-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

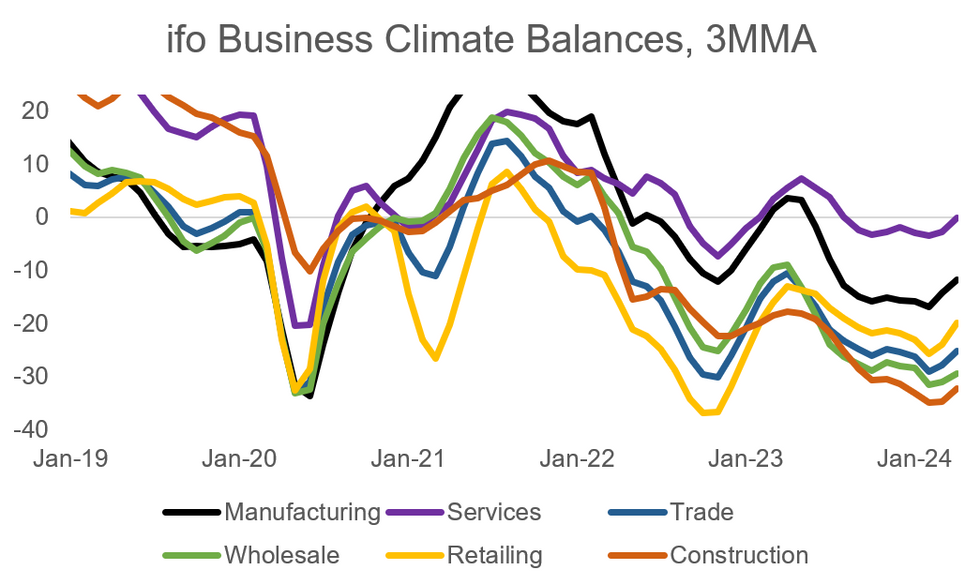

Broad-Based IFO Strength Another Sign Of Economic Stabilisation

Germany's IFO Business Climate index remained in contractionary territory in April but rose for the third consecutive month to 89.4, higher than consensus (88.8) and March's value (87.9, revised from 87.8), and the highest since May 2023. The data broadly mirrors April's flash PMIs, with the uptick driven by the services and construction sectors.

- Both the current assessment (88.9 vs 88.7 cons; 88.1 prior) and expectations (89.9 vs 88.9 cons; 87.5 prior) readings came in above analyst median estimates.

- The improvement was quite broad-based, with the respective diffusion balances of the Business Climate rising in all of the reported sectors. In particular, the services sector (up 2.8p to 3.2, highest since May 2023) and the construction sector (+4.7p to -28.5, highest since July 2023) saw improvement.

- The services sector climate uptick was almost entirely driven by a stronger current assessment (+5.8p to 15.8 in April), while the improvement in the construction sector was based on both a brighter assessment of current conditions and future expectations (+1.3p and +0.9p, respectively). Manufacturing also saw an uptick (+1.4p to -8.5, highest since May 2023) on the back of stronger expectations, though the current assessment balance fell 4.8 points to -8.6, reversing March's gains).

- Looking at the less volatile 3MMA measure, an uptrend seems to be forming, as all sectors printed stronger for the second consecutive month (see chart). The uptrend was most notable in the manufacturing and retailing sectors.

- Overall, the data provide another sign that economic conditions in Germany are stabilising, with surveys mirroring an improvement in "hard" data (including industrial production and services sector turnover). That said, as we outlined earlier this month in our Germany Macro Signal publication (PDF link), other data is weaker and keeps the overall picture ambiguous: for example, the Bundesbank weekly activity tracker suggests some weakness going into Q2, and 'core' factory orders data continue to print lower.

MNI, IFO

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.