September 02, 2024 11:07 GMT

CFTC Points To Cover From Hedge Funds & Asset Managers

US TSY FUTURES

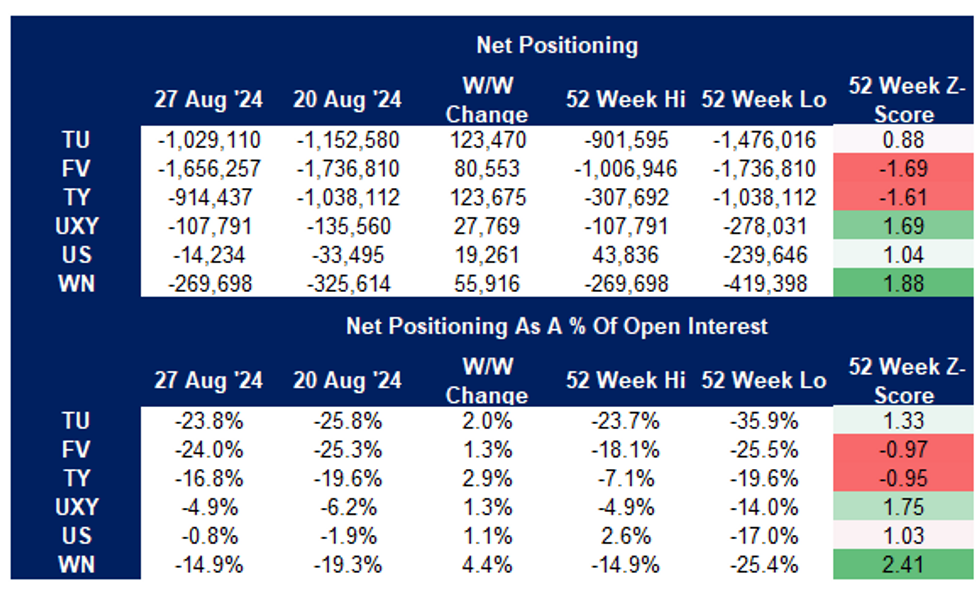

The most recent CFTC report revealed a change in approach across two of the major investor groups.

- Asset managers covered existing long positions in TU through UXY contacts, while hedge funds covered existing shorts across the curve.

- Overall net commercial positioning saw a reduction in net shorts across the Tsy futures curve.

- The reporting period included Fed Chair Powell’s dovish Jackson Hole speech and the July FOMC meeting minutes, which also read dovishly.

- Note futures roll activity may have had some impact, while basis trades will continue to skew positioning metrics.

Source: MNI - Market News/CFTC/Bloomberg

Source: MNI - Market News/CFTC/Bloomberg

112 words