-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBoT Votes Unanimously To Leave Interest Rates On Hold, Gov Sethaput To Speak

Spot USD/THB pushed higher as onshore Thai markets reopened, even some watchers may have deemed yesterday's monetary policy decision and statement from the BoT marginally hawkish. The rate trades +0.080 at THB33.940 after printing best levels in more than four years. A break above the THB34.000 figure would bring Jul 11, 2017 high of THB34.140 into play. Bears look for a fall through Sep 23 low of THB33.155.

- The Bank of Thailand voted unanimously to leave their benchmark interest rate on hold Wednesday. This represented a shift from last month's meeting, when two MPC members had voted to trim the policy rate by 25bp. A large majority of analysts (including us) expected the Committee to stand pat but a handful had anticipated a rate cut.

- Thailand's central bank cited "progress on vaccination and earlier-than-expected relaxation of the containment measures" as factors which will support the economy going forward. The Committee judged that the economy bottomed out in Q3 and will gradually recover from Q4.

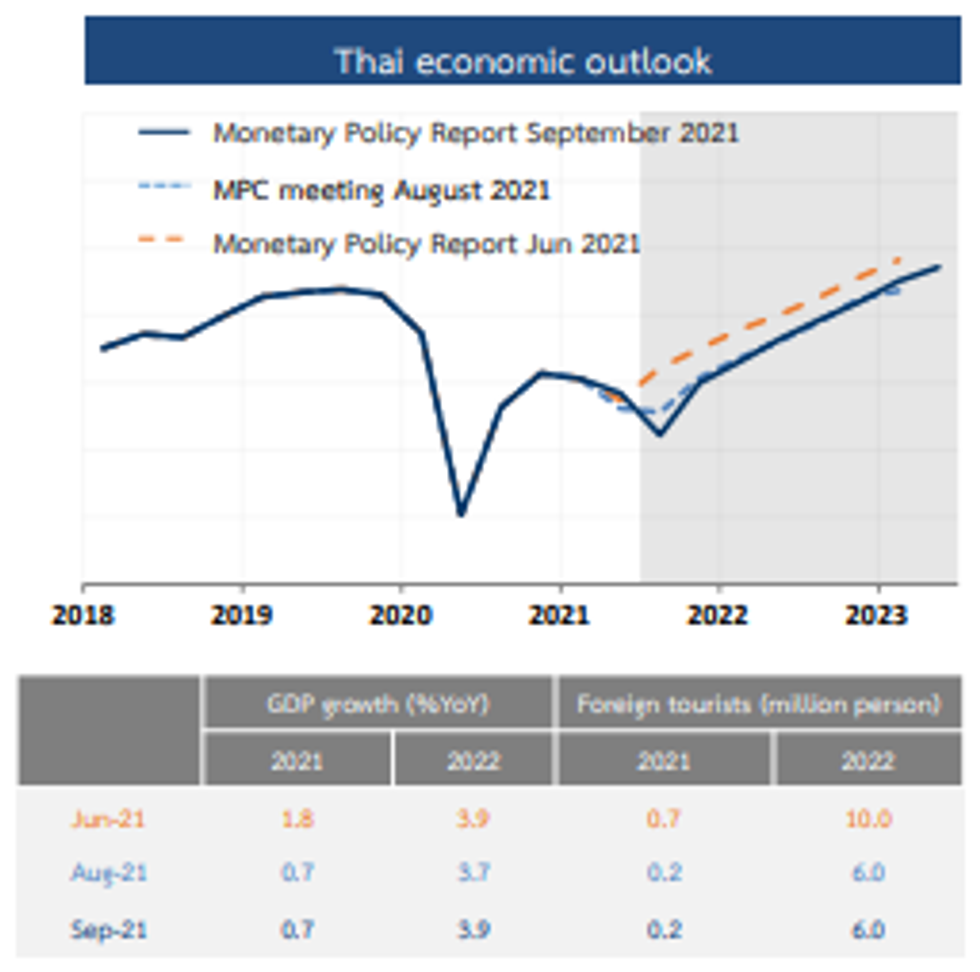

- Policymakers affirmed their 2021 GDP growth projection of +0.7% Y/Y and returned the 2022 growth forecast to +3.9% Y/Y after downgrading it to +3.7% Y/Y last month.

- The edited minutes from this week's gathering of the Monetary Policy Committee will be published in two weeks' time (Oct 13).

- On the data front, focus turns to BoP current account balance and trade data, due today. Looking further afield, Markit M'fing PMI & Business Sentiment Index will hit the wires on Friday.

- It is worth noting that BoT Gov Sethaput will speak at the central bank's annual symposium at 09:00 ICT/03:00 BST. PM Prayuth will chair a meeting of an economic panel half an hour later to discuss measures to boost consumption and provide aid to SMEs.

Fig. 1: Bank of Thailand September Economic Outlook

Source: Bank of Thailand

Source: Bank of Thailand

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.