-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

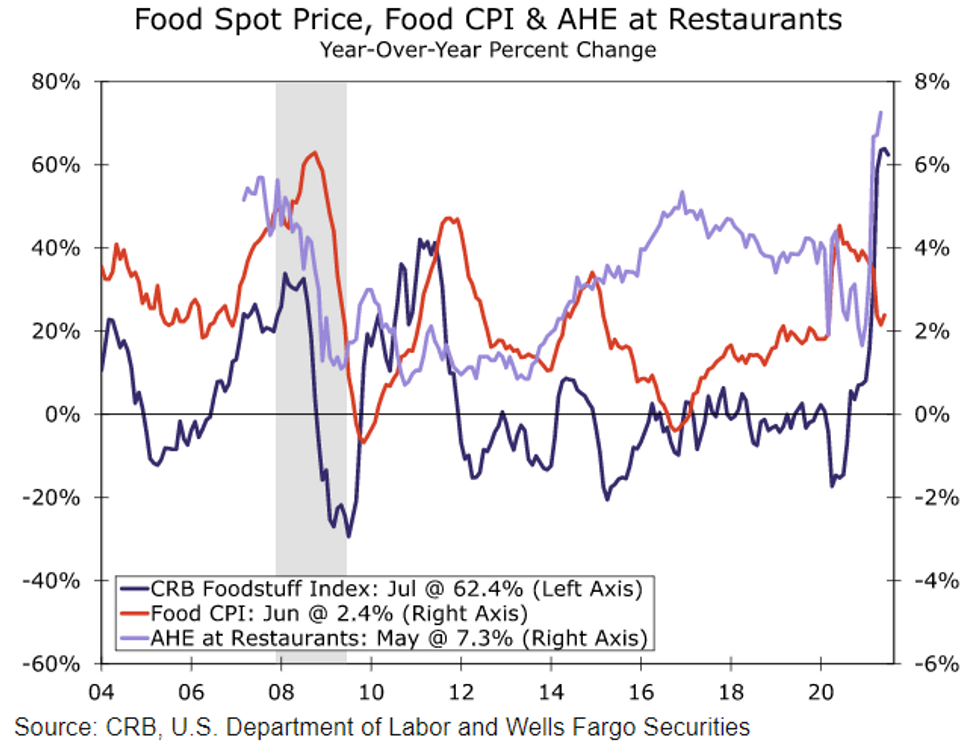

Free AccessWells Fargo: "Another Reopening Fueled Surge in CPI and Then Some"

In today's U.S. June CPI release, Wells Fargo sees "increasing evidence that inflation is broadening out beyond categories at the center of the reopening." They point out "prices have risen at an eye-popping 9.7% annualized pace the past three months as businesses are still struggling to meet surging demand".

- They expect food to "remain a major driver of inflation over the next few months and to offset some of the easing in autos and travel services". And "the upward draft from housing has yet to be realized and will prove more durable. The potential for an even larger boost from shelter comes with rent prices also starting to turn higher."

- But that being said, they don't expect much impact on Fed policy...yet: "Outsized gains tied to relatively small components continue to support the view that the current degree of inflation is transitory, but with price pressures broadening out, questions continue to swirl around when and to what extent inflation will eventually settle down. Most FOMC officials already saw upside risk to their inflation forecasts, but most also viewed uncertainty as historically high. Given the uniqueness of the current period, the dust is far from settled, and most officials seem content to wait for more information on inflation (and the labor market) before feeling ready to taper asset purchases."

- The structural outlook for inflation has changed, they say: "Along with consumer inflation expectations having turned around, the disinflationary forces of the past decade fading and the Fed's greater tolerance of inflation under its new framework, the underlying trend in inflation has moved up in our view."

Source: Wells Fargo

Source: Wells Fargo

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.