-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessAirlines; Wizz26s trade away discount, new FOY29s screening some value here

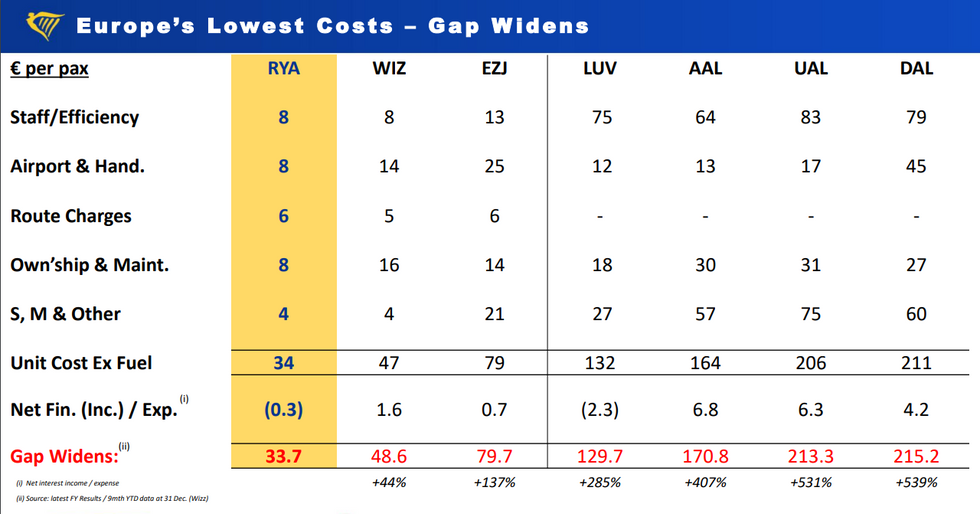

- Ryanair doesn't shy away from celebrating itself (below). As we highlighted during Finnair roadshow, it does indeed have the best unit costs among LCC (& by extension Network) carriers & it translates to an impressive double digit EBIT margin (~15% in current results).

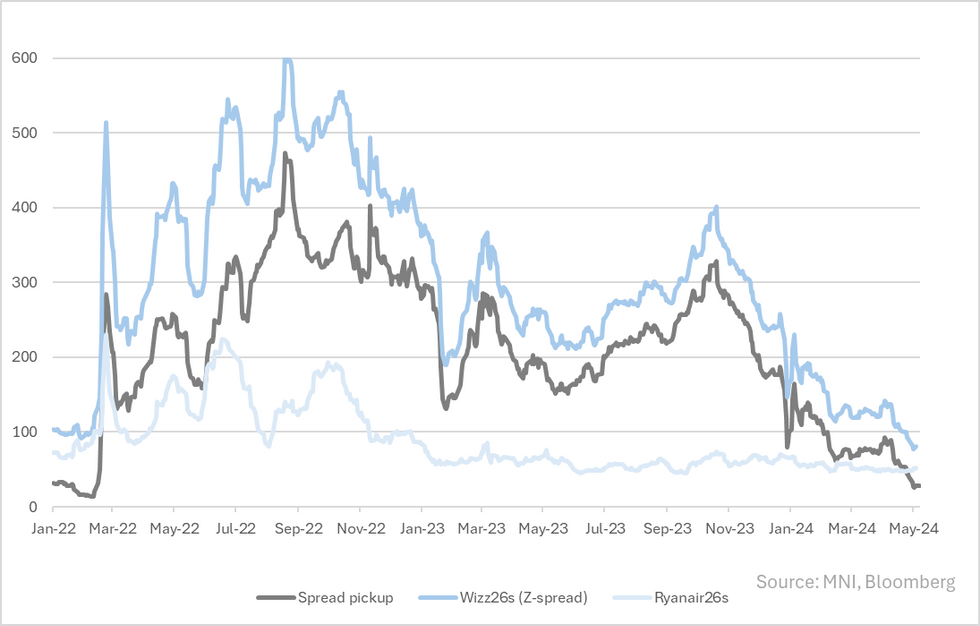

- Only sector screen cheap we had was on the offer side of the Wizz26s; its moved in 25bps since/this month (below) & it now looks fair/take it off.

- New Finnair 29s at Z+203 (issued at +200) are starting to screen some value here. To reiterate 2-notch government uplift here (which includes history of financial support) which will need to balanced with weaker standalone fundaments; lowest scale (€3.1b), highest unit costs among LCC's, EBIT margins only above easyJet & Lufty with guidance a lacklustre 6% (should move it to 2nd last) & elevated exposure to Finland/Helsinki as its hub.

- Its hard to take a firm RV view given no curve or CDS (i.e. liquidity over time), but pickup is substantial against the new AFFP29s (+40bps) for equal (S&P) ratings. That is in some part due to impressive moves in AFFP secondary (new 29s -28bps, 28s -20).

- Not sure if AFFP moves are on optimism of previously lower rated IAG receiving a uplift into IG. As we said then we wouldn't read-through/get our hopes up for AFFP; we didn't see much progress on gross deleveraging in Q1 (reminder S&P treats the €3.5b in hybrids as full debt while co reports as full equity) or strong enough 1Q results/FY guidance for headline earnings to push a upgrade.

- Finally reminder FOY29s does have a CoC put (at par) as protection if Finnish government pulls out so we don't see a need to price it on standalone BB- ratings for now (if so Avis becomes a potential comp - well wide). We keep a light screen cheap on it with no firm view on timing for it to come in (i.e. carry & roll).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.