-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 20-26 January

MNI POLITICAL RISK-Trump Plans Unprecedented Day 1 Exec Orders

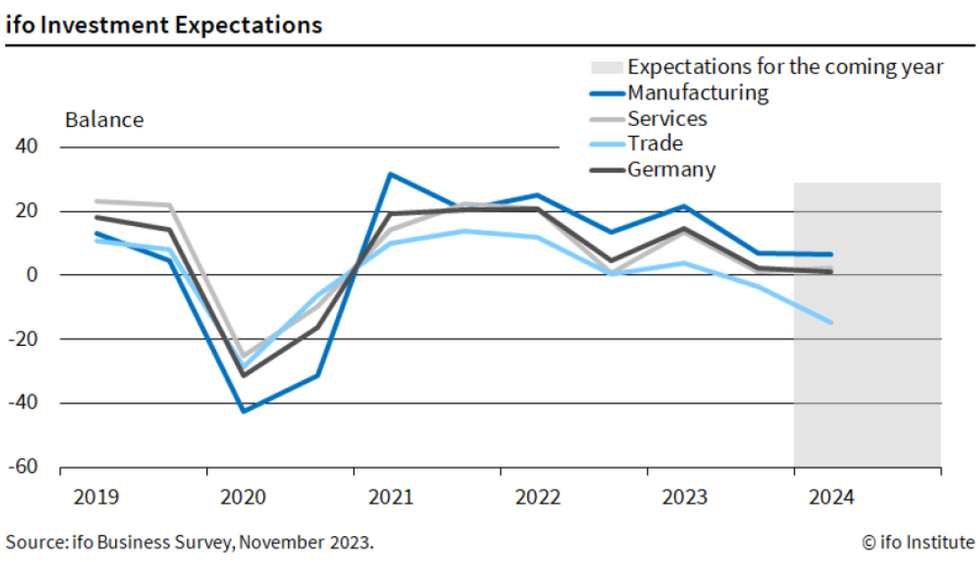

Weaker Investment Expectations Another Negative Signal For Growth

November ifo investment expectations for the current year printed considerably lower (2.2 points vs 14.7 prior) compared to March (last publishing date) in data released this week.

- For planned 2024 investment, the balance stands at positive 1.2 points - where a value of 0 corresponds to the number of companies wanting to increase their investments being equal to the number of companies planning to decrease their investments.

- Ifo points out key factors as being "higher financing costs, weak demand, and uncertainty regarding economic policy".

- The trade sector is the most pessimistic, with expectations falling from 3.7 to -3.5 for 2023, and -14.6 for 2024. For services, investment expectations declined sharply from 13.6 to 1.0 points but stayed positive for 2023 and 2024, 2024 expectations at 2.3.

- The manufacturing sector plans to increase investment the most: the 2023 balance stands at 6.8 points. But that is down from 21.4, with the clearest decline against March seen in energy-intensive firms, particularly chemical production (13.9 to -15.6). For 2024, the expectations balance is 6.6 points in the manufacturing sector.

- Automotive manufacturers are planning large investment regardless of weak economic conditions, with a 2024 balance of 34.0 points.

- While business investment hasn't been strong in the past two years, it has positively contributed to GDP (0.1pp in each of the last 3 quarters) amid otherwise poor domestic demand. This Ifo survey correctly identified the flip from a drag in 2021 to more positive contributions in 2022-23, and as such bodes poorly for fixed investment growth in 2024.

ifo Business Survey

ifo Business Survey

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.