-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessWill the gilt market cope with active gilt sales? (1/2)

- The Bank of England MPC is expected to sign off on the start of QT at its September monetary policy meeting, and many of the details have already been announced. The Bank will look to conduct active gilt sales of around GBP10bln/quarter. The Bank of England’s own Market Participants Survey suggested that the median investor expected that the BOE could sell GBP60bln of gilts in the first 12 months of active sales without disrupting the functioning of the gilt market (an equivalent to GBP15bln/quarter).

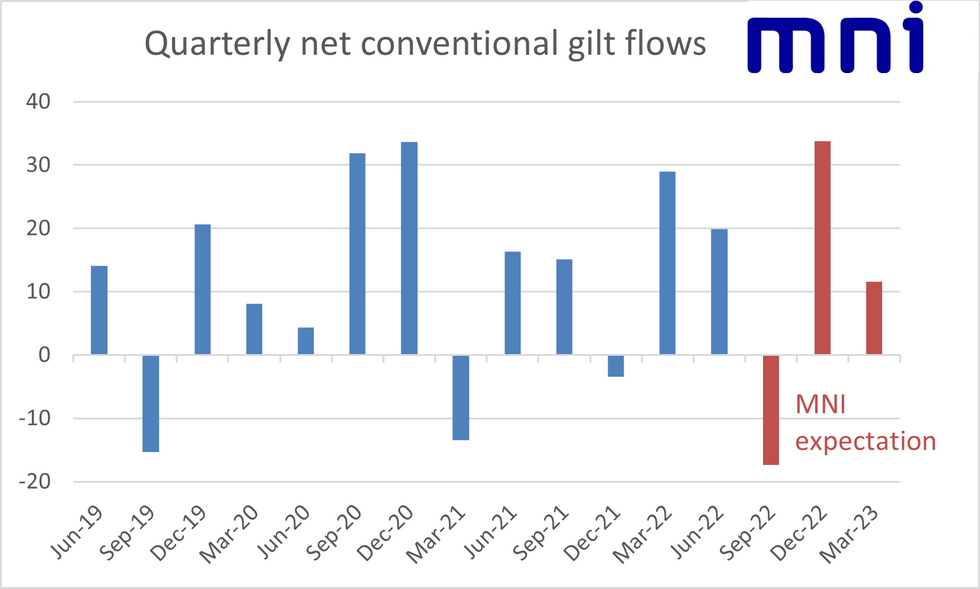

- However, as the chart shows, this will increase quarterly net supply of gilts to an estimated GBP33.7bln in Q4-22 – surpassing the GBP33.6bln seen in Q4-20. And this includes lower gilt sales and supply during December – looking at a two-month period, October/November 2022 will surpass any other period of net gilt supply. These net supply numbers are exacerbated by the fact there are no gilt redemptions in Q4-22. Indeed, with a large redemption due in Q1-23, under current plans net issuance is expected to fall back to around GBP11.6bln. Of course, all of these plans also assume that the gilt remit is not raised – something that is likely to fund any cost of living package or tax cuts from either of the potential new Prime Ministers.

- As we discuss above, the DMO has already held a tender in August and is proposing four additional auctions in the October to December quarter. This is depleting the “unallocated” issuance pot to around GBP600mln – a very low level for this stage of the fiscal year. We think that this is likely because the remit target will be increased alongside a new budget – and the DMO is front-loading issuance a little more than it would usually in anticipation of this. So there is potential for issuance, particularly in November onwards, to increase even further – which could start to increase liquidity pressures and the functioning of the gilt market in our view.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.