May 20, 2024 10:06 GMT

CFTC CoT Shows A/M Generally Adding To Duration, Hedge Funds Extending Most Shorts

US TSY FUTURES

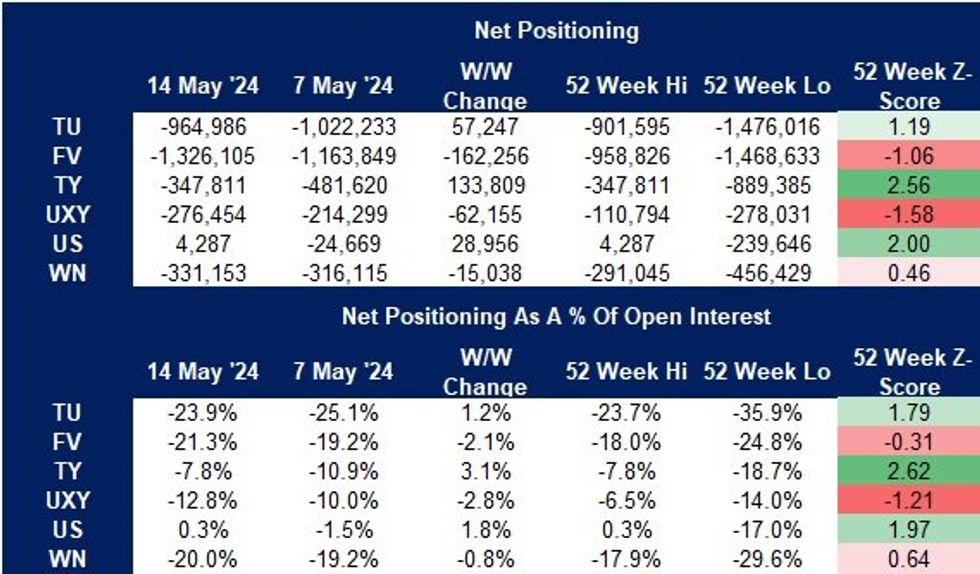

The latest CFTC CoT noted a mix of net non-commercial positioning movements through Tuesday of last week.

- Net shorts were added to in FV, UXY & WN futures.

- Net shorts were pared in TU & TY futures.

- Positioning flipped net long in US futures for the first time since June '22.

- Asset managers extended on their recent run of adding to duration longs (outside of TU & TY futures).

- Meanwhile, hedge funds trimmed their net short position in TU futures. That comes after that positioning metric posted a record net short outright level in late April. They also trimmed net shorts in TY futures, but added to net shorts across the remainder of the curve.

- A reminder that the report covers a period that saw an increase in the frequency of stagflation discussions owing to U.S. data developments and doesn't cover the period seen since last Wednesday's CPI print.

153 words