-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD/JPY Finds Bottom on China News

MNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI BRIEF: China Passenger Car Sales Up In November Y/Y

MNI ASIA MARKETS ANALYSIS: Twitter Poison Pill A Placebo

Carry-Over Pushback on 75Bp Hike; Demand Shock on China Zero Covid

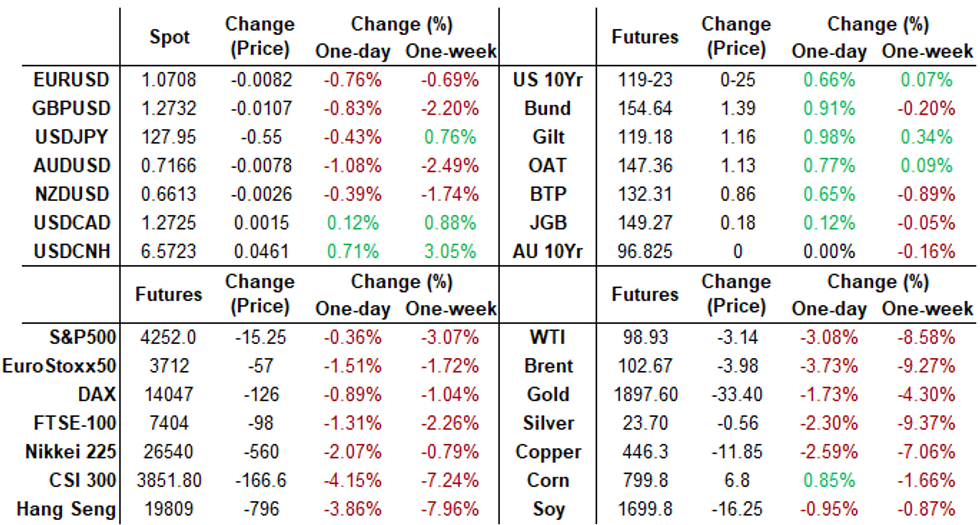

Rate futures trading higher after the bell - well off midday highs that saw 30YY hit 2.8552 low (2.8936% last), yield curves flatter in the short end (2s10s -3.133 at 19.388) as bonds managed to outpace the strong front end bid (2YY slipped to 2.5209 low, 2.6236% last)

- Carry-over short end support after Cleveland Fed Pres Mester pushed back on any need to hike more than 50bp late last Friday -- odds of 75bp hikes evaporating on the day. No comment from Fed with speakers in blackout through the May 4 FOMC.

- Underlying support trigger: Market putting more weight on the demand hit rather than the inflationary pressure from further supply side disruptions on widespread Covid lockdowns prospects in China (panic selling: Shanghai CSI 300 -4.15% to 3851.80, Hang Seng -3.86% to 19809.0).

- The 2-Yr yield is down 5.2bps at 2.6152%, 5-Yr is down 9.1bps at 2.84%, 10-Yr is down 9.4bps at 2.8044%, and 30-Yr is down 6.9bps at 2.8756%.

Late Equity Roundup: Twitter Buyout Unanimously Approved

Stocks have rebounded off midday lows, trading positive in late FI trade as Twitter stock halted. Headlines: Elon Musk to purchase Twitter for $54.20/share cash after securing $25.5B "fully committed financing", taking the micro-blog messaging service private. Buyout unanimously approved by the board.

- ESM2 climbed to 4274.75 high before drawing late selling: currently -4 (-0.09%) at 4263.25 vs. 4196.50 low just ahead noon. Aside from round number resistance of 4300.0, next key resistance in focus is 4355.50 Low Apr 18.

- Earnings resume after the close: Whirlpool (WHR), Cadence (CDNS), SBA Comm (SBAC) to name a few.

- SPX leading/lagging sectors: Communication Services (+1.27%) lead Match Group (MTCH) +6.48%, Twitter was +5.52%.

- Laggers: Energy sector (-3.28%) weighed down by O&G and energy equipment/services as crude slides - "demand" shock tied to China zero covid lockdown fears.

- Meanwhile, Dow Industrials currently trades +51.17 (0.15%) at 33861.6, Nasdaq +78.5 points (0.6%) at 12918.34.

- Dow Industrials Leaders/Laggers: Johnson & Johnson (JNJ) +3.01 at 184.55, Microsoft (+3.85 at 277.88). Chevron (CVX) -3.43 at 157.52 tied to drop in crude.

- RES 4: 4631.00 High Mar 29 and key resistance

- RES 3: 4588.75 High Apr 5

- RES 2: 4509.00 High Apr 21 and a key short-term resistance

- RES 1: 4355.50 Low Apr 18

- PRICE: 4252.0 @ 1510ET Apr 25

- SUP 1: 4200.00 Round number support

- SUP 2: 4129.50 Low Mar 15 and a key support

- SUP 3: 4094.25 Low Feb 24 and a bear trigger

- SUP 4: 4063.24 1.618 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis traded sharply lower Friday. This has confirmed a resumption of the current primary downtrend and in the process, the contract has breached all key Fibonacci retracement points of the bull cycle between Mar 15 - 29. This signals scope for weakness towards 4200.00 next and the key supports at 4129.50, Mar 15 low and 4094.25, the Feb 24 low. Key short-term resistance has been defined at 4509.00, the Apr 21 high.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.0400 to 0.33043% (-0.00343 total last wk)

- 1M -0.00543 to 0.69800% (+0.10900 total last wk)

- 3M +0.01115 to 1.22486% (+0.15100 total last wk) ** Record Low 0.11413% on 9/12/21

- 6M -0.00500 to 1.81871% (+0.26700 total last wk)

- 12M -0.05500 to 2.55171% (+0.38514 total last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $74B

- Daily Overnight Bank Funding Rate: 0.32% volume: $260B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $901B

- Broad General Collateral Rate (BGCR): 0.30%, $335B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $322B

- (rate, volume levels reflect prior session)

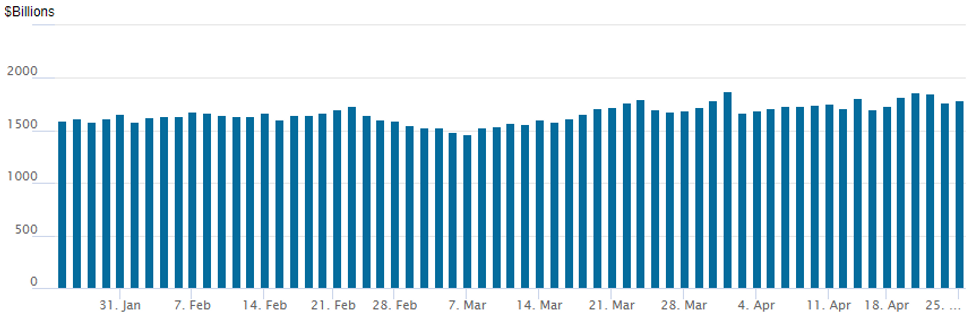

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,783.609B w/ 8 counterparties from prior session 1,765.031B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Option trade was decidedly bullish for underlying rate futures Monday, consistent buying of low delta calls, unwinding or outright selling puts/put spreads as futures surged.- The rally saw chances of 75bp hikes start to evaporate after probability of a 75bp hike in May climbed near 75% last week (before Cleveland Fed President Mester pushed back over the need to hike more than 50bp late Friday).

- Market putting more weight on the demand hit rather than the inflationary pressure from further supply side disruptions on widespread Covid lockdowns prospects in China (panic selling: Shanghai CSI 300 -4.15% to 3851.80, Hang Seng -3.86% to 19809.0).

- 5,000 short Dec 98.75 calls

- Block, 25,000 short May 96.56/96.75 1x2 call spds, 0.0

- Block, 10,000 Sep 96.25 puts, 7.0

- -5,000 Dec 98.00/98.25 put spds 19.0 over Dec 99.00 calls

- 1,600 short May 97.75 calls cab

- 2,000 Jun 98.00/98.12/98.25 put flys

- Overnight trade

- Block, -32,000 Green Jun 96.25/96.62 put spds, 7.5 vs. 96.89/0.19%

- Block, -10,000 Green Jul 96.25/96.62 put spds, 8.5 vs. 96.93/0.15%

- Block, -10,000 Green Sep 96.25/96.62 put spds, 10.0 vs. 96.93/0.13%

- +10,000 Aug 97.37/97.62 call spds, 3.5

- 6,700 FVM 113.5 calls, 30 -- total volume over 71k tied to 113.5/114 call spds

- 7,250 FVM 107.75 puts, 1

- +5,000 TYM 123/124.5 1x2 call spds, 1

- +2,500 TYM 121.5/123.5 1x2 call spds, 10

- -5,000 TYM 118/119 put spds, 17

- Overnight trade

- Block, -10,000 TYM 118.5 puts, 37 w/ 10k on screen at 35

- +10,000 TYM 117.5/119.5 put spds 0.0 vs. -TYM 120.5 calls

- +4,000 TYM 116/118 3x2 put spds, 36 vs. 119-12/0.25%

- +50,000 FVM 113.5/114 call spds, 11

- Block, -20,000 FVM 112.25 puts, 28.5-26

- 4,000 FVM 113 calls, 40

EGBs-GILTS CASH CLOSE: Decisively Risk-Off

The trading week began with clear-cut risk-off price action, with yields tumbling as stocks and commodities fell sharply.

- Concerns over extended and widening lockdowns in China saw the German and UK curves aggressively bull steepen.

- The bond rally accelerated late in the session as equities relapsed following a modest afternoon rebound. Closing 5Y German yields saw their 2nd biggest drop since 2011 (Mar 1st was the biggest).

- Periphery spreads widened; BTPs closed at the richest to Bunds since June 2020.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 13.7bps at 0.146%, 5-Yr is down 16.3bps at 0.589%, 10-Yr is down 13.5bps at 0.837%, and 30-Yr is down 8.4bps at 0.985%.

- UK: The 2-Yr yield is down 16.1bps at 1.553%, 5-Yr is down 13.5bps at 1.625%, 10-Yr is down 12.2bps at 1.841%, and 30-Yr is down 9.1bps at 1.947%.

- Italian BTP spread up 4.1bps at 173.9bps / Spanish up 2.2bps at 98.7bps

EGB Options: Put Spread Selling

Monday's Europe bond / rates options flow included:

- RXN2 150.00/148.00 put spread sold at 34.5 to 33.5 in 10k. Hearing unwind

- OEM2 126.50/125.25 1x1.5 put spread sold at 20.5 in 1.5k

- DUM2 110.50/110.80/111.10 call fly bought for 3.5/3.75 in 4k

FOREX: Historical Safe Havens In Demand Amid Commodity/Risk Selloff

- Both the US Dollar and Japanese Yen faired the best amid G10 currencies on Monday as the commodity complex came under significant pressure to start the week and lent support to historical safe havens.

- Oil prices have taken a considerable leg lower, with Brent and WTI prices off over 5%. Ongoing fears of a weeks-long ultra-strict lockdown being imposed in Beijing, in a similar scenario to that currently taking place in the megacity of Shanghai, is weighing on the outlook for demand.

- In turn, this has contributed to ongoing weakness in the Chinese Yuan. Spot USD/CNH pierced the CNH6.55 figure on its way to fresh one-year highs at 6/6092, while its implied volatilities soared to fresh cycle highs across the curve.

- Early in NY trade, the PBOC cut the FX RRR by 1ppt, in a partial reversal of their last policy move using the tool in December last year (where they raised the FX RRR by 2ppts). The mechanics behind today's policy move mean they lessen the incentive for commercial banks to hold more in FX reserves. The move could be a response to the broad USD/CNY rally we've had over the past week or so and put the top in during Monday’s session

- Furthermore, waning risk sentiment across global markets weighed heavily on the likes of AUD and GBP in addition to near two percent declines for both SEK and NOK.

- Ongoing uncertainties relating to the Ukraine warfare is keeping EURUSD vulnerable and the pair has cleared support at 1.0758, the Apr 14 low and a short-term bear trigger. This confirms a resumption of the downtrend and an extension of the bearish price sequence of lower lows and lower highs. 1.0727 has also been breached, the Apr 24, 2020 low and this signals scope for a move towards 1.0636 next, the Mar 23 2020 low and the next major support.

- A light data docket on Tuesday is headlined by US durable goods and consumer confidence data. Focus will then turn to Australian CPI on Wednesday and Thursday’s Bank of Japan meeting.

FX: Expiries for Apr26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-10(E802mln), $1.0725-50(E2.1bln), $1.0785-05(E2.6bln), $1.0800-05(E1.0bln), $1.0900-10(E560mln)

- USD/JPY: Y125.00($1.2bln), Y126.00-20($1.2bln), Y126.75-80($850mln), Y128.00($575mln)

- AUD/USD: $0.7150-70(A$771mln), $0.7220(A$1.2bln), $0.7350-70(A$1.1bln)

- USD/CAD: C$1.2675($655mln), C$1.2785($575mln)

COMMODITIES: Lockdown Fears Come To The Fore

- In an acceleration of the weakness from Friday, oil prices have slid throughout the day and cleared 50-day EMAs on fears of further China lockdowns following mass testing in Beijing’s largest district.

- Explosions reported in Moldova’s breakaway region of Transdniestria helped saw some bounce but it’s been small compared to the demand destruction from Chinese inactivity (Shanghai lockdowns are already estimated to have knocked 1.2m bpd from demand).

- WTI is -4.7% at $97.30, through the 50-day EMA of $97.80 which next opens key support at $92.6 (Apr 11 low).

- Brent is -5.3% at $101.00, through the 50-day EMA of $102.72 and opening support at $97.57 (Apr 11 low).

- Gold is -1.7% at $1899.3, close to testing the bear trigger of $1890 (Mar 29 low) having cleared support at the 50-day EMA. Resistance is seen at the 20-day EMA of $1952.0.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/04/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 26/04/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 26/04/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/04/2022 | 1245/0845 |  | CA | BOC Deputy Lane panel talk | |

| 26/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/04/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/04/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/04/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/04/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/04/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.