-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

White House Unveils Sizeable Tariff Hikes On Certain Chinese Goods

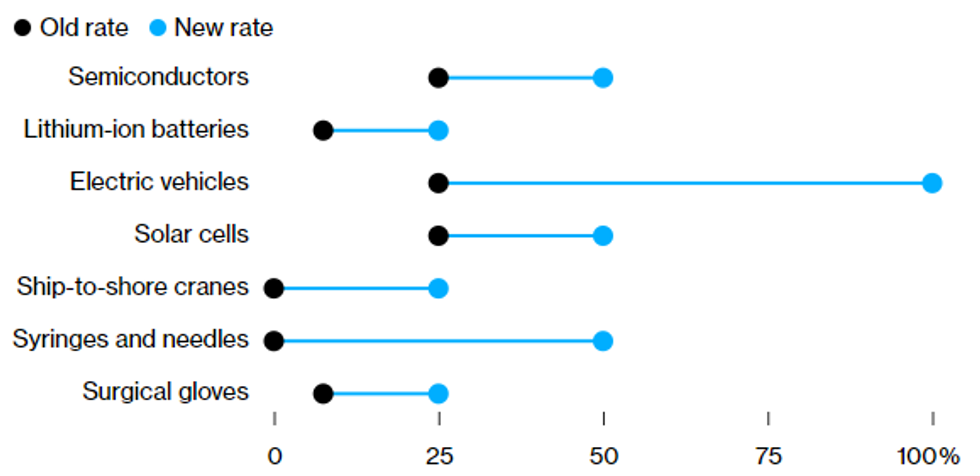

(MNI) London - It has been widely trailed that US President Joe Biden is set to lay out today the latest set of sweeping tariffs on a number of Chinese imports in an effort to support US manufacturing and burnish his hawkish credentials in an election year. Goods set to be targeted with new or increased levies include steel, aluminium, electric vehicles, semiconductors, batteries, solar cells, critical minerals, port cranes and medical products.

- Bloomberg reportsthat "The changes are staggered to take effect from 2024 to 2026, and are more targeted than the 60% flat tariff Trump has proposed. The biggest jump is for EVs, with the tariff rate quadrupling, while other imports are seeing levies doubled or being imposed for the first time."

- There remains the risk that China retaliates with its own tariffs, potentially sparking a tit-for-tat trade war. US Treasury Secretary Janet Yellen stated on 13 May that "Hopefully we will not see a significant Chinese response - but that's always a possibility."

- US Trade Representative Katherine Tai has issued a statement confirming the various rates of tariff. The statement says that "further action [is required] to encourage the elimination of China’s unfair technology transfer-related policies and practices that continue to burden U.S. commerce".

- Political relations had been seen to be improving following the meeting between Biden and President Xi Jinping in late 2023. However, the political realities of running a presidential election campaign against China uber-hawk Donald Trump, combined with Biden's close relations with organised labour imbuing a protectionist streak, could damage trade links further.

Chart 1. Tarrif Rate Changes on Chinese Imports by Product, %

Source: Bloomberg, White House

Source: Bloomberg, White House

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.