-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Inside Range Ahead Key Inflation Data

MNI BRIEF: EU Calls Feb 3 Summit To Brainstorm Defence

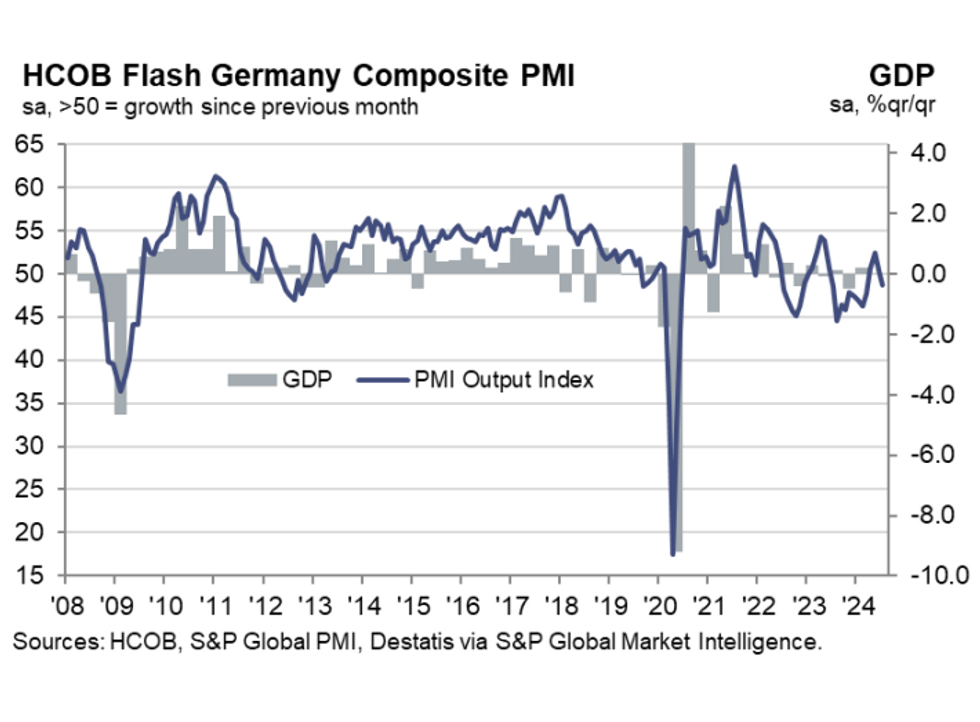

Weaker-than-expected July Flash PMI Helps Bunds To Intraday Highs

The German July flash PMI was weaker than expected across both services and manufacturing, helping Bund futures push towards new intraday highs and retrace the sell-off seen following the French data, and weighing on the EUR in tandem.

The manufacturing sector has been in contractionary territory since June 2022, printing at 42.6 in July (vs 44.0 cons, 43.5 prior). Services meanwhile registered its 5th consecutive month in expansion at 52.0 (vs 53.3 cons, 53.1 prior). The price paid/charged components suggest firms struggled to pass-on cost increases to end consumers.

Key notes from the release:

- “The return to contraction reflected a combination of a deeper decline in manufacturing production and slower growth of services business activity”

- “With firms completing orders at a faster rate than they received them, staffing capacity was scaled back for the second month in a row. The decline in employment continued to be led by the manufacturing sector… but July also saw services firms…. [cut] staffing levels”.

- “Operating expenses in the service sector increased at a slightly quicker pace, while the drag from falling manufacturing purchasing costs eased”…”Nevertheless, the overall rate of cost inflation remained just below its long-run average”.

- “Unlike costs, the rate of inflation ticked down since June, reflecting the slowest rise in service sector output prices for more than three years”.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.