-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessWeak Yen Amplifies Price Pressures, USD/JPY 1-Week Implied Vol Soars Pre-BoJ

No material reaction in USD/JPY to Japanese inflation data, as core CPI rose 3.0% Y/Y in September, matching expectations. The government said that core inflation, excluding the impact of the sales tax hikes, was fastest since August 1991.

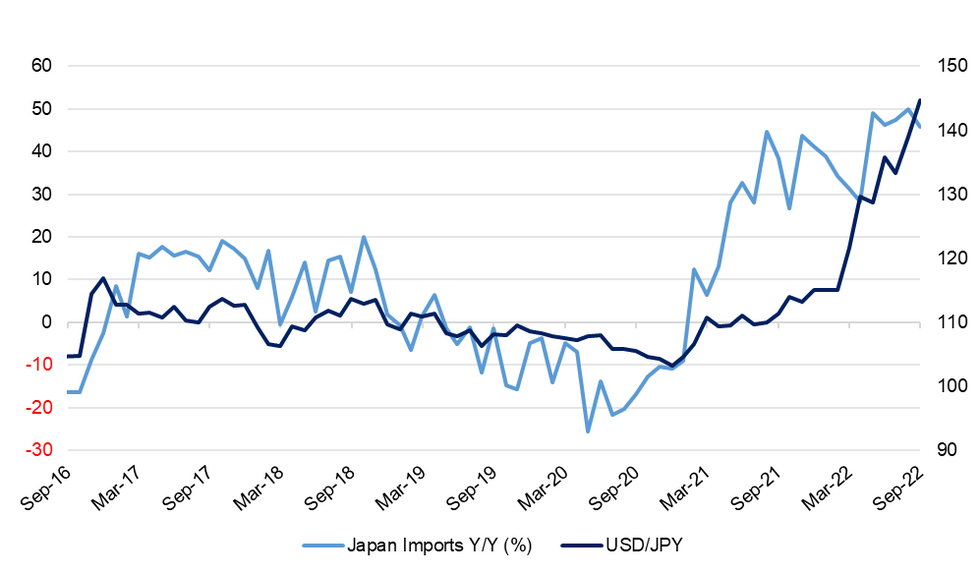

- Sharp depreciation in the exchange rate is fanning inflation by increasing the cost of imported goods. The impact of USD/JPY was reflected in another strong outturn for imports yesterday. Elsewhere, Yomiuri cited estimates suggesting that if USD/JPY stays at Y150, the additional burden on an average household in FY2022 will be Y86,462 versus FY2021, even if fiscal relief measures are factored in.

Source; MNI - Market News/Bloomberg

Source; MNI - Market News/Bloomberg

- Recent BoJ communique showed no deviation from the view that powerful monetary easing is here to stay, with prices driven by cost-push factors rather than meaningful wage growth. The Policy Board will review its monetary policy settings next Friday and is expected to stand its ground.

- Still, rapid yen depreciation, upward pressure on JGB yields, and the political cost of rising living costs are testing the limits of the BoJ's ultra-loose policy. Japan's 10-Year swap rate sits near its highest point since early 2014, the era before negative interest rates.

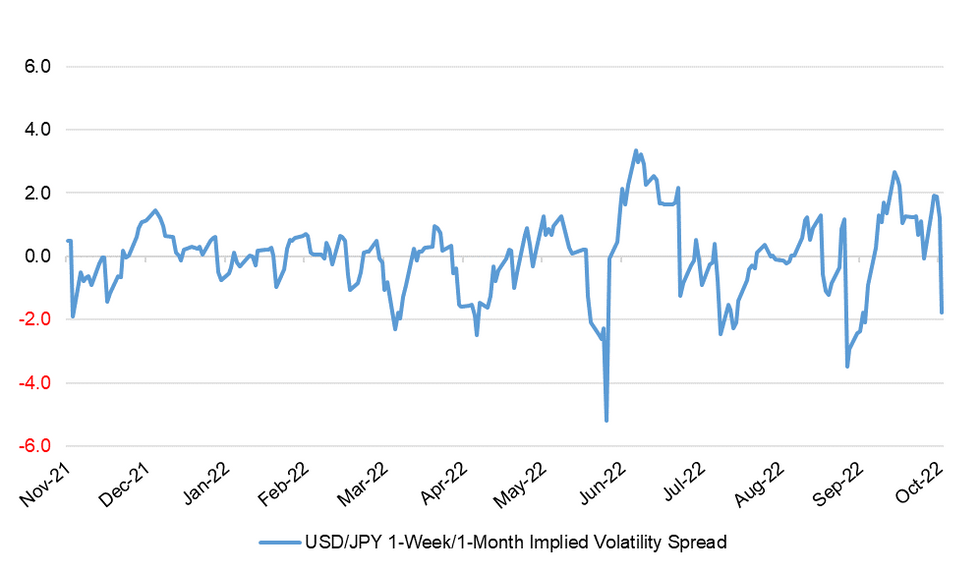

- Resultant uncertainty about the BoJ outlook (including approach to FX matters) is reflected by a surge in USD/JPY 1-week implied volatility this morning, which has topped 16% for the first time since Sep 22. Longer-end vols have remained fairly steady, as 1-week/1-month and 1-week/1-year spreads plunged into negative territory.

Fig. 2: USD/JPY 1-Week/1-Month Implied Volatility Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Spot USD/JPY last deals at Y150.19, a touch higher on the day. Familiar technical contours remain in play. Comments from Japanese officials are hitting the wires as we type, offering little in the way of fresh insights.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.