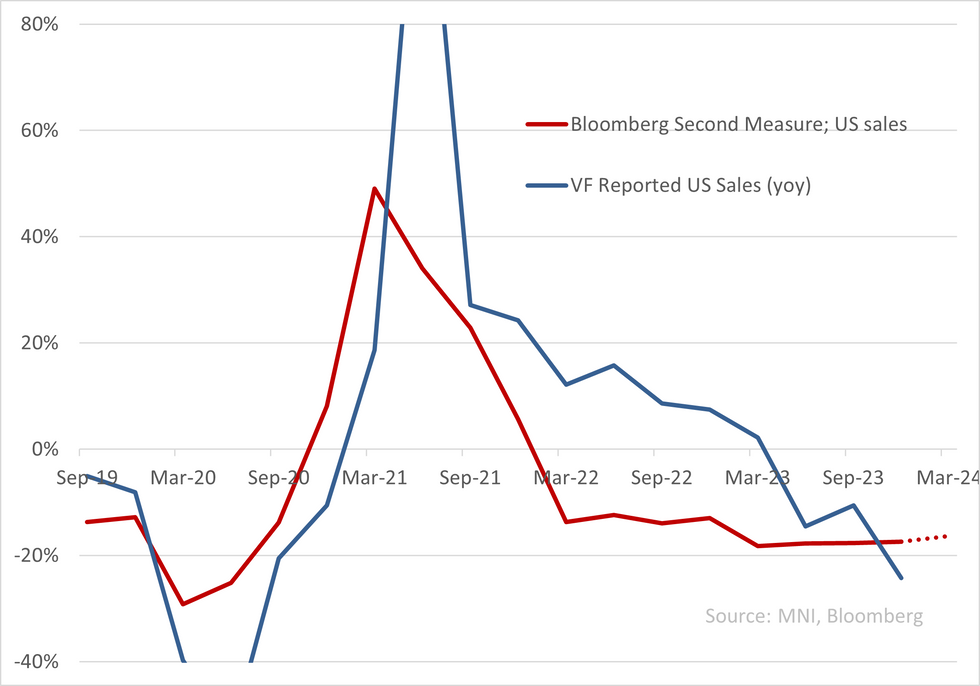

- Bloomberg's Second measure (uses 20m+ card data to sample US spending trends) is pointing to a -16% fall in QoQ sales vs. Apparel peers -4.5% fall.

- Reported VF US revenue tracking error in trend terms is not bad with Second measure (below). This gives some insight into the ~60% of total VF sales that are in the US, noting Euro (& in particular Wholesale) has been where Apparel retails have been reporting more trouble recently - i.e. group sales may be in for more pain.

- Consensus reflects some of this - looking for low double digit fall in constant-currency sales yoy, at a gross margin of ~50% and operating margin in low single digits as SG&A continues running at sizeable ~47% of sales. Company guided to $600m in FCF this year at early Feb results - consensus still holding to guidance.

- '24 FCF guidance in isolation isn't enough for us to firm up a view in €lines given $1.75b in dollar debt stands in between the front €500m '26 line (vs. $1b cash on hand). Mgmt has talked about "strategic portfolio review" which is expected to include brand divestiture (helping raise cash), board changes (some of it activist driven) & cost cutting (project Reinvent).

The 26's trade at Z+147 (vs. $25s at +87) - well wide of any close comps, but for those looking at speculative short-end plays in IG, the Real Estate issuer Aroundtown 26's at +170-190 may screen more value given solid progress on shoring up liquidity.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.