-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessChicago's Goolsbee Eyes Path To "Defeat Inflation Without Tanking Economy"

Chicago Fed Pres Goolsbee has been considered among the more dovish FOMC members and his lengthy speech today makes the case that the Fed risks being too aggressive on rates if it follows "traditional" views, as it "has the chance to achieve something quite rare in the history of central banks - to defeat inflation without tanking the economy".

- This is of particular note given the FOMC's new economic projections which basically lay out a central case of a "soft landing".

- To be sure he doesn't tip his hand on where he sees near-term policy headed, but identifies a risk that the Fed risks overshooting on rates if it sticks to the models that worked in the 1970s versus today's economic landscape.

- "there is what I will call a 'traditionalist view' that says the substantial resource slack generated by a deep recession is necessary to reduce strong inflationary pressures...[this] view tempts us into looking at current growth and labor market conditions as the primary predictors of whether inflation is returning to target... I will argue that this view misses key features of our recent inflationary experience and that, in today’s environment, believing too strongly in the inevitability of a large trade-off between inflation and unemployment comes with the serious risk of a near-term policy error."

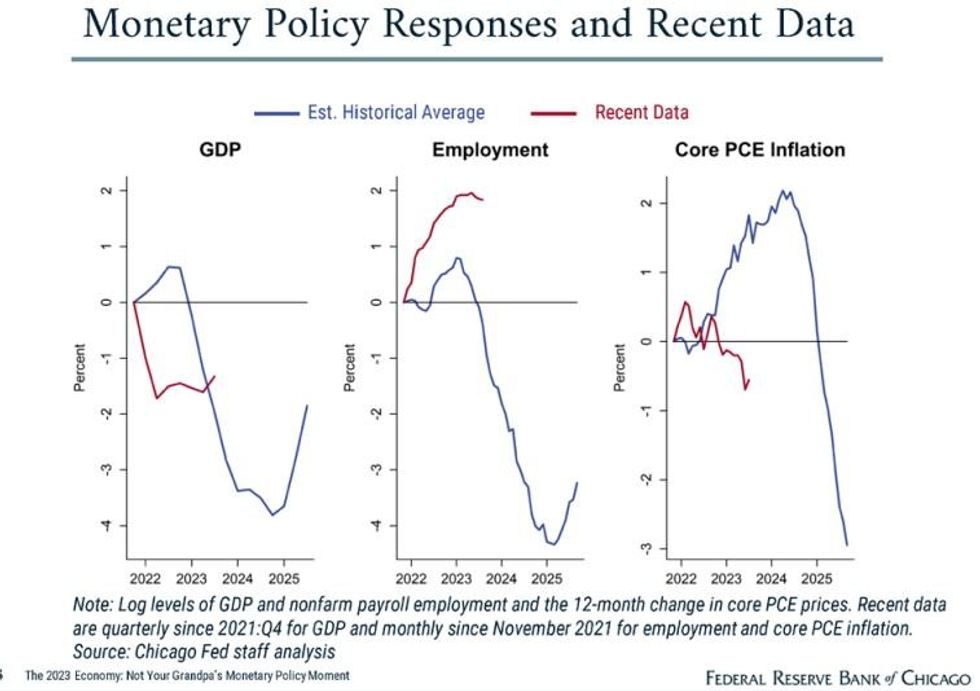

- He notes that versus previous hiking cycles, this one is not going according to the script: "GDP fell more quickly...employment has been much stronger than expected...inflation fell much sooner than the historical average."

- And he appears to argue that there is still plenty of tightening yet to hit the economy with a lag: "if past correlations were to hold, most of the reduction in inflation from monetary policy actions to date is still to come, and it would be large."

- He argues that the recent data suggests "nonmonetary shocks are heavily influencing the economy" and "the nature of the monetary policy environment we are working in today is different".

- With so much in flux from this point of view, he suggests looking at: - the composition of price dynamics ("the key to further progress will be what happens to housing inflation"), productivity growth, inflation expectations, and "don't obsess over the near-term path for real wages".

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.