-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

Aroundtown (ARNDTN: NR, BBB+ Neg) {AT1 GY Equity}

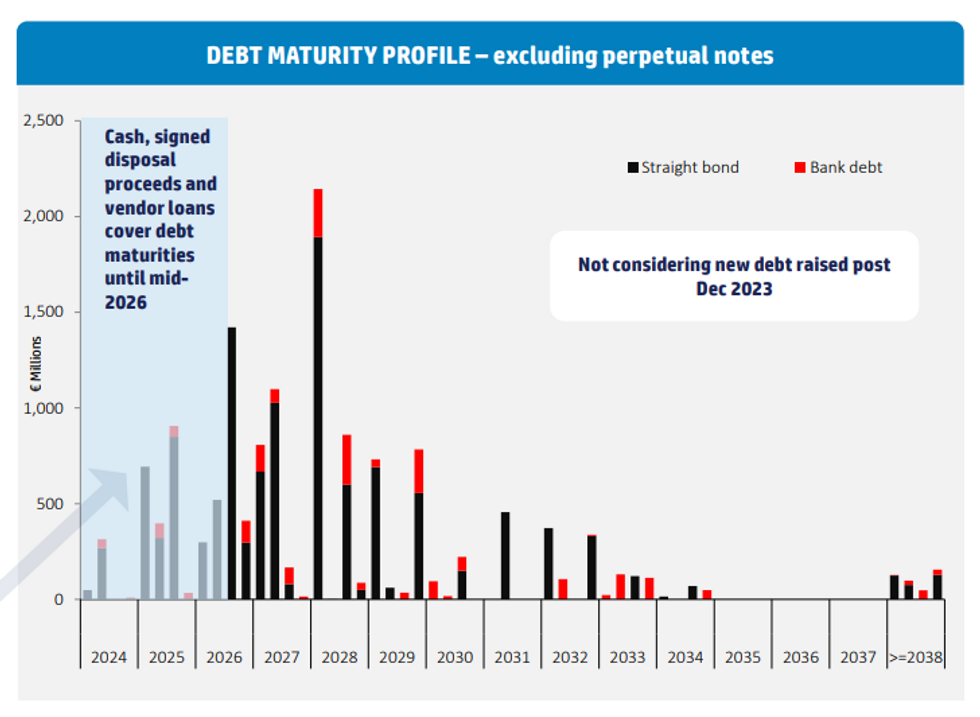

FY23 results came in line & FY24 guidance for FFO of €280-310m looks to be at midpoint of consensus. Asset disposals & singular cash focus for debt repayments has maturities covered through to mid-26 now. Property revaluations totalled -€3.2b (-11%). Re. share price moves would note it has refrained from paying dividends (as expected), i.e. reaction today on headline performance.

- Mids were unch this morning after equities initially dropped up to -10% lower, but are following equities tighter now - non-perp € lines 5-9bps tighter, £ lines unch.

- FY23 results were €1.2b in rental income, adj EBITDA of €1b and FFO of €332m. Property revaluations totalled -€3.2b (-11% devaluation) driving net loss of -€2.4b.

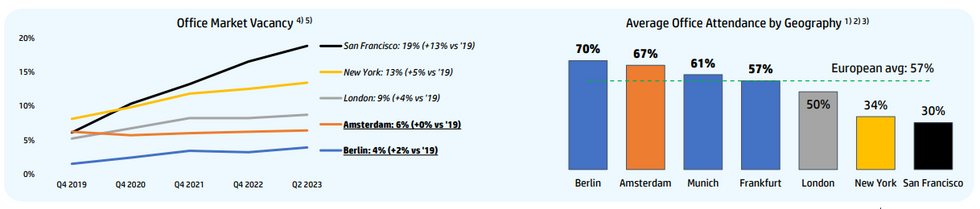

- Vacancy rates in office continue to remain elevated at 12.8% (up from 12.2% last qtr), retail was also up 1pp to 12.3%. It still sees based on avg. working days that Europe is much well positioned vs. US in vacancy rates/trends. LFL rental growth across the group was 3.2% over the year.

- Liquidity was boosted to €3b on €1.2b of disposals over the year (little change in the last qtr), LTV ratio moved up 3% to 43%, interest cover was 4.2* (covenant >=1.8*). Net debt was reduced by -€0.9b including €1.3b in bond buybacks (at "high discount"). Net debt/assets is at 37% well below covenant of 60% - sees €11.8b in losses before its triggered. Note the perpetual notes (including those not called) are treated a 100% equity for covenants.

- Mgmt now sees enough liquidity to cover debt maturities till mid-2026 and still has further disposals in pipeline.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.