-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

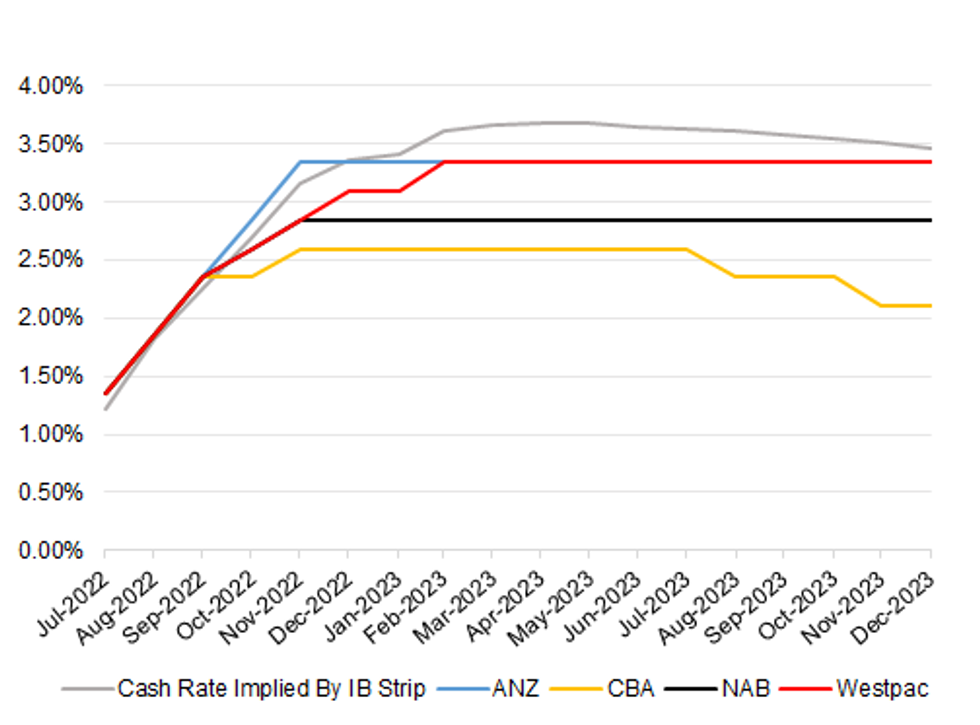

Free AccessBig 4 Views Vs. Market Pricing

After the latest round of hawkish adjustments to the RBA views held by the Big 4, ANZ have the most aggressive hiking view, at least in the immediate term (with their view briefly outstripping what is priced into markets at present, based on IB strip settlement levels at Friday’s close), given that they now look for a further 4 consecutive 50bp rate hikes through November before an elongated pause. This still leaves their terminal rate assumption below that portrayed in wider market pricing. Westpac’s hiking cycle assumptions eventually catch up with ANZ’s, after lagging in the period between the September and February decisions, with an equal terminal rate projection.

- Further out, CBA are the only one of the big 4 with cuts pencilled into their projections before the end of ’23 and also have the shallowest terminal rate assumption (2.60%), which they still deem to be comfortably above their assessment of neutral (1.60%). Meanwhile, Westpac look for 100bp of cuts in ’24 (beyond the forecast horizon provided in the chart). Elsewhere, NAB note that “a combination of below trend growth and inflation moving back to target over 2023 and into 2024, as in our forecasts, raises the possibility of rate cuts at some point in 2023 or 2024,” although their official forecast track has no cuts pencilled in through its horizon. Meanwhile, the IB strip was pricing in circa 22bp of easing in its ’23 cash rate profile, from peak rate to post-peak trough, as of Friday’s close. A reminder that terminal pricing re: the RBA's current tightening cycle operates well shy of its cycle peak at present.

- A reminder that last week saw RBA Governor Lowe stress that the Bank will do what is necessary when it comes to anchoring inflation expectations, with the Bank set to steadily raise interest rates, while he noted that the cash rate will reach the “neutral” level at some point (which he noted sits at 2.50%, at a minimum). This came after Deputy Governor Bullock pointed to a neutral real cash rate of 0.5-1.5% (which equates to 2.5-3.5% in nominal terms when referencing the lower boundary of the Bank’s inflation target range, and 3.0-4.0% when using the mid-point of the range).

- Domestic Q2 CPI data & the latest monetary policy decision from the U.S. Federal Reserve (both due Wednesday) provide the meaningful risk events for participants and economists to digest this week. With the tight labour market, inflation dynamics and supersized rate hikes deployed by some of the RBA’s global counterparts cited as potential trigger points for larger than 50bp moves from Martin Place.

Source: MNI - Market News/ASX/Bloomberg

Source: MNI - Market News/ASX/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.