-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Thune Defends Two-Step 2025 Agenda

MNI US MARKETS ANALYSIS - EUR Steadies Ahead of ECB

MNI ASIA MARKETS ANALYSIS: 2s10s Bear Steepens on 16Bp Range

HIGHLIGHTS

- BOE Hikes 50bps And Launches Gilt Sales

- CREDIT SUISSE DENIES IT'S EXITING US MARKET, Bbg

- US-RUSSIA: Blinken Tells UNSC: "Putin Shredding International Order"

- ECB'S SCHNABEL SAYS INFLATION MAY BE MORE PERSISTENT THAN WE ORIGINALLY THOUGHT, Bbg

US TSYS: Market Roundup, Holding Near Lows Through Second Half

Tsys broadly weaker after the close - holding narrow range through the second half - near first half lows where ylds hit new 15Y highs (2YY 4.1587% after topping 4.0% in aftermath of Wed's 75bp FOMC rate hike; 5YY 3.9399%, 10YY 3.7118%). 2s10s bear steepened to -41.164 high compared to -57.943 low overnight.

- Heavy volumes (TYZ2>2M after the bell) included buy-stops, several rounds of technical selling (TYZ2 slipped below 112-25+ Low Jun 11 2009), curve flattener unwinds/profit taking in the aftermath of Wed's post-FOMC flattening. Modest deal-tied flow and pre-auction short sets ahead final leg of wk's Tsy supply ($15B 10Y TIPS R/O) contributed to moves.

- Brief delayed reaction to BoE rate hike with long end Gilts under heavy pressure, Tsys followed suit while Tsys extending session lows (30YY taps 3.5241% high) following latest weekly claims of 213k vs. 217k est, prior revised to 208k.

- What really turned up the heat on long end selling were unconfirmed rumors of Japan FinMin selling Tsys to support FX intervention (after similar occurred after after PBoC intervened in 2015, one desk said). Some desks questioned the logic of selling Tsys while yield curve control is still occurring.

- Nevertheless, MOF intervention was confirmed selling US$ as well as Tsys to lesser degree -- What exacerbated the sell-off were speculative and fast$ accts selling bonds in anticipation of more intervention, trading desks said.

- Currently, 2-Yr yield is up 7bps at 4.118%, 5-Yr is up 15.2bps at 3.9183%, 10-Yr is up 17bps at 3.6999%, and 30-Yr is up 13.4bps at 3.6366%.

SHORTER TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.75200 to 3.07171% (+0.75614/wk)

- 1M +0.02500 to 3.08400% (+0.07014/wk)

- 3M +0.03757 to 3.64143% (+0.07614/wk) * / **

- 6M +0.05871 to 4.18271% (+0.05942/wk)

- 12M +0.11714 to 4.79957% (+0.12743/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.64143% on 9/22/22

- Daily Effective Fed Funds Rate: 2.33% volume: $99B

- Daily Overnight Bank Funding Rate: 2.32% volume: $300B

- Secured Overnight Financing Rate (SOFR): 2.26%, $951B

- Broad General Collateral Rate (BGCR): 2.25%, $393B

- Tri-Party General Collateral Rate (TGCR): 2.25%, $374B

- (rate, volume levels reflect prior session)

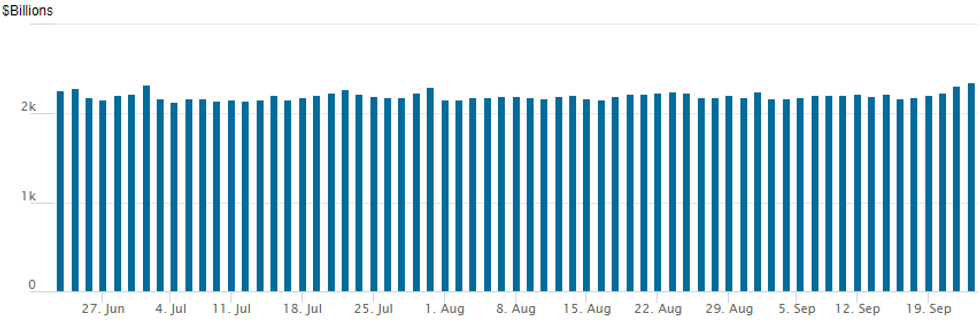

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usages climbs to new record high of $2,359.227B w/ 102 counterparties vs. $2,315.900B prior session. Compares to prior record high of $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

SOFR put options lead with ongoing "higher for longer" rate hike insurance hedging.- Salient trade: Ongoing buyer 5,000 SFRZ3 95.00/95.50/96.00 put flys, 8.5 at 1144-1145ET. Ongoing interest in the limited downside structure targeting late 2023:

- Paper bought +40,000 SFRZ3 (Red Dec) 95.00/95.50/96.00 put flys, 7.0-7.5 on Sep 14: in addition to 30k back in mid-July from 4.0-3.5 Last month included a buy of +70,000 short Dec SOFR 95.50/96.00/96.50 put flys at 8.5 back on Aug 25 (expires same time as SFRZ2 futures but uses SFRZ3 as underlying.

- In other SOFR trade, put spd buy funded via call spd sale block at 1312:42ET

- +20,000 SFRH3 94.25/94.62/95.25 put flys 2.25 over -20,000 SFRH3 95.50/95.87 call spds

- SOFR Options:

- Block, 5,000 SFRZ3 95.00/95.50/96.00 put flys, 8.5

- Block, -5,000 SFRM3 98.00 calls, 2.5 ref 95.45

- -30,000 SFRM3 96.00/97.00 put spds, 83.5-98.75 ref 95.49-.44

- Block, 4,000 short Oct 96.00/96.25/96.50 put flys, 3.0 vs. 95.795/0.10%

- 8,000 SFRF3 95.00/95.12 put spds

- 2,000 SFRZ2 96.25/96.37 put spds vs. short Dec 96.50/96.75 put spds

- Eurodollar Options:

- 15,000 Mar 99.00/99.50 put spds

- 3,500 short Oct 95.25/95.50/95.87 broken put flys

- Treasury Options:

- -2,500 FVX 109 calls, 18.5

- -10,000 FVX 107.25/107.75 put spds, 12.5

- -6,200 FVX 111.5 calls, 1

- -5,000 FVX 111 calls, 2

- -3,000 TYZ 117.5 calls, 7

- Block, 3,250 TYV 113.5/115.5 5x4 put spds, 610 vs 113-22.5

- Blocks/screen, total 29,000 FVX 108.5 puts, 49.5-48

EGBs-GILTS CASH CLOSE: Gilts Underperform In Disorderly Session

Global core bond yields rose further Thursday, in increasingly disorderly fashion.

- The hawkish Fed guidance late Wednesday continued to reverberate, with volatility exacerbated by big swings in multiple currencies early Thursday including the Swiss franc and the Japanese yen - the latter of which saw official intervention in support for the first time since 1998.

- Despite a 50bp vs 75bp hike by the BoE, Gilts underperformed, with yields rising in double-digits across the curve following the Bank following through with Gilt sales starting in October.

- Additionally, Friday sees an updated UK fiscal statement, with some government measures seen driving Gilt weakness.

- Bund yields broke through the 2014 highs; futures saw breaks of support across the board.

- Against that backdrop, and despite a risk-off atmosphere, periphery spreads found opportunity to tighten.

- In addition to the UK fiscal announcement, we get preliminary PMI data Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 8.7bps at 1.846%, 5-Yr is up 9.7bps at 1.936%, 10-Yr is up 7.2bps at 1.965%, and 30-Yr is up 3.2bps at 1.87%.

- UK: The 2-Yr yield is up 13.8bps at 3.528%, 5-Yr is up 18.3bps at 3.563%, 10-Yr is up 18.4bps at 3.495%, and 30-Yr is up 18.6bps at 3.775%.

- Italian BTP spread down 3.8bps at 220.4bps / Greek down 3.4bps at 253.5bps

FX: Expiries for Sep23 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900(E536mln), $0.9950(E724mln), $0.9986-00(E3.1bln), $1.0150(E1.2bln)

- USD/JPY: Y139.85-00($513mln)

- AUD/USD: $0.6675(A$751mln), $0.6865(A$554mln)

- USD/CNY: Cny6.9500($940mln), Cny7.0000($828mln)

Late Equity Roundup: Holding Lows

Stock indexes holding near session lows in late trade -- adding to the week's sell-off back to mid-June levels, Consumer Discretionary and Financial shares continued to underperform. Currently, SPX eminis trade -29.75 (-0.78%) at 3776; DJIA -65.86 (-0.22%) at 30117.16; Nasdaq -167.6 (-1.5%) at 11052.13 - or -24% YoY.

- SPX leading/lagging sectors: Health Care shares outperformed Thu (+0.68%) lead by pharmaceuticals and biotech (Eli Lilly +4.60%, BMY +2.69, JNJ +2.25%), Energy sector up next (+0.40%) followed by Communication Services holding steady w/ diversified telecom shares outperforming. Laggers: Consumer Discretionary (-2.34%) with autos and consumer services underperforming. Financials next up (-1.52%), headlines Credit Suisse shares still weaker after earlier headlines exploring US mkt exit were denied.

- Dow Industrials Leaders/Laggers: United Health (UNH) +5.01 at 517.09, Amgen (AMGN) +4.16 at 228.62, Merck (MRK) +3.25 at 87.78. Laggers: Goldman Sachs (GS) -9.18 at 311.53, American Express (AXP) -5.88 at 142.83, Boeing (BA) -4.60 at 138.71.

E-MINI S&P (Z2): Bear Trend Extension

- RES 4: 4313.50 High Aug 18

- RES 3: 4234.25 High Aug 26

- RES 2: 4032.28/4175.00/47 50-day EMA / High Sep 13

- RES 1: 3936.25 High Sep 20

- PRICE: 3775.0 @ 1445ET Sep 22

- SUP 1: 3766.75 Intraday low

- SUP 2: 3741.75 Low Jul 14

- SUP 3: 3657.00 Low Jun 17 and a major support

- SUP 4: 3600.00 Round number support

S&P E-Minis traded lower Wednesday and have cleared recent lows to confirm a resumption of the bear cycle that started mid-August. The break lower strengthens bearish conditions and paves the way for a move towards 3741.75, the Jul 14 low. The key support at 3657.00, Jun 17 low, has also been exposed. On the upside, initial firm resistance has been defined at 3936.25, the Sep 20 high.

COMMODITIES: EU Looking At Russia Oil Price Cap In Earnest

- Crude oil continues a mixed week, retracing from earlier session highs but keeping mild gains on the day as various sources look for the EU to rush to agree on a Russia oil price cap after Putin’s threats. Separately, Exxon was forced to shut down operations at its 235kbpd Fos-Sur-Mer refinery due to industrial action.

- WTI is +0.5% at $83.37 and despite hitting a high of $86 remains within yesterday’s range, leaving resistance at $86.68 (Sep 21 high) and support at $81.73 (Sep 19 low) with a bearish outlook.

- Brent is +0.5% at $90.3 also remains within yesterday’s range, maintaining resistance at $93.5 (Sep 21 high) and support at $88.5 (Sep 19 low) with a bearish outlook.

- Gold is -0.2% at $1670.88, having been pulled two ways after BoJ intervention but Russia-Ukraine tensions rising. It came very close to testing support at $1654.2 (Sep 16 low) early in the session before swinging to almost testing resistance at $1688.9 (Sep 1 low).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/09/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 23/09/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/09/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/09/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/09/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/09/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/09/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/09/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/09/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/09/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/09/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/09/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 23/09/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 23/09/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/09/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/09/2022 | 1800/1400 |  | US | Fed Listens Event |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.