-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessChinese Activity Data Sap More Strength From Yuan

Offshore yuan extends losses after the release of China's monthly activity data, which miss expectations across the board.

- Industrial output unexpectedly shrank in April, while the contraction in retail sales was deeper than forecast. The unemployment rate rose more than anticipated, while fixed assets ( and property investment growth printed below estimates.

Source: MNI - Market News/Bloomberg/Citi

Source: MNI - Market News/Bloomberg/Citi

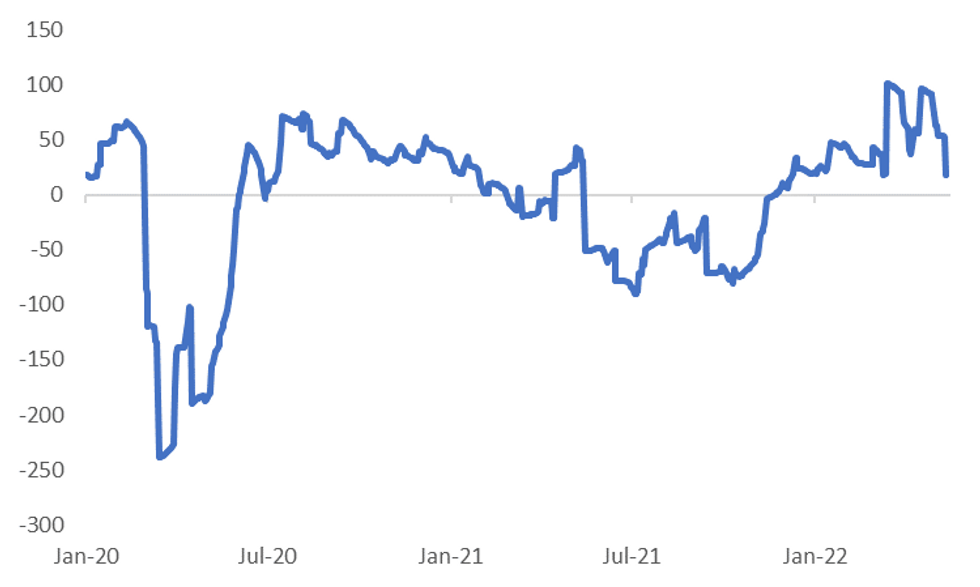

- The collapse in China's manufacturing production (-2.9% Y/Y in April vs. median estimate of +0.5% vs. +5.0% in March) bodes ill for other regional EM currencies, as evidenced by the strong co-movement in industrial output growth and ADXY index change over the recent months.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Worth pointing out that YtD infrastructure spending growth slowed to +6.80% Y/Y in April from +8.50% prior. This comes as the Economic Information Daily reported that China could issue CNY2tn worth of special government bonds in Q2 to boost infrastructure activity.

- The data reflected the devastating impact of strict COVID-19 countermeasures implemented by Beijing. The picture painted by the report was so bleak that it outweighed headlines on the relaxation of some restrictions/another day of zero community transmission in Shanghai.

- Offshore yuan went offered earlier as the PBOC kept the interest rate applied to its 1-Year MLF operations & net liquidity unchanged, disappointing some dovish market participants.

- The surprise in the yuan fixing was very modest (7 pips) but ended a 9-session run of stronger than expected fixes.

- Spot USD/CNH trades at CNH6.8113, up 115 pips at typing. A rally above Friday's high of CNH6.8380 is needed for the resumption of the uptrend, with Sep 24, 2020 high of CNH6.8462 providing the next layer of resistance. Bears look for a retreat past the round figure of CNH6.7000, a significant resistance-turned-support level.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.