May 21, 2024 12:24 GMT

Avinor (AVINOR; A1/A S)

TRANSPORTATION

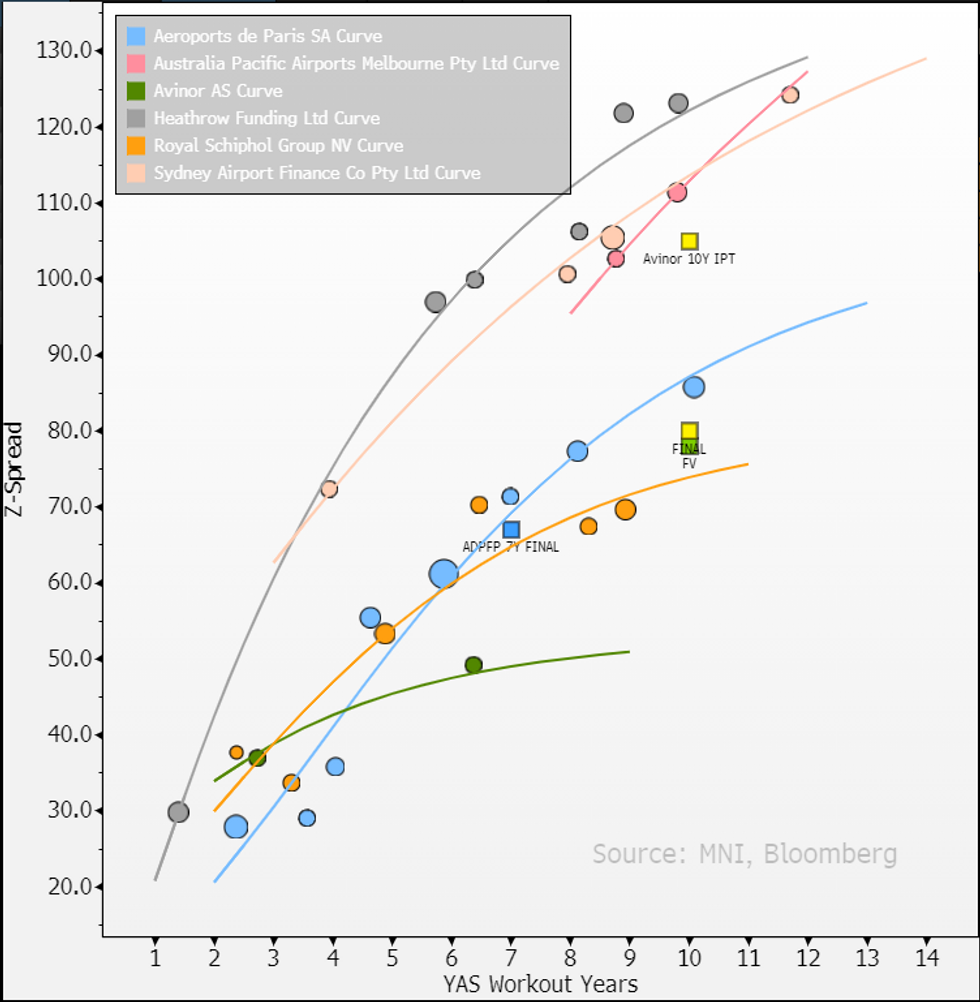

€500m 10Y FINAL +80 vs. FV +78

- 2bp NIC, 25bps in from IPT, books >€1.2b.

- Weak metrics in comparison to Aerports de Paris 7Y 2 weeks ago; tightened 38bps in from IPT & 3bps through our FV, with books >3.2b on same size.

- As we highlighted sizeable pickup (+40bps) for 1 to 2-notch step down into Sydney, Melbourne & Heathrow - not sure if that finally weighed on demand.

- Regardless it has shown in secondary performance; new ADPFPs +4 out, while Melbourne airport's 10Y from late Feb have come in -17bps and Sydney Airport 8/12Y from 3 weeks ago 5/10 in.

- ADPFP 10y/34s (NR/A Neg/BBB+) unch today, and left spread +5bps to new Avinor.

- FV from earlier; https://marketnews.com/avinor-avinor-a1-a-s-266833...

123 words