-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

BoJ Resilience & Wider Recession Worry Sees Off Vigilantes

The BoJ has seen off the vigilantes that tested it’s will in mid-June, at least for now, leaving it as the last dove standing in major central bank circles.

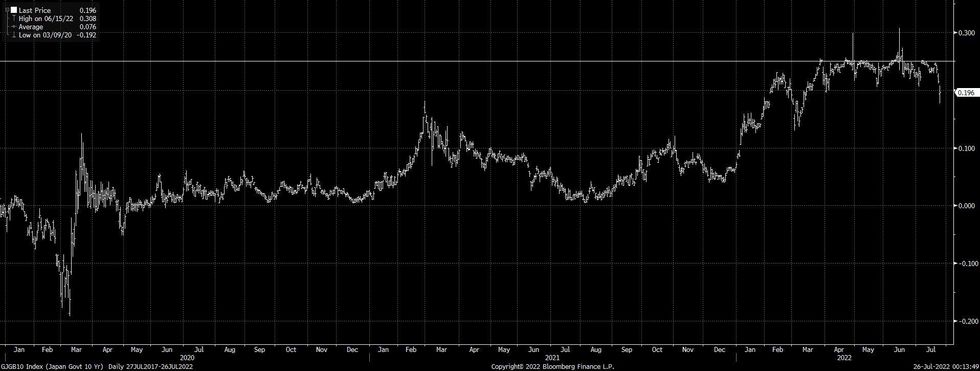

10-Year JGB yields touched the lowest level observed since March on Monday, pulling away from the upper end of the Bank’s permitted -/+0.25% trading range.

Fig. 1: 10-Year JGB Yields (%)

Source: MNI – Market News/Bloomberg

Source: MNI – Market News/Bloomberg

Elsewhere, 10-Year Japanese swap rates have cratered after the BoJ upped its bond buying during June (to a record monthly level), employed some creative tactics when it came to limiting the futures/cash JGB basis blowout and reaffirmed the need to maintain its current policy settings owing to a lack of demand-pull inflation. Wider recession-based worry, centred on the U.S. & Europe, has also helped.

Note that gains in swap rates beyond 10s have been a little stickier given the lack of relative BoJ control further out the JGB curve, although those metrics are still back from cycle highs.

Fig. 2: Japan 10- To 40-Year Swap Rates (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

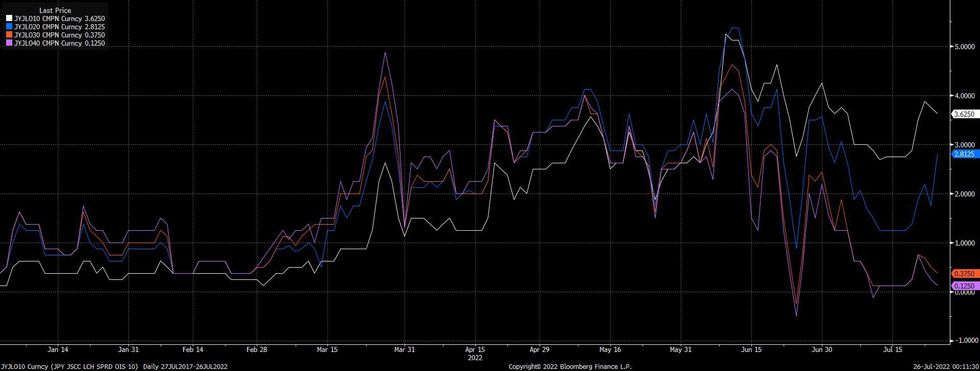

We have documented the recent BoJ-driven covering of short positions in both JGB futures and Japanese bonds on the part of foreign investors in some detail, with that particular investor cohort seen as the main driving force behind the June challenge of the BoJ’s YCC parameters. We would also highlight the post-June BoJ pullback in LCH/JSCC swap spreads covering the 10+-Year zone of the curve, with the moves in these spreads once again indicating that offshore participants were driving the market challenge of the BoJ in June, widening into the June BoJ decision, before narrowing as offshore participants pared their bets re: BoJ YCC capitulation

Fig. 3: LCH/JSCC 10- to 40-Year Swap Spreads (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.