-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

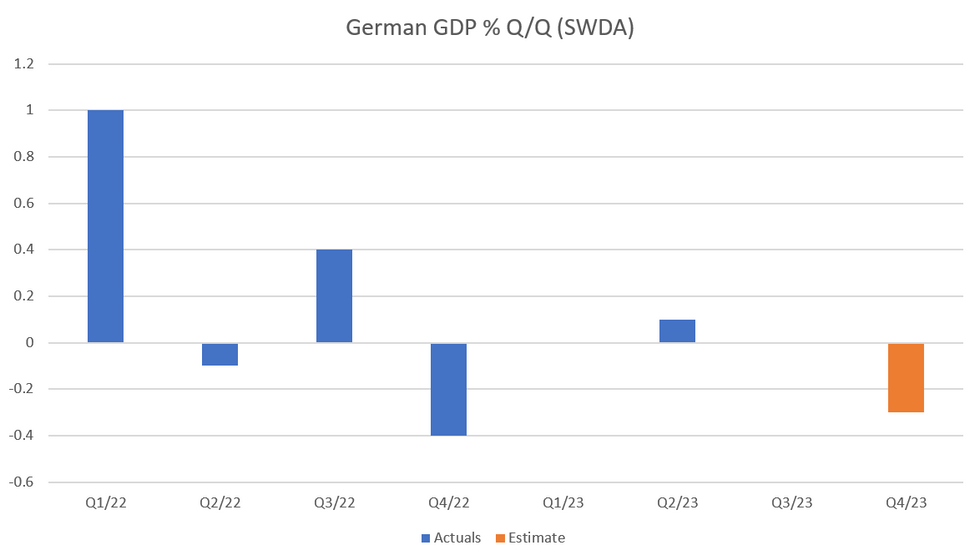

Free Access2023 GDP Decline Underlines Weak Domestic Demand Narrative

German 2023 real GDP is estimated by Destatis to have met consensus expectations by contracting -0.3% Y/Y (vs -0.3% cons and 1.8% in 2022), the first drop since the pandemic-hit 2020. On a calendar-adjusted basis, real GDP decreased by an estimated -0.1% Y/Y. GDP fell an estimated -0.3% in Q423 (vs 0.0% prior, revised from -0.1%).

- Destatis cited higher prices, unfavourable financing conditions, and low domestic and foreign demand for the drop in output.

- Weakness was driven primarily by private consumption (~51% of GDP), which contracted by -0.8% Y/Y, and is now 1.5% below 2019 levels. Consumers were hurt by lower real wages amid the high inflation environment. Lower consumption could be seen particularly in areas impacted by strong price increases, with Destatis specifically citing the category of furnishings and household appliances (-6.2% Y/Y).

- Government consumption declined for the first time in almost 20 years (-1.7% Y/Y, accounts for ~22% of GDP), driven by the discontinuation of Covid-related measures. As the government is planning to stay within its constitutional debt brake limits in 2024, a significant rebound this year is unlikely.

- Gross fixed capital formation (~22% of GDP) declined the third time in the last four years at -0.3% Y/Y, with slowing residential construction and weak industrial investment likely contributing (details are not yet available).

- Net exports contributed positively with imports declining stronger than exports (-3.0% and -1.8%, respectively). Weak imports mirror the low domestic demand already indicated by other data series recently.

- Looking at sectoral drivers of real gross value added, activity clearly slowed in industrial production (excl. construction) at -2.0% Y/Y; services were relatively resilient and decreased only -0.1%.

- The data were poor from a productivity perspective as well: real GDP per person employed decreased -1.0% Y/Y in 2023, with GDP per hour worked falling -0.9% Y/Y.

- Final prints containing more detail are to be released in the next weeks. Current private sector consensus forecasts are for +0.3% real GDP in 2024, led by a bounce in private consumption (to +0.8% Y/Y).

| Inflation-adjusted figures, % Y/Y | 2020 | 2021 | 2022 | 2023e |

| Private consumer spending | -5.9 | 1.5 | 3.9 | -0.8 |

| Government consumption expenditure | 4.1 | 3.1 | 1.6 | -1.7 |

| Gross fixed capital formation | -2.4 | -0.2 | 0.1 | -0.3 |

| Exports | -9.3 | 9.7 | 3.3 | -1.8 |

| Imports | -8.3 | 8.9 | 6.6 | -3.0 |

| Net Exports | -1.0 | 0.9 | -1.2 | 0.6 |

| GDP | -3.8 | 3.2 | 1.8 | -0.3 |

| GDP per person employed | -3.1 | 3.0 | 0.4 | -1.0 |

| GDP per hour worked | 1.2 | 0.6 | 0.5 | -0.9 |

| Total gross value added | -4.0 | 3.3 | 1.7 | -0.1 |

MNI, Destatis

MNI, Destatis

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.